Dean Capital Management raised its position in Rush Enterprises, Inc. (NASDAQ:RUSHA - Free Report) by 21.1% during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 41,379 shares of the company's stock after buying an additional 7,197 shares during the quarter. Rush Enterprises accounts for 1.0% of Dean Capital Management's holdings, making the stock its 25th biggest holding. Dean Capital Management owned 0.05% of Rush Enterprises worth $2,210,000 at the end of the most recent reporting period.

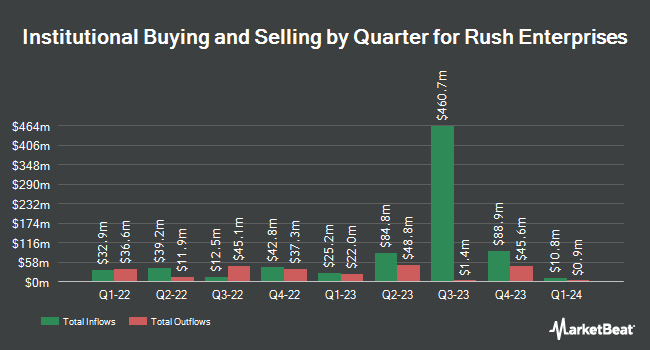

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in RUSHA. Tower Research Capital LLC TRC grew its holdings in Rush Enterprises by 121.5% in the 4th quarter. Tower Research Capital LLC TRC now owns 1,123 shares of the company's stock valued at $62,000 after buying an additional 616 shares in the last quarter. Deutsche Bank AG grew its holdings in Rush Enterprises by 2.1% in the 4th quarter. Deutsche Bank AG now owns 677,750 shares of the company's stock valued at $37,134,000 after buying an additional 13,745 shares in the last quarter. Jefferies Financial Group Inc. acquired a new position in Rush Enterprises in the 4th quarter valued at $241,000. Janus Henderson Group PLC grew its holdings in Rush Enterprises by 6.8% in the 4th quarter. Janus Henderson Group PLC now owns 329,027 shares of the company's stock valued at $18,028,000 after buying an additional 20,823 shares in the last quarter. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its holdings in Rush Enterprises by 4.0% in the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 34,633 shares of the company's stock valued at $1,898,000 after buying an additional 1,338 shares in the last quarter. 84.43% of the stock is owned by institutional investors and hedge funds.

Rush Enterprises Price Performance

NASDAQ:RUSHA traded down $1.93 during trading hours on Friday, hitting $55.66. The company's stock had a trading volume of 241,975 shares, compared to its average volume of 252,862. The stock has a fifty day simple moving average of $55.55 and a 200-day simple moving average of $53.16. The company has a market capitalization of $4.33 billion, a P/E ratio of 15.86, a PEG ratio of 1.57 and a beta of 0.88. The company has a debt-to-equity ratio of 0.23, a current ratio of 1.39 and a quick ratio of 0.32. Rush Enterprises, Inc. has a twelve month low of $47.06 and a twelve month high of $65.43.

Rush Enterprises (NASDAQ:RUSHA - Get Free Report) last released its quarterly earnings data on Wednesday, July 30th. The company reported $0.90 earnings per share for the quarter, beating the consensus estimate of $0.80 by $0.10. The business had revenue of $1.93 billion for the quarter, compared to analyst estimates of $1.89 billion. Rush Enterprises had a return on equity of 13.29% and a net margin of 3.73%. On average, analysts anticipate that Rush Enterprises, Inc. will post 3.91 EPS for the current fiscal year.

Rush Enterprises Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, September 12th. Investors of record on Tuesday, August 12th were paid a $0.19 dividend. This represents a $0.76 annualized dividend and a yield of 1.4%. This is a boost from Rush Enterprises's previous quarterly dividend of $0.18. The ex-dividend date of this dividend was Tuesday, August 12th. Rush Enterprises's payout ratio is 21.65%.

Analyst Upgrades and Downgrades

Several research firms have recently issued reports on RUSHA. Wall Street Zen lowered Rush Enterprises from a "buy" rating to a "hold" rating in a report on Sunday, July 13th. Stephens reissued an "overweight" rating on shares of Rush Enterprises in a report on Monday, August 4th. One equities research analyst has rated the stock with a Buy rating, Based on data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $61.00.

Read Our Latest Analysis on Rush Enterprises

Insider Activity at Rush Enterprises

In other Rush Enterprises news, COO Jason Wilder sold 4,980 shares of the stock in a transaction dated Tuesday, August 12th. The stock was sold at an average price of $55.55, for a total value of $276,639.00. Following the completion of the transaction, the chief operating officer directly owned 79,692 shares in the company, valued at approximately $4,426,890.60. This trade represents a 5.88% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Michael Mcroberts sold 6,000 shares of the stock in a transaction dated Monday, August 4th. The shares were sold at an average price of $54.64, for a total value of $327,840.00. Following the completion of the transaction, the director owned 15,771 shares of the company's stock, valued at $861,727.44. This represents a 27.56% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 15,480 shares of company stock valued at $862,104 over the last ninety days. 12.28% of the stock is owned by corporate insiders.

Rush Enterprises Profile

(

Free Report)

Rush Enterprises, Inc, through its subsidiaries, operates as an integrated retailer of commercial vehicles and related services in the United States and Canada. The company operates a network of commercial vehicle dealerships under the Rush Truck Centers name. Its Rush Truck Centers primarily sell commercial vehicles manufactured by Peterbilt, International, Hino, Ford, Isuzu, IC Bus, Blue Bird, and Dennis Eagle.

Featured Articles

Before you consider Rush Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rush Enterprises wasn't on the list.

While Rush Enterprises currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.