Black Swift Group LLC lifted its stake in MercadoLibre, Inc. (NASDAQ:MELI - Free Report) by 252.9% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,500 shares of the company's stock after buying an additional 1,075 shares during the period. Black Swift Group LLC's holdings in MercadoLibre were worth $2,926,000 as of its most recent SEC filing.

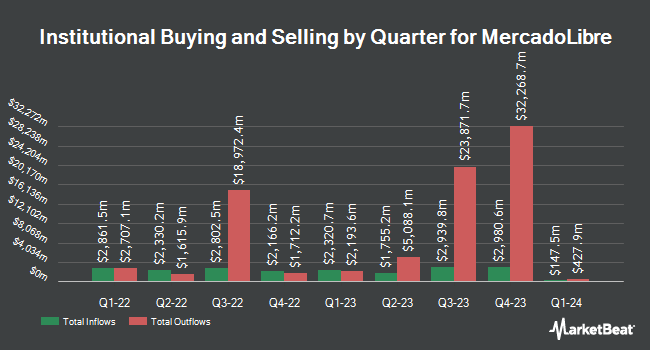

A number of other large investors have also modified their holdings of the stock. Bank Pictet & Cie Europe AG acquired a new position in MercadoLibre in the fourth quarter valued at approximately $561,000. TD Private Client Wealth LLC lifted its stake in MercadoLibre by 32.0% in the fourth quarter. TD Private Client Wealth LLC now owns 66 shares of the company's stock valued at $112,000 after acquiring an additional 16 shares during the last quarter. LPL Financial LLC boosted its stake in shares of MercadoLibre by 13.4% during the 4th quarter. LPL Financial LLC now owns 39,490 shares of the company's stock worth $67,150,000 after acquiring an additional 4,678 shares in the last quarter. Vanguard Group Inc. grew its stake in MercadoLibre by 1.4% in the 4th quarter. Vanguard Group Inc. now owns 205,628 shares of the company's stock valued at $349,658,000 after buying an additional 2,900 shares during the last quarter. Finally, Interchange Capital Partners LLC increased its position in MercadoLibre by 30.1% in the 4th quarter. Interchange Capital Partners LLC now owns 173 shares of the company's stock worth $295,000 after buying an additional 40 shares during the period. Institutional investors and hedge funds own 87.62% of the company's stock.

MercadoLibre Stock Down 1.2%

Shares of MELI traded down $28.49 during trading hours on Friday, reaching $2,362.56. The stock had a trading volume of 278,387 shares, compared to its average volume of 393,848. The company has a current ratio of 1.20, a quick ratio of 1.18 and a debt-to-equity ratio of 0.57. The firm has a 50-day simple moving average of $2,480.35 and a 200 day simple moving average of $2,198.06. MercadoLibre, Inc. has a 12 month low of $1,579.78 and a 12 month high of $2,645.22. The company has a market capitalization of $119.78 billion, a price-to-earnings ratio of 58.11, a P/E/G ratio of 1.42 and a beta of 1.49.

MercadoLibre (NASDAQ:MELI - Get Free Report) last issued its quarterly earnings data on Wednesday, May 7th. The company reported $9.74 EPS for the quarter, topping the consensus estimate of $7.82 by $1.92. The firm had revenue of $5.94 billion during the quarter, compared to the consensus estimate of $5.55 billion. MercadoLibre had a return on equity of 48.46% and a net margin of 9.21%. The company's quarterly revenue was up 37.0% compared to the same quarter last year. During the same period in the prior year, the business posted $6.78 earnings per share. Equities research analysts predict that MercadoLibre, Inc. will post 43.96 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several research firms have commented on MELI. Benchmark downgraded MercadoLibre from a "buy" rating to a "cautious" rating in a research report on Thursday, May 1st. UBS Group set a $3,000.00 price target on MercadoLibre in a research note on Monday, June 2nd. Barclays reduced their target price on shares of MercadoLibre from $3,100.00 to $3,000.00 and set an "overweight" rating on the stock in a research note on Wednesday. JPMorgan Chase & Co. boosted their price target on shares of MercadoLibre from $2,250.00 to $2,600.00 and gave the company a "neutral" rating in a research report on Thursday, May 22nd. Finally, Morgan Stanley reaffirmed an "overweight" rating on shares of MercadoLibre in a report on Thursday, May 1st. One equities research analyst has rated the stock with a sell rating, three have given a hold rating, eleven have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, MercadoLibre currently has a consensus rating of "Moderate Buy" and a consensus target price of $2,639.69.

Check Out Our Latest Stock Report on MELI

About MercadoLibre

(

Free Report)

MercadoLibre, Inc operates online commerce platforms in the United States. It operates Mercado Libre Marketplace, an automated online commerce platform that enables businesses, merchants, and individuals to list merchandise and conduct sales and purchases digitally; and Mercado Pago FinTech platform, a financial technology solution platform, which facilitates transactions on and off its marketplaces by providing a mechanism that allows its users to send and receive payments online, as well as allows users to transfer money through their websites or on the apps.

See Also

Before you consider MercadoLibre, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MercadoLibre wasn't on the list.

While MercadoLibre currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.