De Lisle Partners LLP decreased its stake in shares of Sterling Infrastructure, Inc. (NASDAQ:STRL - Free Report) by 2.5% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 72,957 shares of the construction company's stock after selling 1,900 shares during the period. Sterling Infrastructure makes up about 1.4% of De Lisle Partners LLP's investment portfolio, making the stock its 15th largest holding. De Lisle Partners LLP owned about 0.24% of Sterling Infrastructure worth $8,257,000 as of its most recent filing with the Securities & Exchange Commission.

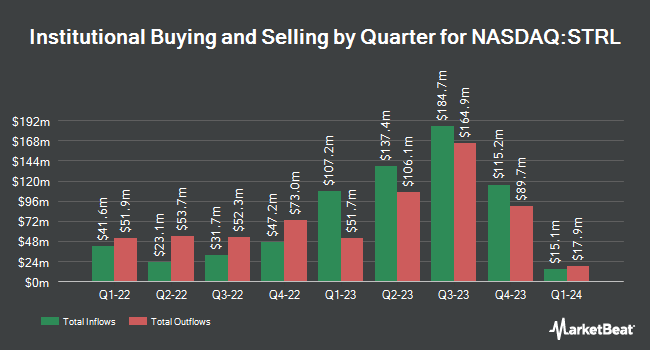

Several other large investors also recently made changes to their positions in the stock. Vanguard Group Inc. increased its position in shares of Sterling Infrastructure by 30.0% during the fourth quarter. Vanguard Group Inc. now owns 2,523,804 shares of the construction company's stock worth $425,135,000 after acquiring an additional 581,847 shares in the last quarter. Invesco Ltd. boosted its holdings in Sterling Infrastructure by 22.5% during the fourth quarter. Invesco Ltd. now owns 757,273 shares of the construction company's stock worth $127,563,000 after purchasing an additional 139,081 shares during the last quarter. Capital Research Global Investors boosted its holdings in Sterling Infrastructure by 78.5% during the fourth quarter. Capital Research Global Investors now owns 574,976 shares of the construction company's stock worth $96,855,000 after purchasing an additional 252,934 shares during the last quarter. Congress Asset Management Co. boosted its holdings in Sterling Infrastructure by 6.5% during the first quarter. Congress Asset Management Co. now owns 532,198 shares of the construction company's stock worth $60,250,000 after purchasing an additional 32,255 shares during the last quarter. Finally, GW&K Investment Management LLC boosted its holdings in Sterling Infrastructure by 37.7% during the first quarter. GW&K Investment Management LLC now owns 500,028 shares of the construction company's stock worth $56,608,000 after purchasing an additional 136,777 shares during the last quarter. Institutional investors own 80.95% of the company's stock.

Insiders Place Their Bets

In other news, General Counsel Mark D. Wolf sold 3,500 shares of the firm's stock in a transaction dated Tuesday, June 24th. The shares were sold at an average price of $225.87, for a total transaction of $790,545.00. Following the completion of the sale, the general counsel owned 29,315 shares in the company, valued at approximately $6,621,379.05. This trade represents a 10.67% decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Dana C. O'brien sold 10,154 shares of the firm's stock in a transaction dated Monday, June 16th. The stock was sold at an average price of $206.58, for a total transaction of $2,097,613.32. Following the transaction, the director directly owned 16,498 shares in the company, valued at approximately $3,408,156.84. This represents a 38.10% decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 2.70% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on the stock. Wall Street Zen cut shares of Sterling Infrastructure from a "buy" rating to a "hold" rating in a report on Saturday, July 5th. DA Davidson increased their target price on shares of Sterling Infrastructure from $205.00 to $265.00 and gave the stock a "buy" rating in a report on Wednesday, June 18th.

Read Our Latest Analysis on Sterling Infrastructure

Sterling Infrastructure Stock Performance

Shares of STRL stock opened at $263.59 on Tuesday. The stock has a market cap of $8.02 billion, a P/E ratio of 30.79, a P/E/G ratio of 2.22 and a beta of 1.40. The company has a debt-to-equity ratio of 0.34, a current ratio of 1.32 and a quick ratio of 1.32. The company has a fifty day moving average price of $219.65 and a two-hundred day moving average price of $169.32. Sterling Infrastructure, Inc. has a one year low of $93.50 and a one year high of $270.38.

Sterling Infrastructure Profile

(

Free Report)

Sterling Infrastructure, Inc engages in the provision of e-infrastructure, transportation, and building solutions primarily in the United States. It operates through three segments: E-Infrastructure Solutions, Transportation Solutions, and Building Solutions. The E-Infrastructure Solutions segment provides site development services for the blue-chip end users in the e-commerce distribution center, data center, manufacturing, warehousing, and power generation sectors.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sterling Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sterling Infrastructure wasn't on the list.

While Sterling Infrastructure currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.