Ascent Group LLC grew its position in Credit Acceptance Corporation (NASDAQ:CACC - Free Report) by 10.1% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 8,224 shares of the credit services provider's stock after purchasing an additional 752 shares during the period. Ascent Group LLC owned about 0.07% of Credit Acceptance worth $4,190,000 at the end of the most recent reporting period.

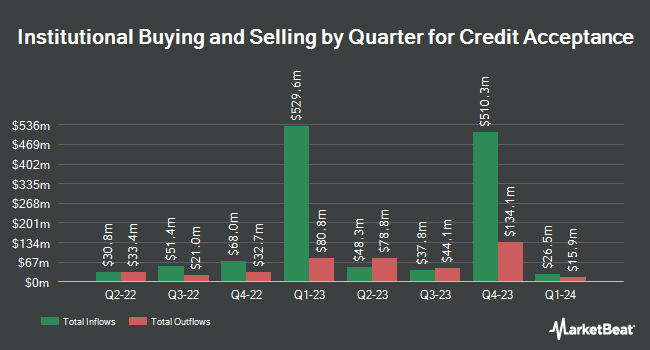

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Public Employees Retirement System of Ohio raised its holdings in shares of Credit Acceptance by 10.3% in the second quarter. Public Employees Retirement System of Ohio now owns 2,296 shares of the credit services provider's stock valued at $1,170,000 after purchasing an additional 215 shares during the last quarter. Wedge Capital Management L L P NC grew its position in Credit Acceptance by 12.9% during the second quarter. Wedge Capital Management L L P NC now owns 3,276 shares of the credit services provider's stock valued at $1,669,000 after buying an additional 375 shares during the period. Chemistry Wealth Management LLC bought a new position in Credit Acceptance during the second quarter valued at about $235,000. Rhumbline Advisers grew its position in Credit Acceptance by 0.8% during the first quarter. Rhumbline Advisers now owns 9,122 shares of the credit services provider's stock valued at $4,710,000 after buying an additional 70 shares during the period. Finally, Bayforest Capital Ltd bought a new position in Credit Acceptance during the first quarter valued at about $225,000. Hedge funds and other institutional investors own 81.71% of the company's stock.

Insiders Place Their Bets

In other Credit Acceptance news, CEO Kenneth Booth sold 4,000 shares of the stock in a transaction dated Thursday, September 18th. The shares were sold at an average price of $506.59, for a total transaction of $2,026,360.00. Following the completion of the transaction, the chief executive officer owned 68,116 shares in the company, valued at $34,506,884.44. This trade represents a 5.55% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, COO Jonathan Lum sold 6,000 shares of the stock in a transaction dated Monday, August 25th. The stock was sold at an average price of $512.61, for a total transaction of $3,075,660.00. Following the transaction, the chief operating officer owned 31,493 shares of the company's stock, valued at $16,143,626.73. This represents a 16.00% decrease in their position. The disclosure for this sale can be found here. Insiders sold 13,697 shares of company stock worth $6,981,255 over the last quarter. 6.60% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

Separately, Weiss Ratings restated a "hold (c)" rating on shares of Credit Acceptance in a research report on Saturday, September 27th. Two investment analysts have rated the stock with a Hold rating and one has issued a Sell rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Reduce" and a consensus target price of $440.00.

Check Out Our Latest Report on Credit Acceptance

Credit Acceptance Price Performance

Shares of NASDAQ:CACC opened at $485.86 on Friday. The company has a quick ratio of 22.03, a current ratio of 22.03 and a debt-to-equity ratio of 4.16. The firm has a market capitalization of $5.46 billion, a PE ratio of 14.01 and a beta of 1.19. Credit Acceptance Corporation has a twelve month low of $414.15 and a twelve month high of $560.00. The company has a 50-day moving average price of $491.10 and a two-hundred day moving average price of $495.67.

Credit Acceptance (NASDAQ:CACC - Get Free Report) last issued its earnings results on Thursday, July 31st. The credit services provider reported $8.56 earnings per share for the quarter, missing analysts' consensus estimates of $9.84 by ($1.28). The business had revenue of $583.80 million for the quarter, compared to the consensus estimate of $583.30 million. Credit Acceptance had a return on equity of 27.06% and a net margin of 18.69%.Credit Acceptance's revenue for the quarter was up 8.5% compared to the same quarter last year. During the same quarter in the prior year, the business earned $10.29 EPS. Equities analysts forecast that Credit Acceptance Corporation will post 53.24 EPS for the current year.

Credit Acceptance Profile

(

Free Report)

Credit Acceptance Corporation engages in the provision of financing programs, and related products and services in the United States. The company advances money to automobile dealers in exchange for the right to service the underlying consumer loans; and buys the consumer loans from the dealers and keeps the amount collected from the consumers.

Featured Articles

Want to see what other hedge funds are holding CACC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Credit Acceptance Corporation (NASDAQ:CACC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Credit Acceptance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Credit Acceptance wasn't on the list.

While Credit Acceptance currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.