Benjamin Edwards Inc. decreased its position in shares of OSI Systems, Inc. (NASDAQ:OSIS - Free Report) by 30.4% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 2,880 shares of the technology company's stock after selling 1,256 shares during the quarter. Benjamin Edwards Inc.'s holdings in OSI Systems were worth $560,000 at the end of the most recent quarter.

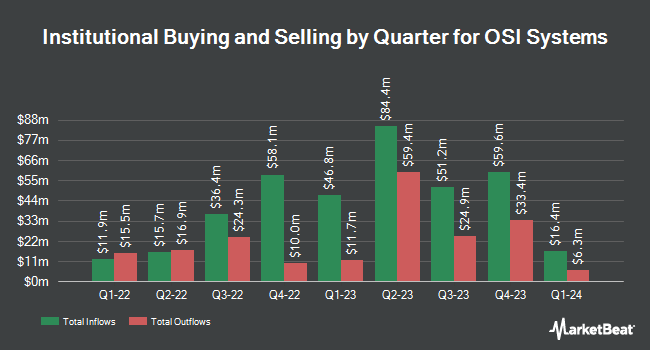

Several other institutional investors have also modified their holdings of OSIS. National Bank of Canada FI increased its stake in shares of OSI Systems by 118.2% during the 1st quarter. National Bank of Canada FI now owns 144 shares of the technology company's stock worth $28,000 after purchasing an additional 78 shares in the last quarter. Nisa Investment Advisors LLC increased its stake in shares of OSI Systems by 139.5% during the 1st quarter. Nisa Investment Advisors LLC now owns 194 shares of the technology company's stock worth $38,000 after purchasing an additional 113 shares in the last quarter. Quantessence Capital LLC purchased a new position in shares of OSI Systems during the 4th quarter worth approximately $231,000. Xponance Inc. purchased a new position in shares of OSI Systems during the 1st quarter worth approximately $233,000. Finally, Sequoia Financial Advisors LLC purchased a new position in shares of OSI Systems during the 1st quarter worth approximately $234,000. Hedge funds and other institutional investors own 89.21% of the company's stock.

Insider Activity at OSI Systems

In related news, Director William Francis Ballhaus, Jr. sold 750 shares of the company's stock in a transaction that occurred on Wednesday, May 21st. The stock was sold at an average price of $228.88, for a total transaction of $171,660.00. Following the sale, the director directly owned 24,055 shares of the company's stock, valued at approximately $5,505,708.40. This represents a 3.02% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, Director Meyer/ Luskin sold 1,000 shares of the company's stock in a transaction that occurred on Thursday, June 12th. The shares were sold at an average price of $237.15, for a total value of $237,150.00. Following the sale, the director directly owned 11,214 shares in the company, valued at approximately $2,659,400.10. This represents a 8.19% decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 5.20% of the company's stock.

Analyst Ratings Changes

OSIS has been the topic of several recent analyst reports. Roth Mkm upped their price objective on shares of OSI Systems from $224.00 to $245.00 and gave the company a "buy" rating in a research note on Friday, May 2nd. B. Riley restated a "buy" rating and issued a $255.00 target price (up from $221.00) on shares of OSI Systems in a report on Friday, May 2nd. Wall Street Zen raised shares of OSI Systems from a "sell" rating to a "hold" rating in a research note on Friday, May 16th. Finally, Oppenheimer lifted their price target on shares of OSI Systems from $225.00 to $260.00 and gave the company an "outperform" rating in a report on Monday, May 5th. Two analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, OSI Systems currently has an average rating of "Moderate Buy" and a consensus price target of $228.33.

View Our Latest Report on OSIS

OSI Systems Stock Performance

OSIS stock opened at $233.49 on Friday. The company has a current ratio of 2.11, a quick ratio of 1.38 and a debt-to-equity ratio of 0.53. The firm has a market cap of $3.92 billion, a P/E ratio of 28.41, a P/E/G ratio of 2.00 and a beta of 1.31. OSI Systems, Inc. has a 12-month low of $129.84 and a 12-month high of $241.64. The stock's 50 day simple moving average is $223.39 and its 200 day simple moving average is $210.47.

OSI Systems Profile

(

Free Report)

OSI Systems, Inc designs and manufactures electronic systems and components. It operates in three segments: Security, Healthcare, and Optoelectronics and Manufacturing. The Security segment offers baggage and parcel inspection, cargo and vehicle inspection, hold baggage and people screening, radiation monitoring, explosive and narcotics trace detection systems, and optical inspection systems under the Rapiscan name.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider OSI Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OSI Systems wasn't on the list.

While OSI Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.