Signature Wealth Management Partners LLC lifted its stake in shares of CrowdStrike (NASDAQ:CRWD - Free Report) by 21.1% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 3,684 shares of the company's stock after acquiring an additional 643 shares during the quarter. CrowdStrike accounts for 0.9% of Signature Wealth Management Partners LLC's portfolio, making the stock its 23rd largest holding. Signature Wealth Management Partners LLC's holdings in CrowdStrike were worth $1,299,000 as of its most recent filing with the Securities & Exchange Commission.

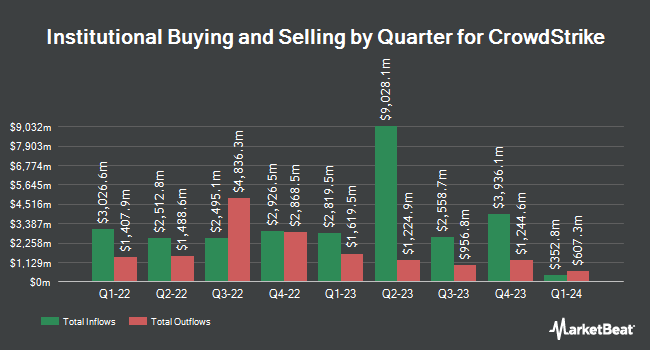

A number of other hedge funds have also modified their holdings of CRWD. Jennison Associates LLC boosted its stake in CrowdStrike by 21.1% in the 1st quarter. Jennison Associates LLC now owns 6,565,275 shares of the company's stock worth $2,314,785,000 after purchasing an additional 1,144,295 shares during the period. Northern Trust Corp raised its stake in CrowdStrike by 16.6% during the 4th quarter. Northern Trust Corp now owns 2,271,722 shares of the company's stock valued at $777,292,000 after purchasing an additional 324,136 shares during the period. FMR LLC lifted its holdings in shares of CrowdStrike by 15.0% in the fourth quarter. FMR LLC now owns 2,204,171 shares of the company's stock valued at $754,179,000 after purchasing an additional 287,960 shares in the last quarter. Price T Rowe Associates Inc. MD boosted its position in shares of CrowdStrike by 11.9% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 1,938,331 shares of the company's stock worth $663,221,000 after buying an additional 206,159 shares during the period. Finally, Voya Investment Management LLC grew its holdings in shares of CrowdStrike by 43.5% during the fourth quarter. Voya Investment Management LLC now owns 1,920,901 shares of the company's stock valued at $657,106,000 after buying an additional 582,471 shares in the last quarter. 71.16% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

CRWD has been the subject of several research analyst reports. Susquehanna increased their price objective on CrowdStrike from $425.00 to $530.00 and gave the stock a "positive" rating in a research note on Wednesday, June 4th. Stifel Nicolaus upped their target price on CrowdStrike from $480.00 to $495.00 and gave the company a "buy" rating in a report on Wednesday, June 4th. Citigroup restated an "outperform" rating on shares of CrowdStrike in a report on Monday, May 5th. Jefferies Financial Group boosted their price objective on shares of CrowdStrike from $520.00 to $530.00 and gave the company a "buy" rating in a research report on Thursday, July 24th. Finally, Oppenheimer upped their price objective on shares of CrowdStrike from $410.00 to $520.00 and gave the company an "outperform" rating in a research note on Wednesday, June 4th. One analyst has rated the stock with a sell rating, nineteen have given a hold rating and twenty-six have given a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $461.17.

Read Our Latest Research Report on CrowdStrike

Insider Activity at CrowdStrike

In related news, Director Johanna Flower sold 2,073 shares of the company's stock in a transaction on Tuesday, July 15th. The stock was sold at an average price of $474.21, for a total value of $983,037.33. Following the completion of the transaction, the director directly owned 81,383 shares in the company, valued at approximately $38,592,632.43. This represents a 2.48% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CAO Anurag Saha sold 1,768 shares of the firm's stock in a transaction on Tuesday, June 24th. The stock was sold at an average price of $491.77, for a total value of $869,449.36. Following the completion of the transaction, the chief accounting officer directly owned 41,251 shares of the company's stock, valued at approximately $20,286,004.27. This trade represents a 4.11% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 235,570 shares of company stock worth $110,581,672 in the last three months. Company insiders own 3.32% of the company's stock.

CrowdStrike Stock Performance

NASDAQ CRWD opened at $446.66 on Friday. The company's fifty day moving average is $479.51 and its two-hundred day moving average is $422.47. CrowdStrike has a 52-week low of $200.81 and a 52-week high of $517.98. The company has a debt-to-equity ratio of 0.21, a current ratio of 1.85 and a quick ratio of 1.85. The firm has a market capitalization of $111.33 billion, a price-to-earnings ratio of -647.33 and a beta of 1.13.

CrowdStrike (NASDAQ:CRWD - Get Free Report) last released its earnings results on Tuesday, June 3rd. The company reported $0.73 earnings per share for the quarter, topping analysts' consensus estimates of $0.66 by $0.07. CrowdStrike had a positive return on equity of 0.43% and a negative net margin of 4.17%. The business had revenue of $1.10 billion for the quarter, compared to the consensus estimate of $1.11 billion. During the same period last year, the business earned $0.93 earnings per share. The firm's revenue for the quarter was up 19.8% compared to the same quarter last year. Equities research analysts forecast that CrowdStrike will post 0.55 EPS for the current year.

About CrowdStrike

(

Free Report)

CrowdStrike Holdings, Inc provides cybersecurity solutions in the United States and internationally. Its unified platform offers cloud-delivered protection of endpoints, cloud workloads, identity, and data. The company offers corporate endpoint and cloud workload security, managed security, security and vulnerability management, IT operations management, identity protection, SIEM and log management, threat intelligence, data protection, security orchestration, automation and response and AI powered workflow automation, and securing generative AI workload services.

See Also

Want to see what other hedge funds are holding CRWD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for CrowdStrike (NASDAQ:CRWD - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CrowdStrike, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CrowdStrike wasn't on the list.

While CrowdStrike currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report