Bellwether Advisors LLC reduced its holdings in shares of Ross Stores, Inc. (NASDAQ:ROST - Free Report) by 40.0% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 4,517 shares of the apparel retailer's stock after selling 3,013 shares during the period. Bellwether Advisors LLC's holdings in Ross Stores were worth $577,000 at the end of the most recent reporting period.

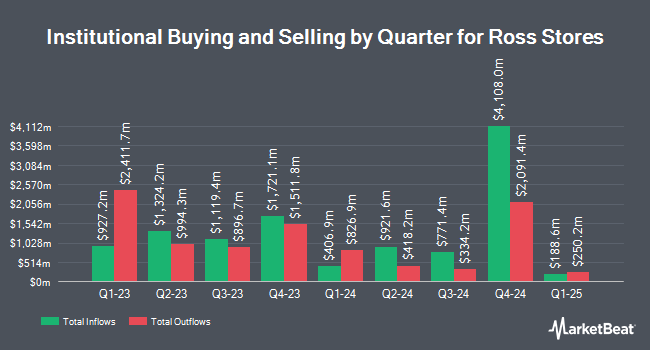

A number of other institutional investors and hedge funds have also bought and sold shares of the business. Price T Rowe Associates Inc. MD grew its position in Ross Stores by 25.7% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 19,515,891 shares of the apparel retailer's stock valued at $2,952,170,000 after acquiring an additional 3,995,760 shares during the last quarter. Geode Capital Management LLC grew its position in Ross Stores by 1.7% during the fourth quarter. Geode Capital Management LLC now owns 8,287,162 shares of the apparel retailer's stock valued at $1,250,423,000 after acquiring an additional 135,117 shares during the last quarter. FMR LLC grew its position in Ross Stores by 11.9% during the fourth quarter. FMR LLC now owns 7,620,083 shares of the apparel retailer's stock valued at $1,152,690,000 after acquiring an additional 807,850 shares during the last quarter. Invesco Ltd. grew its position in Ross Stores by 4.2% during the fourth quarter. Invesco Ltd. now owns 3,805,427 shares of the apparel retailer's stock valued at $575,647,000 after acquiring an additional 154,486 shares during the last quarter. Finally, Northern Trust Corp grew its position in Ross Stores by 12.1% during the fourth quarter. Northern Trust Corp now owns 3,572,823 shares of the apparel retailer's stock valued at $540,461,000 after acquiring an additional 386,838 shares during the last quarter. 86.86% of the stock is currently owned by institutional investors.

Ross Stores Stock Up 1.8%

Ross Stores stock traded up $2.49 on Monday, hitting $140.82. 2,687,617 shares of the stock traded hands, compared to its average volume of 2,427,210. The company has a current ratio of 1.55, a quick ratio of 0.95 and a debt-to-equity ratio of 0.18. The firm has a market cap of $46.06 billion, a P/E ratio of 22.25, a price-to-earnings-growth ratio of 2.64 and a beta of 1.11. The business's fifty day simple moving average is $135.05 and its 200 day simple moving average is $137.69. Ross Stores, Inc. has a 1 year low of $122.36 and a 1 year high of $163.60.

Ross Stores (NASDAQ:ROST - Get Free Report) last announced its quarterly earnings data on Thursday, May 22nd. The apparel retailer reported $1.47 EPS for the quarter, beating the consensus estimate of $1.44 by $0.03. The business had revenue of $4.98 billion during the quarter, compared to analyst estimates of $4.94 billion. Ross Stores had a return on equity of 38.77% and a net margin of 9.79%. The company's revenue for the quarter was up 2.6% on a year-over-year basis. During the same quarter last year, the firm posted $1.46 earnings per share. As a group, sell-side analysts forecast that Ross Stores, Inc. will post 6.17 earnings per share for the current year.

Ross Stores Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, June 30th. Shareholders of record on Tuesday, June 10th were given a dividend of $0.405 per share. This represents a $1.62 annualized dividend and a yield of 1.15%. The ex-dividend date was Tuesday, June 10th. Ross Stores's dividend payout ratio is currently 25.59%.

Analyst Upgrades and Downgrades

A number of brokerages have commented on ROST. JPMorgan Chase & Co. increased their price target on shares of Ross Stores from $154.00 to $156.00 and gave the company an "overweight" rating in a research report on Monday. Citigroup upgraded shares of Ross Stores from a "neutral" rating to a "buy" rating and set a $146.00 target price on the stock in a report on Thursday, April 3rd. Loop Capital cut their target price on shares of Ross Stores from $175.00 to $170.00 and set a "buy" rating on the stock in a report on Friday, May 23rd. Morgan Stanley cut their target price on shares of Ross Stores from $128.00 to $126.00 and set an "equal weight" rating on the stock in a report on Friday, May 23rd. Finally, Evercore ISI cut their target price on shares of Ross Stores from $170.00 to $160.00 and set an "outperform" rating on the stock in a report on Friday, May 23rd. Five investment analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $159.06.

Check Out Our Latest Report on Ross Stores

Ross Stores Profile

(

Free Report)

Ross Stores, Inc, together with its subsidiaries, operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd's DISCOUNTS brand names in the United States. Its stores primarily offer apparel, accessories, footwear, and home fashions. The company's Ross Dress for Less stores sell its products at department and specialty stores to middle income households; and dd's DISCOUNTS stores sell its products at department and discount stores for households with moderate income.

Featured Articles

Before you consider Ross Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ross Stores wasn't on the list.

While Ross Stores currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.