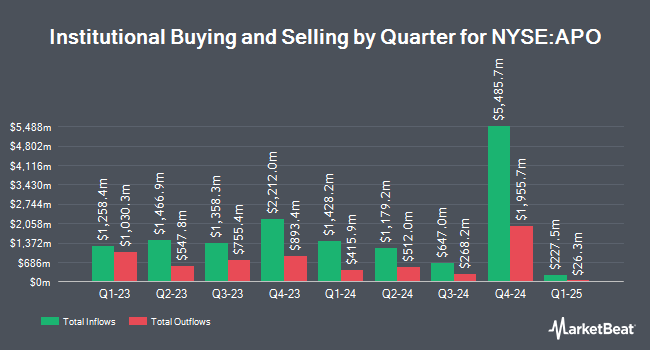

XTX Topco Ltd raised its holdings in Apollo Global Management Inc. (NYSE:APO - Free Report) by 106.1% during the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 31,085 shares of the financial services provider's stock after purchasing an additional 16,006 shares during the period. XTX Topco Ltd's holdings in Apollo Global Management were worth $4,257,000 as of its most recent SEC filing.

Other large investors have also recently added to or reduced their stakes in the company. Fourth Dimension Wealth LLC acquired a new position in Apollo Global Management in the fourth quarter worth $25,000. GW&K Investment Management LLC boosted its holdings in Apollo Global Management by 84.5% in the first quarter. GW&K Investment Management LLC now owns 190 shares of the financial services provider's stock worth $26,000 after purchasing an additional 87 shares during the period. ORG Partners LLC boosted its holdings in Apollo Global Management by 285.0% in the first quarter. ORG Partners LLC now owns 231 shares of the financial services provider's stock worth $32,000 after purchasing an additional 171 shares during the period. Farmers & Merchants Investments Inc. acquired a new position in Apollo Global Management in the first quarter worth $39,000. Finally, Meeder Asset Management Inc. boosted its holdings in Apollo Global Management by 118.6% in the first quarter. Meeder Asset Management Inc. now owns 317 shares of the financial services provider's stock worth $43,000 after purchasing an additional 172 shares during the period. 77.06% of the stock is currently owned by institutional investors.

Apollo Global Management Price Performance

APO stock traded down $7.02 during trading hours on Friday, hitting $138.30. 4,587,463 shares of the stock traded hands, compared to its average volume of 3,614,874. The stock has a 50-day simple moving average of $140.48 and a 200 day simple moving average of $142.54. Apollo Global Management Inc. has a one year low of $95.11 and a one year high of $189.49. The company has a market cap of $79.04 billion, a P/E ratio of 24.22, a P/E/G ratio of 1.64 and a beta of 1.59. The company has a current ratio of 1.36, a quick ratio of 1.36 and a debt-to-equity ratio of 0.34.

Apollo Global Management (NYSE:APO - Get Free Report) last released its quarterly earnings results on Friday, May 2nd. The financial services provider reported $1.82 earnings per share for the quarter, missing analysts' consensus estimates of $1.84 by ($0.02). Apollo Global Management had a net margin of 14.59% and a return on equity of 13.45%. The company had revenue of $5.55 billion during the quarter, compared to analyst estimates of $977.14 million. During the same quarter last year, the business earned $1.72 EPS. The company's revenue for the quarter was down 21.2% compared to the same quarter last year. Equities analysts forecast that Apollo Global Management Inc. will post 8 earnings per share for the current year.

Insider Buying and Selling at Apollo Global Management

In related news, CFO Martin Kelly sold 4,000 shares of the stock in a transaction on Tuesday, May 6th. The stock was sold at an average price of $132.57, for a total value of $530,280.00. Following the completion of the transaction, the chief financial officer owned 373,164 shares in the company, valued at $49,470,351.48. This trade represents a 1.06% decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. 8.20% of the stock is owned by company insiders.

Wall Street Analysts Forecast Growth

A number of research analysts recently commented on the company. Citigroup upped their price objective on Apollo Global Management from $160.00 to $170.00 and gave the stock a "buy" rating in a research note on Thursday, July 10th. Barclays upped their price objective on Apollo Global Management from $156.00 to $168.00 and gave the stock an "overweight" rating in a research note on Thursday, July 10th. Evercore ISI upped their price objective on Apollo Global Management from $150.00 to $155.00 and gave the stock an "outperform" rating in a research note on Thursday, July 10th. TD Cowen lowered their price objective on Apollo Global Management from $214.00 to $144.00 and set a "buy" rating for the company in a research note on Wednesday, April 9th. Finally, UBS Group lowered their price objective on Apollo Global Management from $170.00 to $155.00 and set a "neutral" rating for the company in a research note on Thursday, May 1st. One analyst has rated the stock with a sell rating, two have given a hold rating, seventeen have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $161.00.

Get Our Latest Analysis on Apollo Global Management

About Apollo Global Management

(

Free Report)

Apollo Global Management, Inc is a private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets. The firm prefers to invest in private and public markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth, venture capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions.

Featured Articles

Before you consider Apollo Global Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apollo Global Management wasn't on the list.

While Apollo Global Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.