Cerity Partners LLC boosted its stake in shares of TC Energy Corporation (NYSE:TRP - Free Report) TSE: TRP by 113.2% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 33,945 shares of the pipeline company's stock after purchasing an additional 18,022 shares during the period. Cerity Partners LLC's holdings in TC Energy were worth $1,603,000 at the end of the most recent reporting period.

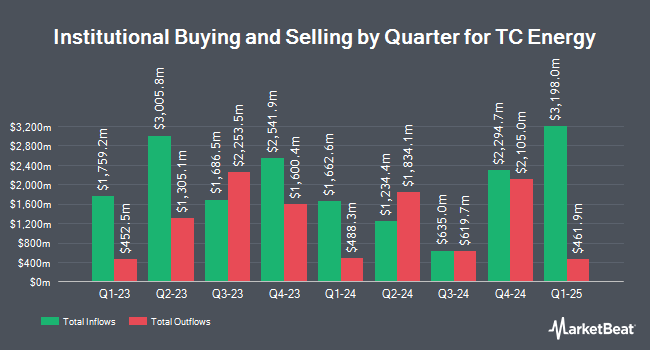

Other hedge funds also recently made changes to their positions in the company. Lowe Wealth Advisors LLC acquired a new stake in TC Energy during the 1st quarter worth approximately $30,000. Millstone Evans Group LLC purchased a new position in TC Energy in the 4th quarter worth approximately $41,000. Golden State Wealth Management LLC grew its position in TC Energy by 222.2% in the first quarter. Golden State Wealth Management LLC now owns 1,076 shares of the pipeline company's stock valued at $51,000 after acquiring an additional 742 shares in the last quarter. HM Payson & Co. acquired a new position in shares of TC Energy during the first quarter worth $60,000. Finally, Tower Research Capital LLC TRC lifted its position in shares of TC Energy by 67.1% during the fourth quarter. Tower Research Capital LLC TRC now owns 1,658 shares of the pipeline company's stock worth $77,000 after purchasing an additional 666 shares in the last quarter. Institutional investors and hedge funds own 83.13% of the company's stock.

TC Energy Price Performance

Shares of NYSE TRP traded down $0.33 during trading on Thursday, hitting $47.78. The company had a trading volume of 596,408 shares, compared to its average volume of 2,451,672. TC Energy Corporation has a 52 week low of $37.41 and a 52 week high of $51.99. The business's 50-day moving average is $48.89 and its 200 day moving average is $47.85. The company has a market cap of $49.69 billion, a P/E ratio of 15.77, a PEG ratio of 4.62 and a beta of 0.76. The company has a debt-to-equity ratio of 1.61, a quick ratio of 0.63 and a current ratio of 0.70.

TC Energy (NYSE:TRP - Get Free Report) TSE: TRP last released its earnings results on Thursday, May 1st. The pipeline company reported $0.66 earnings per share for the quarter, missing the consensus estimate of $0.70 by ($0.04). TC Energy had a return on equity of 11.41% and a net margin of 29.17%. The firm had revenue of $1.78 billion during the quarter, compared to analysts' expectations of $2.57 billion. During the same period last year, the business earned $1.02 earnings per share. Equities research analysts predict that TC Energy Corporation will post 2.63 earnings per share for the current fiscal year.

TC Energy Cuts Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, July 31st. Shareholders of record on Monday, June 30th will be paid a $0.6142 dividend. The ex-dividend date is Monday, June 30th. This represents a $2.46 annualized dividend and a yield of 5.14%. TC Energy's dividend payout ratio is presently 82.51%.

Wall Street Analyst Weigh In

Several research firms recently issued reports on TRP. Citigroup started coverage on shares of TC Energy in a report on Friday, April 4th. They issued a "neutral" rating on the stock. CIBC raised TC Energy from a "neutral" rating to a "sector outperform" rating in a research report on Friday, May 2nd. Finally, Cibc World Mkts upgraded TC Energy from a "hold" rating to a "strong-buy" rating in a research note on Friday, May 2nd. One analyst has rated the stock with a sell rating, three have issued a hold rating, six have given a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, TC Energy currently has a consensus rating of "Moderate Buy" and a consensus price target of $62.00.

Get Our Latest Stock Report on TRP

TC Energy Profile

(

Free Report)

TC Energy Corporation operates as an energy infrastructure company in North America. It operates through five segments: Canadian Natural Gas Pipelines; U.S. Natural Gas Pipelines; Mexico Natural Gas Pipelines; Liquids Pipelines; and Power and Energy Solutions. The company builds and operates a network of 93,600 kilometers of natural gas pipelines, which transports natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, interconnecting pipelines, LNG export terminals, and other businesses.

Further Reading

Before you consider TC Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TC Energy wasn't on the list.

While TC Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.