Envestnet Asset Management Inc. decreased its position in Confluent, Inc. (NASDAQ:CFLT - Free Report) by 8.3% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 109,417 shares of the company's stock after selling 9,904 shares during the quarter. Envestnet Asset Management Inc.'s holdings in Confluent were worth $2,565,000 as of its most recent SEC filing.

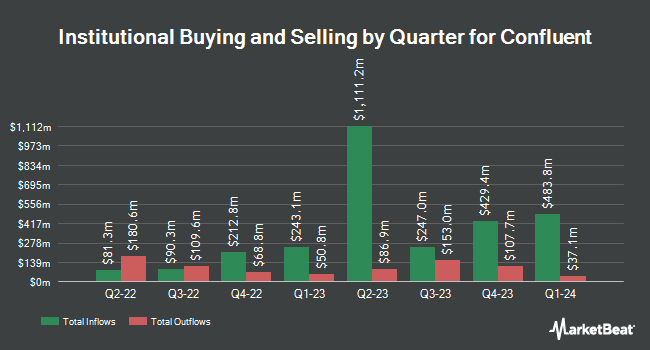

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Credit Industriel ET Commercial purchased a new stake in shares of Confluent during the fourth quarter worth $28,000. Cloud Capital Management LLC purchased a new stake in shares of Confluent during the first quarter worth $26,000. Versant Capital Management Inc increased its position in shares of Confluent by 2,458.2% during the first quarter. Versant Capital Management Inc now owns 1,714 shares of the company's stock worth $40,000 after acquiring an additional 1,647 shares during the period. GAMMA Investing LLC increased its position in shares of Confluent by 26.8% during the first quarter. GAMMA Investing LLC now owns 3,128 shares of the company's stock worth $73,000 after acquiring an additional 661 shares during the period. Finally, BI Asset Management Fondsmaeglerselskab A S purchased a new stake in shares of Confluent during the fourth quarter worth $153,000. Hedge funds and other institutional investors own 78.09% of the company's stock.

Confluent Stock Down 1.3%

Confluent stock opened at $27.00 on Tuesday. Confluent, Inc. has a fifty-two week low of $17.79 and a fifty-two week high of $37.90. The company has a debt-to-equity ratio of 1.07, a quick ratio of 4.42 and a current ratio of 4.42. The company has a market capitalization of $9.19 billion, a P/E ratio of -27.55 and a beta of 0.99. The stock has a 50-day simple moving average of $24.30 and a 200-day simple moving average of $25.49.

Confluent (NASDAQ:CFLT - Get Free Report) last announced its earnings results on Wednesday, April 30th. The company reported $0.08 earnings per share for the quarter, topping the consensus estimate of $0.07 by $0.01. Confluent had a negative net margin of 31.42% and a negative return on equity of 29.92%. The business had revenue of $271.12 million during the quarter, compared to the consensus estimate of $264.45 million. During the same quarter in the prior year, the firm earned $0.05 earnings per share. The business's quarterly revenue was up 24.8% compared to the same quarter last year. Equities research analysts expect that Confluent, Inc. will post -0.83 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of analysts have recently weighed in on CFLT shares. DA Davidson cut their price objective on Confluent from $42.00 to $28.00 and set a "buy" rating on the stock in a research report on Thursday, May 1st. Needham & Company LLC cut their price objective on Confluent from $40.00 to $26.00 and set a "buy" rating on the stock in a research report on Thursday, May 1st. Stephens started coverage on Confluent in a research report on Friday, July 18th. They set an "overweight" rating and a $31.00 price objective on the stock. JMP Securities cut their price objective on Confluent from $40.00 to $36.00 and set a "market outperform" rating on the stock in a research report on Thursday, May 1st. Finally, Oppenheimer dropped their target price on Confluent from $35.00 to $32.00 and set an "outperform" rating on the stock in a report on Thursday, May 1st. One research analyst has rated the stock with a sell rating, six have assigned a hold rating, twenty-one have issued a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $30.36.

Read Our Latest Report on CFLT

Insider Buying and Selling at Confluent

In related news, CEO Edward Jay Kreps sold 232,500 shares of Confluent stock in a transaction on Thursday, June 5th. The shares were sold at an average price of $24.50, for a total value of $5,696,250.00. Following the transaction, the chief executive officer directly owned 452,488 shares in the company, valued at $11,085,956. This trade represents a 33.94% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, CAO Kong Phan sold 3,575 shares of Confluent stock in a transaction on Friday, June 20th. The shares were sold at an average price of $23.49, for a total transaction of $83,976.75. Following the completion of the transaction, the chief accounting officer owned 239,742 shares in the company, valued at approximately $5,631,539.58. This trade represents a 1.47% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 546,669 shares of company stock valued at $12,637,193. Corporate insiders own 13.82% of the company's stock.

About Confluent

(

Free Report)

Confluent, Inc operates a data streaming platform in the United States and internationally. The company provides platforms that allow customers to connect their applications, systems, and data layers, such as Confluent Cloud, a managed cloud-native software-as-a-service; and Confluent Platform, an enterprise-grade self-managed software.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Confluent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Confluent wasn't on the list.

While Confluent currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.