Banco BTG Pactual S.A. lifted its holdings in shares of Netflix, Inc. (NASDAQ:NFLX - Free Report) by 19.1% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,489 shares of the Internet television network's stock after purchasing an additional 399 shares during the quarter. Banco BTG Pactual S.A.'s holdings in Netflix were worth $2,321,000 at the end of the most recent quarter.

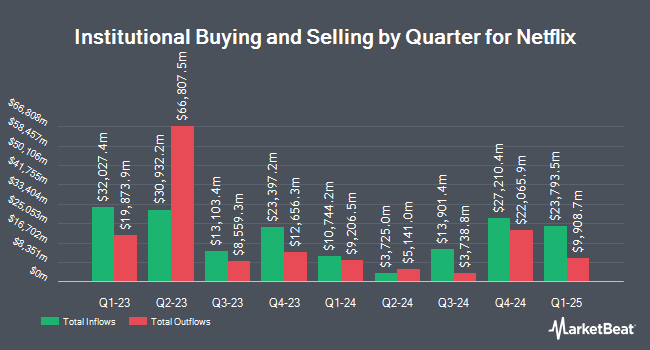

Several other hedge funds and other institutional investors also recently modified their holdings of the business. Brighton Jones LLC lifted its position in Netflix by 5.0% in the 4th quarter. Brighton Jones LLC now owns 5,390 shares of the Internet television network's stock worth $4,804,000 after buying an additional 257 shares during the last quarter. Revolve Wealth Partners LLC lifted its position in Netflix by 16.4% in the 4th quarter. Revolve Wealth Partners LLC now owns 1,023 shares of the Internet television network's stock worth $912,000 after buying an additional 144 shares during the last quarter. BIP Wealth LLC lifted its position in Netflix by 23.8% in the 4th quarter. BIP Wealth LLC now owns 453 shares of the Internet television network's stock worth $403,000 after buying an additional 87 shares during the last quarter. Transce3nd LLC bought a new stake in Netflix in the 4th quarter worth approximately $32,000. Finally, J. Safra Sarasin Holding AG lifted its position in Netflix by 72.1% in the 4th quarter. J. Safra Sarasin Holding AG now owns 7,609 shares of the Internet television network's stock worth $6,789,000 after buying an additional 3,187 shares during the last quarter. Hedge funds and other institutional investors own 80.93% of the company's stock.

Netflix Trading Down 0.6%

NFLX stock traded down $7.65 during midday trading on Thursday, hitting $1,206.21. The company had a trading volume of 2,043,018 shares, compared to its average volume of 3,016,992. The company has a current ratio of 1.34, a quick ratio of 1.34 and a debt-to-equity ratio of 0.58. Netflix, Inc. has a 52 week low of $660.80 and a 52 week high of $1,341.15. The stock's 50 day moving average price is $1,231.56 and its 200 day moving average price is $1,108.85. The stock has a market cap of $512.55 billion, a price-to-earnings ratio of 51.39, a PEG ratio of 2.04 and a beta of 1.59.

Netflix (NASDAQ:NFLX - Get Free Report) last announced its quarterly earnings data on Thursday, July 17th. The Internet television network reported $7.19 earnings per share for the quarter, beating the consensus estimate of $7.07 by $0.12. Netflix had a return on equity of 42.50% and a net margin of 24.58%.The firm had revenue of $11.08 billion during the quarter, compared to the consensus estimate of $11.04 billion. During the same quarter in the previous year, the company posted $4.88 earnings per share. The business's revenue was up 15.9% on a year-over-year basis. Netflix has set its FY 2025 guidance at EPS. Q3 2025 guidance at 6.870-6.870 EPS. As a group, equities research analysts expect that Netflix, Inc. will post 24.58 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of analysts recently weighed in on the company. Canaccord Genuity Group restated a "buy" rating on shares of Netflix in a research report on Thursday, July 10th. JPMorgan Chase & Co. boosted their target price on Netflix from $1,230.00 to $1,300.00 and gave the stock a "neutral" rating in a research report on Friday, July 18th. Loop Capital restated a "hold" rating on shares of Netflix in a research report on Tuesday, July 15th. Citigroup restated a "neutral" rating and issued a $1,250.00 target price (up previously from $1,020.00) on shares of Netflix in a research report on Thursday, May 29th. Finally, Jefferies Financial Group restated a "buy" rating on shares of Netflix in a research report on Tuesday, August 12th. One analyst has rated the stock with a Strong Buy rating, twenty-two have issued a Buy rating, ten have issued a Hold rating and three have assigned a Sell rating to the stock. According to MarketBeat.com, Netflix has a consensus rating of "Moderate Buy" and an average target price of $1,297.66.

Read Our Latest Research Report on Netflix

Insiders Place Their Bets

In related news, Director Reed Hastings sold 26,933 shares of the company's stock in a transaction that occurred on Monday, June 2nd. The stock was sold at an average price of $1,211.66, for a total transaction of $32,633,638.78. Following the completion of the transaction, the director owned 394 shares in the company, valued at $477,394.04. This represents a 98.56% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Gregory K. Peters sold 2,026 shares of the company's stock in a transaction that occurred on Tuesday, August 5th. The shares were sold at an average price of $1,157.44, for a total value of $2,344,973.44. Following the transaction, the chief executive officer owned 12,781 shares of the company's stock, valued at approximately $14,793,240.64. This represents a 13.68% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 146,307 shares of company stock worth $179,443,809 in the last ninety days. Insiders own 1.37% of the company's stock.

Netflix Profile

(

Free Report)

Netflix, Inc provides entertainment services. It offers TV series, documentaries, feature films, and games across various genres and languages. The company also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

Further Reading

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report