Caisse DE Depot ET Placement DU Quebec lessened its stake in shares of Hormel Foods Corporation (NYSE:HRL - Free Report) by 36.6% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 135,340 shares of the company's stock after selling 78,000 shares during the period. Caisse DE Depot ET Placement DU Quebec's holdings in Hormel Foods were worth $4,187,000 at the end of the most recent reporting period.

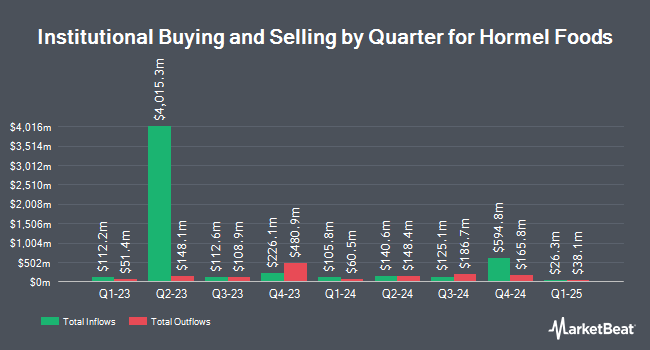

A number of other hedge funds have also recently added to or reduced their stakes in the stock. ProShare Advisors LLC increased its stake in Hormel Foods by 7.3% during the 4th quarter. ProShare Advisors LLC now owns 6,072,682 shares of the company's stock worth $190,500,000 after acquiring an additional 413,669 shares during the period. Millennium Management LLC increased its stake in Hormel Foods by 6.2% during the 4th quarter. Millennium Management LLC now owns 4,488,678 shares of the company's stock worth $140,810,000 after acquiring an additional 261,742 shares during the period. Dimensional Fund Advisors LP increased its stake in Hormel Foods by 10.8% during the 1st quarter. Dimensional Fund Advisors LP now owns 4,157,026 shares of the company's stock worth $128,594,000 after acquiring an additional 405,719 shares during the period. Northern Trust Corp increased its stake in Hormel Foods by 1.4% during the 1st quarter. Northern Trust Corp now owns 3,007,461 shares of the company's stock worth $93,051,000 after acquiring an additional 41,236 shares during the period. Finally, Pacer Advisors Inc. increased its stake in Hormel Foods by 9,725.4% during the 1st quarter. Pacer Advisors Inc. now owns 2,335,797 shares of the company's stock worth $72,270,000 after acquiring an additional 2,312,024 shares during the period. Institutional investors own 40.99% of the company's stock.

Hormel Foods Trading Up 1.2%

NYSE:HRL traded up $0.30 during trading hours on Wednesday, hitting $25.33. 1,333,846 shares of the company were exchanged, compared to its average volume of 3,274,544. The company has a fifty day simple moving average of $29.01 and a 200 day simple moving average of $29.58. Hormel Foods Corporation has a one year low of $23.71 and a one year high of $33.80. The company has a current ratio of 2.47, a quick ratio of 1.17 and a debt-to-equity ratio of 0.35. The stock has a market capitalization of $13.93 billion, a price-to-earnings ratio of 18.48, a price-to-earnings-growth ratio of 5.67 and a beta of 0.31.

Hormel Foods (NYSE:HRL - Get Free Report) last posted its quarterly earnings data on Thursday, August 28th. The company reported $0.35 earnings per share for the quarter, missing the consensus estimate of $0.41 by ($0.06). Hormel Foods had a return on equity of 10.06% and a net margin of 6.26%.The business had revenue of $3.03 billion during the quarter, compared to the consensus estimate of $2.98 billion. During the same period last year, the business posted $0.37 earnings per share. The business's revenue was up 4.6% on a year-over-year basis. Hormel Foods has set its Q4 2025 guidance at 0.380-0.400 EPS. FY 2025 guidance at 1.430-1.450 EPS. Sell-side analysts expect that Hormel Foods Corporation will post 1.65 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research firms have commented on HRL. BNP Paribas Exane upgraded Hormel Foods from an "underperform" rating to a "neutral" rating and set a $30.00 price objective on the stock in a research note on Tuesday, May 27th. Barclays restated an "overweight" rating and set a $34.00 price objective (down previously from $36.00) on shares of Hormel Foods in a research note on Friday, August 29th. JPMorgan Chase & Co. reduced their target price on Hormel Foods from $34.00 to $30.00 and set an "overweight" rating on the stock in a report on Friday, August 29th. Stephens reaffirmed an "equal weight" rating and issued a $31.00 target price on shares of Hormel Foods in a report on Thursday, May 22nd. Finally, Bank of America reduced their target price on Hormel Foods from $35.00 to $28.00 and set a "neutral" rating on the stock in a report on Friday, August 29th. Four equities research analysts have rated the stock with a Buy rating, four have assigned a Hold rating and one has assigned a Sell rating to the company's stock. According to MarketBeat, the stock has an average rating of "Hold" and a consensus price target of $30.88.

Get Our Latest Analysis on Hormel Foods

About Hormel Foods

(

Free Report)

Hormel Foods Corporation develops, processes, and distributes various meat, nuts, and other food products to retail, foodservice, deli, and commercial customers in the United States and internationally. It operates through three segments: Retail, Foodservice, and International segments. The company provides various perishable products that include fresh meats, frozen items, refrigerated meal solutions, sausages, hams, guacamoles, and bacons; and shelf-stable products comprising canned luncheon meats, nut butters, snack nuts, chili, shelf-stable microwaveable meals, hash, stews, tortillas, salsas, tortilla chips, nutritional food supplements, and others.

Featured Stories

Before you consider Hormel Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hormel Foods wasn't on the list.

While Hormel Foods currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.