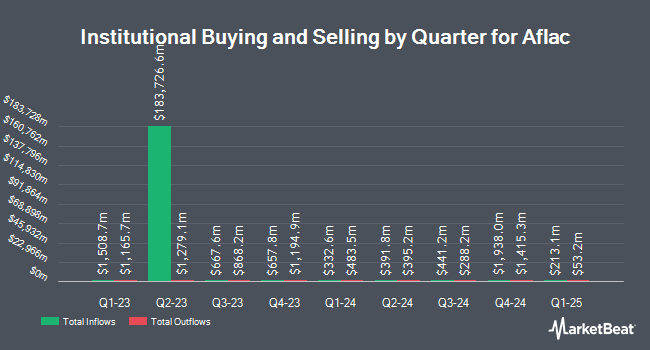

Columbus Macro LLC cut its stake in Aflac Incorporated (NYSE:AFL - Free Report) by 4.6% in the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 64,681 shares of the financial services provider's stock after selling 3,113 shares during the quarter. Columbus Macro LLC's holdings in Aflac were worth $6,821,000 at the end of the most recent quarter.

Several other institutional investors have also added to or reduced their stakes in the stock. Kingswood Wealth Advisors LLC raised its holdings in Aflac by 11.7% in the 2nd quarter. Kingswood Wealth Advisors LLC now owns 8,562 shares of the financial services provider's stock worth $903,000 after purchasing an additional 896 shares in the last quarter. KLP Kapitalforvaltning AS raised its holdings in Aflac by 3.2% in the 2nd quarter. KLP Kapitalforvaltning AS now owns 309,970 shares of the financial services provider's stock worth $32,689,000 after purchasing an additional 9,700 shares in the last quarter. SteelPeak Wealth LLC raised its holdings in Aflac by 41.8% in the 2nd quarter. SteelPeak Wealth LLC now owns 26,567 shares of the financial services provider's stock worth $2,802,000 after purchasing an additional 7,829 shares in the last quarter. Regency Capital Management Inc. DE raised its holdings in Aflac by 5.9% in the 2nd quarter. Regency Capital Management Inc. DE now owns 35,048 shares of the financial services provider's stock worth $3,696,000 after purchasing an additional 1,964 shares in the last quarter. Finally, Next Level Wealth Planning LLC raised its holdings in Aflac by 6.5% in the 2nd quarter. Next Level Wealth Planning LLC now owns 3,147 shares of the financial services provider's stock worth $332,000 after purchasing an additional 192 shares in the last quarter. 67.44% of the stock is currently owned by institutional investors.

Aflac Stock Performance

Shares of NYSE AFL opened at $111.87 on Thursday. The firm's 50-day moving average price is $107.06 and its 200-day moving average price is $105.50. The company has a quick ratio of 0.11, a current ratio of 0.11 and a debt-to-equity ratio of 0.33. The company has a market cap of $59.83 billion, a PE ratio of 25.37, a PEG ratio of 3.13 and a beta of 0.86. Aflac Incorporated has a 52-week low of $96.95 and a 52-week high of $115.44.

Aflac (NYSE:AFL - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The financial services provider reported $1.78 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.71 by $0.07. The firm had revenue of $4.16 billion for the quarter, compared to the consensus estimate of $4.30 billion. Aflac had a net margin of 15.32% and a return on equity of 15.08%. The business's quarterly revenue was down 19.0% compared to the same quarter last year. During the same quarter last year, the firm posted $1.83 EPS. As a group, analysts anticipate that Aflac Incorporated will post 6.88 EPS for the current year.

Aflac Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, September 2nd. Investors of record on Wednesday, August 20th were issued a $0.58 dividend. The ex-dividend date of this dividend was Wednesday, August 20th. This represents a $2.32 dividend on an annualized basis and a dividend yield of 2.1%. Aflac's dividend payout ratio (DPR) is presently 52.61%.

Aflac declared that its board has initiated a share repurchase program on Tuesday, August 12th that allows the company to repurchase 100,000,000 outstanding shares. This repurchase authorization allows the financial services provider to buy shares of its stock through open market purchases. Shares repurchase programs are typically an indication that the company's management believes its stock is undervalued.

Wall Street Analysts Forecast Growth

AFL has been the subject of several research reports. Evercore ISI restated an "underperform" rating and issued a $106.00 price objective (up from $105.00) on shares of Aflac in a report on Thursday, August 14th. Keefe, Bruyette & Woods increased their price target on shares of Aflac from $106.00 to $108.00 and gave the stock a "market perform" rating in a research note on Monday, August 11th. UBS Group decreased their price target on shares of Aflac from $114.00 to $111.00 and set a "neutral" rating for the company in a research note on Wednesday, August 6th. JPMorgan Chase & Co. increased their price target on shares of Aflac from $96.00 to $100.00 and gave the stock a "neutral" rating in a research note on Tuesday, July 8th. Finally, Wall Street Zen upgraded shares of Aflac from a "sell" rating to a "hold" rating in a research note on Saturday, August 9th. Four equities research analysts have rated the stock with a Buy rating, seven have issued a Hold rating and two have given a Sell rating to the stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $110.17.

Read Our Latest Stock Report on AFL

Insider Activity

In related news, Director Joseph L. Moskowitz sold 1,000 shares of the firm's stock in a transaction that occurred on Friday, August 8th. The shares were sold at an average price of $102.57, for a total value of $102,570.00. Following the transaction, the director owned 25,105 shares of the company's stock, valued at approximately $2,575,019.85. This trade represents a 3.83% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Insiders own 0.90% of the company's stock.

Aflac Company Profile

(

Free Report)

Aflac Incorporated, through its subsidiaries, provides supplemental health and life insurance products. The company operates through Aflac Japan and Aflac U.S. segments. The Aflac Japan segment offers cancer, medical, nursing care, work leave, GIFT, and whole and term life insurance products, as well as WAYS and child endowment plans under saving type insurance products in Japan.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Aflac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aflac wasn't on the list.

While Aflac currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.