Mackenzie Financial Corp lowered its holdings in shares of CommVault Systems, Inc. (NASDAQ:CVLT - Free Report) by 84.5% in the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 37,553 shares of the software maker's stock after selling 204,770 shares during the quarter. Mackenzie Financial Corp owned approximately 0.09% of CommVault Systems worth $5,924,000 as of its most recent filing with the Securities & Exchange Commission.

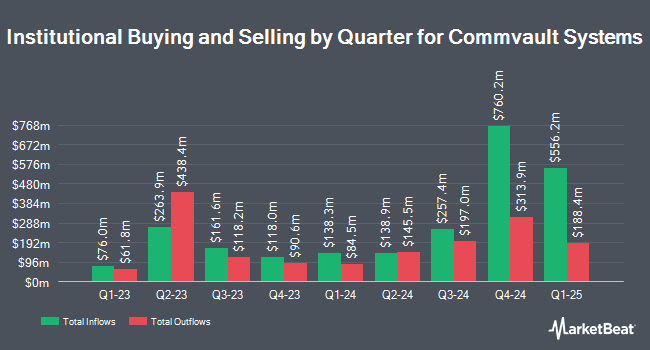

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Quarry LP increased its position in shares of CommVault Systems by 888.2% during the 4th quarter. Quarry LP now owns 168 shares of the software maker's stock valued at $25,000 after purchasing an additional 151 shares during the last quarter. SBI Securities Co. Ltd. increased its position in shares of CommVault Systems by 101.3% during the 1st quarter. SBI Securities Co. Ltd. now owns 159 shares of the software maker's stock valued at $25,000 after purchasing an additional 80 shares during the last quarter. Whipplewood Advisors LLC increased its position in shares of CommVault Systems by 584.0% during the 1st quarter. Whipplewood Advisors LLC now owns 171 shares of the software maker's stock valued at $27,000 after purchasing an additional 146 shares during the last quarter. Cullen Frost Bankers Inc. purchased a new stake in shares of CommVault Systems during the 1st quarter valued at about $27,000. Finally, MassMutual Private Wealth & Trust FSB increased its position in shares of CommVault Systems by 208.3% during the 1st quarter. MassMutual Private Wealth & Trust FSB now owns 185 shares of the software maker's stock valued at $29,000 after purchasing an additional 125 shares during the last quarter. Hedge funds and other institutional investors own 93.50% of the company's stock.

CommVault Systems Trading Up 3.8%

Shares of NASDAQ:CVLT traded up $6.77 during midday trading on Monday, reaching $186.50. 470,770 shares of the company were exchanged, compared to its average volume of 526,881. The stock has a market cap of $8.29 billion, a PE ratio of 103.61 and a beta of 0.70. The business's fifty day moving average is $177.02 and its two-hundred day moving average is $169.07. CommVault Systems, Inc. has a one year low of $127.35 and a one year high of $200.68.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently commented on the stock. Royal Bank Of Canada upped their price target on shares of CommVault Systems from $185.00 to $217.00 and gave the company a "sector perform" rating in a research report on Wednesday, July 30th. Wells Fargo & Company increased their target price on shares of CommVault Systems from $190.00 to $220.00 and gave the stock an "overweight" rating in a report on Wednesday, July 30th. KeyCorp increased their target price on shares of CommVault Systems from $195.00 to $225.00 and gave the stock an "overweight" rating in a report on Wednesday, July 30th. Guggenheim set a $220.00 target price on shares of CommVault Systems in a report on Tuesday, July 29th. Finally, Wall Street Zen raised shares of CommVault Systems from a "hold" rating to a "buy" rating in a report on Thursday, May 1st. Three research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $205.63.

Check Out Our Latest Research Report on CVLT

Insider Activity

In other news, insider Gary Merrill sold 1,748 shares of the stock in a transaction that occurred on Thursday, May 22nd. The stock was sold at an average price of $174.91, for a total transaction of $305,742.68. Following the completion of the transaction, the insider directly owned 89,923 shares in the company, valued at approximately $15,728,431.93. This represents a 1.91% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Sanjay Mirchandani sold 1,709 shares of the stock in a transaction that occurred on Thursday, May 22nd. The shares were sold at an average price of $175.00, for a total value of $299,075.00. Following the transaction, the chief executive officer owned 469,648 shares of the company's stock, valued at $82,188,400. This represents a 0.36% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 1.00% of the company's stock.

CommVault Systems Profile

(

Free Report)

Commvault Systems, Inc provides data protection platform that helps customers to secure, defend, and recover their data in the United States and internationally. The company offers Commvault Backup and Recovery, a backup and recovery solution; Commvault Disaster Recovery, a replication and disaster recovery solution; Commvault Complete Data Protection, a data protection solution; and Metallic Data Protection as-a-service, which delivers enterprise-grade data protection as a service on a cloud platform, with advanced built-in security controls.

See Also

Before you consider CommVault Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CommVault Systems wasn't on the list.

While CommVault Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.