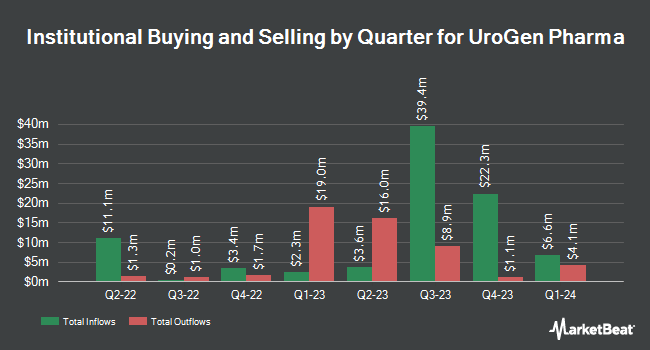

ARK Investment Management LLC increased its stake in shares of Urogen Pharma (NASDAQ:URGN - Free Report) by 32.6% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 185,790 shares of the company's stock after purchasing an additional 45,642 shares during the quarter. ARK Investment Management LLC owned 0.40% of Urogen Pharma worth $2,055,000 as of its most recent SEC filing.

Several other hedge funds have also recently modified their holdings of URGN. Renaissance Technologies LLC acquired a new stake in shares of Urogen Pharma during the fourth quarter valued at $1,472,000. Lazard Asset Management LLC purchased a new stake in shares of Urogen Pharma during the 4th quarter valued at about $67,000. Janus Henderson Group PLC purchased a new stake in shares of Urogen Pharma during the 4th quarter valued at about $149,000. ProShare Advisors LLC purchased a new stake in Urogen Pharma during the 4th quarter worth approximately $137,000. Finally, Rhumbline Advisers increased its holdings in Urogen Pharma by 4.3% during the 1st quarter. Rhumbline Advisers now owns 53,466 shares of the company's stock worth $591,000 after purchasing an additional 2,196 shares during the last quarter. 91.29% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

URGN has been the subject of a number of recent research reports. Oppenheimer set a $31.00 price objective on Urogen Pharma and gave the stock a "buy" rating in a research note on Friday, June 13th. Guggenheim reaffirmed a "buy" rating and issued a $30.00 target price (up from $15.00) on shares of Urogen Pharma in a research report on Friday, June 13th. Scotiabank reiterated an "outperform" rating on shares of Urogen Pharma in a research note on Friday, June 13th. HC Wainwright restated a "buy" rating and set a $50.00 target price on shares of Urogen Pharma in a research note on Tuesday, July 8th. Finally, D. Boral Capital reiterated a "buy" rating and issued a $25.00 price objective on shares of Urogen Pharma in a research report on Monday, July 7th. One research analyst has rated the stock with a hold rating, six have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Buy" and an average target price of $32.86.

Get Our Latest Research Report on Urogen Pharma

Insider Activity at Urogen Pharma

In related news, insider Mark Schoenberg sold 5,162 shares of the stock in a transaction on Monday, June 9th. The shares were sold at an average price of $7.37, for a total transaction of $38,043.94. Following the sale, the insider directly owned 153,378 shares of the company's stock, valued at approximately $1,130,395.86. This represents a 3.26% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. 4.70% of the stock is currently owned by company insiders.

Urogen Pharma Stock Up 2.7%

NASDAQ:URGN traded up $0.52 during midday trading on Wednesday, hitting $19.42. The company had a trading volume of 589,282 shares, compared to its average volume of 1,602,601. The stock's fifty day moving average price is $11.61 and its 200-day moving average price is $10.84. The company has a market capitalization of $896.97 million, a PE ratio of -6.10 and a beta of 1.02. Urogen Pharma has a 52-week low of $3.42 and a 52-week high of $19.74.

Urogen Pharma (NASDAQ:URGN - Get Free Report) last announced its quarterly earnings data on Monday, May 12th. The company reported ($0.92) EPS for the quarter, missing the consensus estimate of ($0.83) by ($0.09). Urogen Pharma had a negative net margin of 150.68% and a negative return on equity of 97,487.15%. The firm had revenue of $20.25 million for the quarter, compared to the consensus estimate of $22.71 million. As a group, research analysts forecast that Urogen Pharma will post -3.12 earnings per share for the current year.

About Urogen Pharma

(

Free Report)

UroGen Pharma Ltd., a biotechnology company, engages in the development and commercialization of solutions for urothelial and specialty cancers. It offers RTGel, a novel proprietary polymeric biocompatible, reverse thermal gelation hydrogel technology to improve therapeutic profiles of existing drugs; and Jelmyto for pyelocalyceal solution.

Recommended Stories

Before you consider Urogen Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Urogen Pharma wasn't on the list.

While Urogen Pharma currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.