ARK Investment Management LLC increased its stake in shares of Check Point Software Technologies Ltd. (NASDAQ:CHKP - Free Report) by 18.7% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 10,440 shares of the technology company's stock after buying an additional 1,647 shares during the quarter. ARK Investment Management LLC's holdings in Check Point Software Technologies were worth $2,379,000 at the end of the most recent quarter.

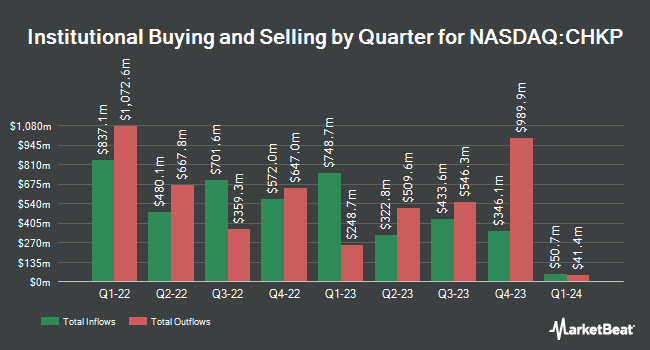

A number of other institutional investors also recently added to or reduced their stakes in CHKP. Larson Financial Group LLC boosted its stake in Check Point Software Technologies by 23.2% in the 1st quarter. Larson Financial Group LLC now owns 260 shares of the technology company's stock worth $59,000 after purchasing an additional 49 shares during the period. TD Waterhouse Canada Inc. increased its stake in Check Point Software Technologies by 1.7% in the fourth quarter. TD Waterhouse Canada Inc. now owns 3,095 shares of the technology company's stock valued at $578,000 after acquiring an additional 52 shares during the period. MassMutual Private Wealth & Trust FSB boosted its position in Check Point Software Technologies by 19.6% in the first quarter. MassMutual Private Wealth & Trust FSB now owns 336 shares of the technology company's stock valued at $77,000 after buying an additional 55 shares in the last quarter. 3Chopt Investment Partners LLC lifted its position in shares of Check Point Software Technologies by 0.3% during the first quarter. 3Chopt Investment Partners LLC now owns 19,571 shares of the technology company's stock worth $4,461,000 after purchasing an additional 56 shares in the last quarter. Finally, Cable Hill Partners LLC lifted its position in shares of Check Point Software Technologies by 4.1% during the first quarter. Cable Hill Partners LLC now owns 1,563 shares of the technology company's stock worth $343,000 after purchasing an additional 61 shares in the last quarter. Hedge funds and other institutional investors own 98.51% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts have recently issued reports on CHKP shares. Stephens lowered their price objective on shares of Check Point Software Technologies from $255.00 to $229.00 and set an "equal weight" rating for the company in a research report on Thursday, April 24th. Morgan Stanley reduced their target price on shares of Check Point Software Technologies from $235.00 to $220.00 and set an "equal weight" rating on the stock in a report on Wednesday, April 16th. Wells Fargo & Company dropped their price target on shares of Check Point Software Technologies from $280.00 to $265.00 and set an "overweight" rating on the stock in a research report on Thursday, April 24th. Jefferies Financial Group boosted their price target on shares of Check Point Software Technologies from $255.00 to $260.00 and gave the company a "buy" rating in a research note on Thursday, July 24th. Finally, Scotiabank reduced their price target on shares of Check Point Software Technologies from $250.00 to $240.00 and set a "sector outperform" rating for the company in a research report on Thursday, April 24th. Fifteen investment analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, Check Point Software Technologies currently has a consensus rating of "Moderate Buy" and a consensus target price of $236.50.

View Our Latest Report on Check Point Software Technologies

Check Point Software Technologies Stock Performance

NASDAQ:CHKP traded down $29.81 on Wednesday, hitting $188.52. The stock had a trading volume of 2,125,440 shares, compared to its average volume of 898,068. The firm's fifty day simple moving average is $222.78 and its two-hundred day simple moving average is $218.06. Check Point Software Technologies Ltd. has a 1 year low of $169.01 and a 1 year high of $234.35. The stock has a market cap of $20.73 billion, a P/E ratio of 24.93, a price-to-earnings-growth ratio of 3.12 and a beta of 0.64.

Check Point Software Technologies Profile

(

Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Featured Stories

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.