Applied Finance Capital Management LLC trimmed its position in shares of The Travelers Companies, Inc. (NYSE:TRV - Free Report) by 50.2% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 93,177 shares of the insurance provider's stock after selling 94,112 shares during the quarter. Travelers Companies makes up 1.8% of Applied Finance Capital Management LLC's holdings, making the stock its 16th biggest holding. Applied Finance Capital Management LLC's holdings in Travelers Companies were worth $24,642,000 at the end of the most recent reporting period.

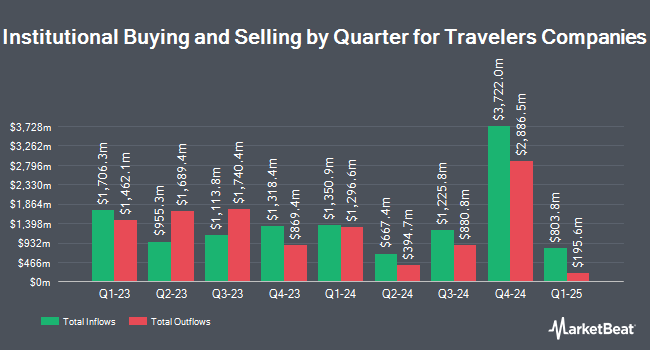

Several other hedge funds and other institutional investors also recently made changes to their positions in the company. Cetera Investment Advisers bought a new stake in shares of Travelers Companies in the 1st quarter valued at about $14,520,000. One Wealth Advisors LLC grew its position in shares of Travelers Companies by 33.7% in the 1st quarter. One Wealth Advisors LLC now owns 1,223 shares of the insurance provider's stock valued at $323,000 after buying an additional 308 shares during the last quarter. Journey Strategic Wealth LLC grew its position in shares of Travelers Companies by 9.4% in the 1st quarter. Journey Strategic Wealth LLC now owns 921 shares of the insurance provider's stock valued at $244,000 after buying an additional 79 shares during the last quarter. Carnegie Investment Counsel grew its position in shares of Travelers Companies by 5.4% in the 1st quarter. Carnegie Investment Counsel now owns 13,605 shares of the insurance provider's stock valued at $3,598,000 after buying an additional 696 shares during the last quarter. Finally, Machina Capital S.A.S. bought a new stake in shares of Travelers Companies in the 1st quarter valued at about $925,000. 82.45% of the stock is currently owned by institutional investors.

Travelers Companies Stock Up 0.0%

Shares of TRV traded up $0.12 during mid-day trading on Wednesday, hitting $259.94. 246,053 shares of the company's stock were exchanged, compared to its average volume of 1,344,972. The stock's 50-day moving average is $264.78 and its 200-day moving average is $257.38. The company has a market cap of $58.52 billion, a price-to-earnings ratio of 11.49, a P/E/G ratio of 3.02 and a beta of 0.51. The Travelers Companies, Inc. has a fifty-two week low of $206.43 and a fifty-two week high of $277.83. The company has a debt-to-equity ratio of 0.27, a quick ratio of 0.33 and a current ratio of 0.33.

Travelers Companies (NYSE:TRV - Get Free Report) last issued its quarterly earnings results on Thursday, July 17th. The insurance provider reported $6.51 earnings per share for the quarter, topping the consensus estimate of $3.52 by $2.99. The firm had revenue of $11.54 billion during the quarter, compared to the consensus estimate of $11.02 billion. Travelers Companies had a return on equity of 18.68% and a net margin of 10.97%. The company's revenue for the quarter was up 7.4% on a year-over-year basis. During the same period last year, the company earned $2.51 earnings per share. On average, sell-side analysts anticipate that The Travelers Companies, Inc. will post 17.02 earnings per share for the current fiscal year.

Travelers Companies Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Wednesday, September 10th will be issued a $1.10 dividend. This represents a $4.40 annualized dividend and a yield of 1.69%. The ex-dividend date of this dividend is Wednesday, September 10th. Travelers Companies's dividend payout ratio (DPR) is 19.46%.

Insider Buying and Selling at Travelers Companies

In other Travelers Companies news, EVP Maria Olivo sold 36,199 shares of the firm's stock in a transaction that occurred on Thursday, May 29th. The stock was sold at an average price of $274.20, for a total transaction of $9,925,765.80. Following the completion of the sale, the executive vice president owned 118,116 shares in the company, valued at $32,387,407.20. This trade represents a 23.46% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO Daniel S. Frey sold 20,286 shares of the stock in a transaction that occurred on Thursday, May 29th. The stock was sold at an average price of $273.48, for a total value of $5,547,815.28. Following the transaction, the chief financial officer directly owned 26,932 shares in the company, valued at approximately $7,365,363.36. This represents a 42.96% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 175,374 shares of company stock worth $47,929,912. Company insiders own 1.46% of the company's stock.

Wall Street Analysts Forecast Growth

TRV has been the topic of a number of research reports. UBS Group upped their price target on Travelers Companies from $275.00 to $284.00 and gave the stock a "neutral" rating in a research note on Monday, July 21st. Keefe, Bruyette & Woods upped their price target on Travelers Companies from $304.00 to $316.00 and gave the stock an "outperform" rating in a research note on Friday, July 18th. Wall Street Zen raised Travelers Companies from a "hold" rating to a "buy" rating in a research note on Friday, July 18th. Evercore ISI increased their price objective on Travelers Companies from $288.00 to $296.00 and gave the stock an "outperform" rating in a research note on Thursday, April 17th. Finally, JPMorgan Chase & Co. increased their price target on Travelers Companies from $260.00 to $271.00 and gave the company an "underweight" rating in a research report on Tuesday, April 8th. Two investment analysts have rated the stock with a sell rating, eleven have given a hold rating and seven have given a buy rating to the stock. Based on data from MarketBeat, Travelers Companies has a consensus rating of "Hold" and a consensus target price of $275.56.

Read Our Latest Stock Analysis on TRV

Travelers Companies Company Profile

(

Free Report)

The Travelers Companies, Inc, through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally. The company operates through three segments: Business Insurance, Bond & Specialty Insurance, and Personal Insurance.

Recommended Stories

Before you consider Travelers Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Travelers Companies wasn't on the list.

While Travelers Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report