AWH Capital L.P. lowered its position in Evolus, Inc. (NASDAQ:EOLS - Free Report) by 5.4% during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 600,600 shares of the company's stock after selling 34,400 shares during the quarter. Evolus makes up approximately 10.5% of AWH Capital L.P.'s holdings, making the stock its biggest position. AWH Capital L.P. owned about 0.93% of Evolus worth $7,225,000 at the end of the most recent reporting period.

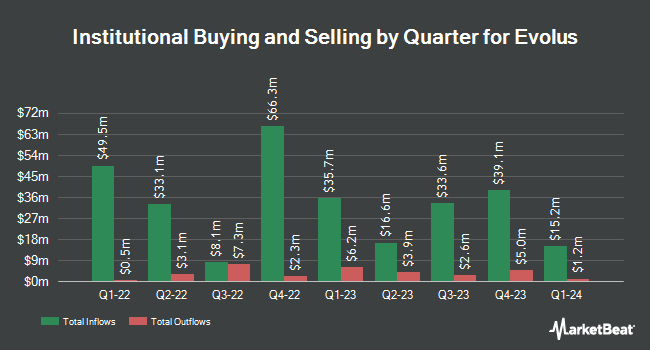

Other institutional investors and hedge funds have also recently bought and sold shares of the company. AlphaQuest LLC bought a new stake in shares of Evolus during the 1st quarter worth about $39,000. State of Wyoming boosted its stake in shares of Evolus by 988.1% during the 1st quarter. State of Wyoming now owns 3,754 shares of the company's stock worth $45,000 after acquiring an additional 3,409 shares in the last quarter. IFP Advisors Inc boosted its stake in shares of Evolus by 99.0% during the 1st quarter. IFP Advisors Inc now owns 9,427 shares of the company's stock worth $113,000 after acquiring an additional 4,691 shares in the last quarter. Rafferty Asset Management LLC bought a new stake in shares of Evolus during the 4th quarter worth about $115,000. Finally, Man Group plc bought a new stake in shares of Evolus during the 4th quarter worth about $121,000. Hedge funds and other institutional investors own 90.69% of the company's stock.

Evolus Stock Performance

Shares of NASDAQ EOLS traded up $0.15 during trading hours on Friday, hitting $7.66. 534,857 shares of the company's stock were exchanged, compared to its average volume of 1,045,975. Evolus, Inc. has a 1-year low of $5.71 and a 1-year high of $17.82. The company has a debt-to-equity ratio of 22.00, a current ratio of 2.27 and a quick ratio of 1.86. The stock has a market capitalization of $495.45 million, a price-to-earnings ratio of -7.82 and a beta of 1.07. The company's 50-day moving average price is $8.26 and its 200-day moving average price is $10.13.

Analyst Upgrades and Downgrades

Several analysts have recently issued reports on EOLS shares. Wall Street Zen downgraded Evolus from a "hold" rating to a "sell" rating in a research note on Saturday, August 9th. BTIG Research decreased their price target on Evolus from $21.00 to $18.00 and set a "buy" rating for the company in a research note on Wednesday, August 6th. Needham & Company LLC reiterated a "hold" rating and set a $22.00 price target on shares of Evolus in a research note on Wednesday, August 6th. Finally, HC Wainwright decreased their price target on Evolus from $27.00 to $20.00 and set a "buy" rating for the company in a research note on Wednesday, August 6th. Four analysts have rated the stock with a Buy rating and one has issued a Hold rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $21.25.

Check Out Our Latest Analysis on EOLS

Insiders Place Their Bets

In other news, Director Brady Stewart purchased 30,000 shares of the business's stock in a transaction on Friday, August 15th. The stock was purchased at an average price of $6.82 per share, with a total value of $204,600.00. Following the acquisition, the director directly owned 88,629 shares in the company, valued at approximately $604,449.78. The trade was a 51.17% increase in their position. The purchase was disclosed in a filing with the SEC, which is accessible through this link. Also, insider David Moatazedi sold 111,323 shares of the company's stock in a transaction that occurred on Friday, June 13th. The shares were sold at an average price of $10.05, for a total value of $1,118,796.15. Following the completion of the transaction, the insider directly owned 381,509 shares of the company's stock, valued at approximately $3,834,165.45. This trade represents a 22.59% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 133,627 shares of company stock worth $1,325,764 over the last quarter. 6.10% of the stock is currently owned by company insiders.

About Evolus

(

Free Report)

Evolus, Inc, a performance beauty company, focuses on delivering products in the cash-pay aesthetic market in the United States, Canada, and Europe. The company offers Jeuveau, a proprietary 900 kilodalton purified botulinum toxin type A formulation for the temporary improvement in the appearance of moderate to severe glabellar lines in adults.

Recommended Stories

Before you consider Evolus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evolus wasn't on the list.

While Evolus currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.