CAP Partners LLC purchased a new stake in British American Tobacco p.l.c. (NYSE:BTI - Free Report) during the first quarter, according to its most recent filing with the SEC. The firm purchased 5,517 shares of the company's stock, valued at approximately $228,000.

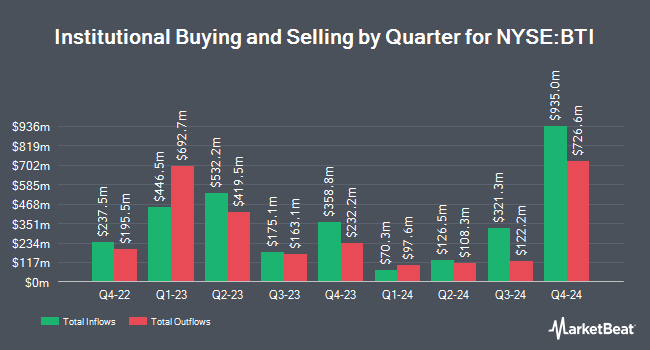

A number of other institutional investors and hedge funds have also made changes to their positions in BTI. Orion Portfolio Solutions LLC grew its stake in British American Tobacco by 5.6% during the 4th quarter. Orion Portfolio Solutions LLC now owns 66,514 shares of the company's stock worth $2,416,000 after buying an additional 3,522 shares during the last quarter. National Bank of Canada FI grew its stake in British American Tobacco by 2.5% during the 4th quarter. National Bank of Canada FI now owns 90,676 shares of the company's stock worth $3,293,000 after buying an additional 2,190 shares during the last quarter. Massachusetts Financial Services Co. MA grew its stake in British American Tobacco by 6.0% during the 4th quarter. Massachusetts Financial Services Co. MA now owns 136,585 shares of the company's stock worth $4,961,000 after buying an additional 7,785 shares during the last quarter. Huntington National Bank grew its stake in British American Tobacco by 8.4% during the 4th quarter. Huntington National Bank now owns 4,791 shares of the company's stock worth $174,000 after buying an additional 373 shares during the last quarter. Finally, World Investment Advisors grew its stake in British American Tobacco by 44.2% during the 4th quarter. World Investment Advisors now owns 7,930 shares of the company's stock worth $288,000 after buying an additional 2,430 shares during the last quarter. 16.16% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on BTI shares. Jefferies Financial Group started coverage on British American Tobacco in a research note on Wednesday, July 9th. They set a "buy" rating on the stock. Bank of America assumed coverage on British American Tobacco in a research note on Wednesday, April 30th. They set a "buy" rating on the stock. Wall Street Zen cut British American Tobacco from a "buy" rating to a "hold" rating in a research report on Saturday, July 26th. Finally, Barclays reaffirmed an "overweight" rating on shares of British American Tobacco in a research report on Friday, June 13th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating and four have given a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $33.00.

Read Our Latest Report on British American Tobacco

British American Tobacco Stock Performance

BTI traded up $0.67 on Friday, reaching $54.35. 5,764,393 shares of the stock were exchanged, compared to its average volume of 5,956,833. The company's 50-day moving average price is $49.14 and its 200 day moving average price is $43.65. British American Tobacco p.l.c. has a fifty-two week low of $34.12 and a fifty-two week high of $54.91. The company has a debt-to-equity ratio of 0.65, a current ratio of 0.76 and a quick ratio of 0.52. The firm has a market capitalization of $112.11 billion, a PE ratio of 11.16, a PEG ratio of 4.96 and a beta of 0.38.

British American Tobacco Cuts Dividend

The business also recently disclosed a dividend, which will be paid on Wednesday, August 6th. Stockholders of record on Monday, June 30th will be issued a $0.7391 dividend. This represents a dividend yield of 599.0%. The ex-dividend date of this dividend is Friday, June 27th. British American Tobacco's payout ratio is 60.78%.

British American Tobacco Company Profile

(

Free Report)

British American Tobacco p.l.c. engages in the provision of tobacco and nicotine products to consumers worldwide. It also offers vapour, heated, and modern oral nicotine products; combustible cigarettes; and traditional oral products, such as snus and moist snuff. The company offers its products under the Vuse, glo, Velo, Grizzly, Kodiak, Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Camel, Natural American Spirit, Newport, Vogue, Viceroy, Kool, Peter Stuyvesant, Craven A, State Express 555 and Shuang Xi brands.

Featured Articles

Before you consider British American Tobacco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and British American Tobacco wasn't on the list.

While British American Tobacco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.