Confluent Today

$24.50 -1.06 (-4.15%) As of 04:00 PM Eastern

- 52-Week Range

- $17.79

▼

$37.90 - Price Target

- $30.11

Confluent Inc. NASDAQ: CFLT is a leading data streaming platform provider. Data streaming is the continuous transmission of data, usually in real-time, like stock market data, social media feeds, and GPS navigation.

This continuous flow of data is in contrast to batch processing, which collects and processes data in chunks like billing and payroll systems.

The Complexities of Data Streaming and Kafka

We are surrounded by streaming data and easily take it for granted. It’s a complex process that requires the ability to process large volumes of data with specialized frameworks using data pipelines optimized for low latency transmission and high throughput to ensure real-time processing without performance degradation or lag. It’s vital for continuous machine learning and artificial intelligence (AI) training, analysis, and deployment.

The founders of Apache Kafka, an open-source distributed event streaming platform, co-founded Confluent. Confluent's platform was built around Kafka. Confluent offers enterprise-grade commercial tools, infrastructure, support, and services that enhance Kafka's use. New product innovations driving growth include TableFlow, Flink, freight clusters, and AI model inference.

Major Well-Known Customers on Their Use Cases

As a leader in the business services sector, Confluent enables real-time data streaming for well-known clients like Booking Holdings Inc. NASDAQ: BKNG (updating real-time flight and hotel prices and availability), Domino’s Pizza NYSE: DPZ (real-time order tracking), Intel Co. NASDAQ: INTC (cyber intelligence and security), Lyft Inc. NASDAQ: LYFT (location and pricing data), Netflix Inc. NASDAQ: NFLX (video streaming, real-time analytics and recommendations) and Walmart Inc. NYSE: WMT (updating inventory and pricing data in real-time). OpenAI uses Confluent to deliver real-time data streams, and they have expanded the relationship to scale with its growing platform usage.

Confluent CEO Jay Kreps discussed hosting the Current 2024 data streaming event during its Q3 conference call. Kreps pointed out, “And some of the most popular sessions focused on how companies leverage data streaming to power transformative AI use cases like creating customer chatbots, building AI and ML pipelines to detect fraud and delivering hyper-personalized AI customer experiences. We continue to see excitement, interest and use cases around Gen AI growing across our customers and in the ecosystem of AI solutions providers.”

Transition to the Cloud and a Consumption Model

The legacy Confluent platform was an on-premise model that resides on the client’s servers. However, Confluent has transitioned to the cloud with its Confluent Cloud platform under a consumption model that offers more flexibility for companies. This segment has an enterprise install base exceeding 5,400 companies, driving its 42% YoY revenue growth to $130 million in its third quarter of 2024. Subscription revenue climbed 27% YoY to $240 million. Its customers generating over $100,000 grew 14% YoY to 1,346.

Solid Recovery for Confluent Driven by Tailwinds

Confluent Stock Forecast Today

12-Month Stock Price Forecast:$30.1122.90% UpsideModerate BuyBased on 29 Analyst Ratings | Current Price | $24.50 |

|---|

| High Forecast | $41.00 |

|---|

| Average Forecast | $30.11 |

|---|

| Low Forecast | $22.00 |

|---|

Confluent Stock Forecast DetailsConfluent also reported Q3 EPS of 10 cents, beating consensus estimates by 5 cents. Total revenues grew 25% YoY to $250.2 million, beating $244.2 million consensus estimates. Non-GAAP operating margin expanded to 6.3%. Confluent believes the data-streaming category is worth $60 billion. Several major tailwinds power its growth, which includes the exponential growth in real-time data from GenAI, social media, IoT, eCommerce transactions, edge computing, AI applications, and video streaming. The data is being used more than ever to power data-driven decisions from real-time data integration, analytics, and insights.

Confluent offered in-line Q4 EPS guidance of 5 cents, matching consensus estimates, with subscription revenue expected between $245 million and $246 million. However, Confluent provided upside guidance for full-year 2024 EPS of 25 cents versus 21 cents analyst estimates, with subscription revenue climbing to $916.5 million to $917.5 million.

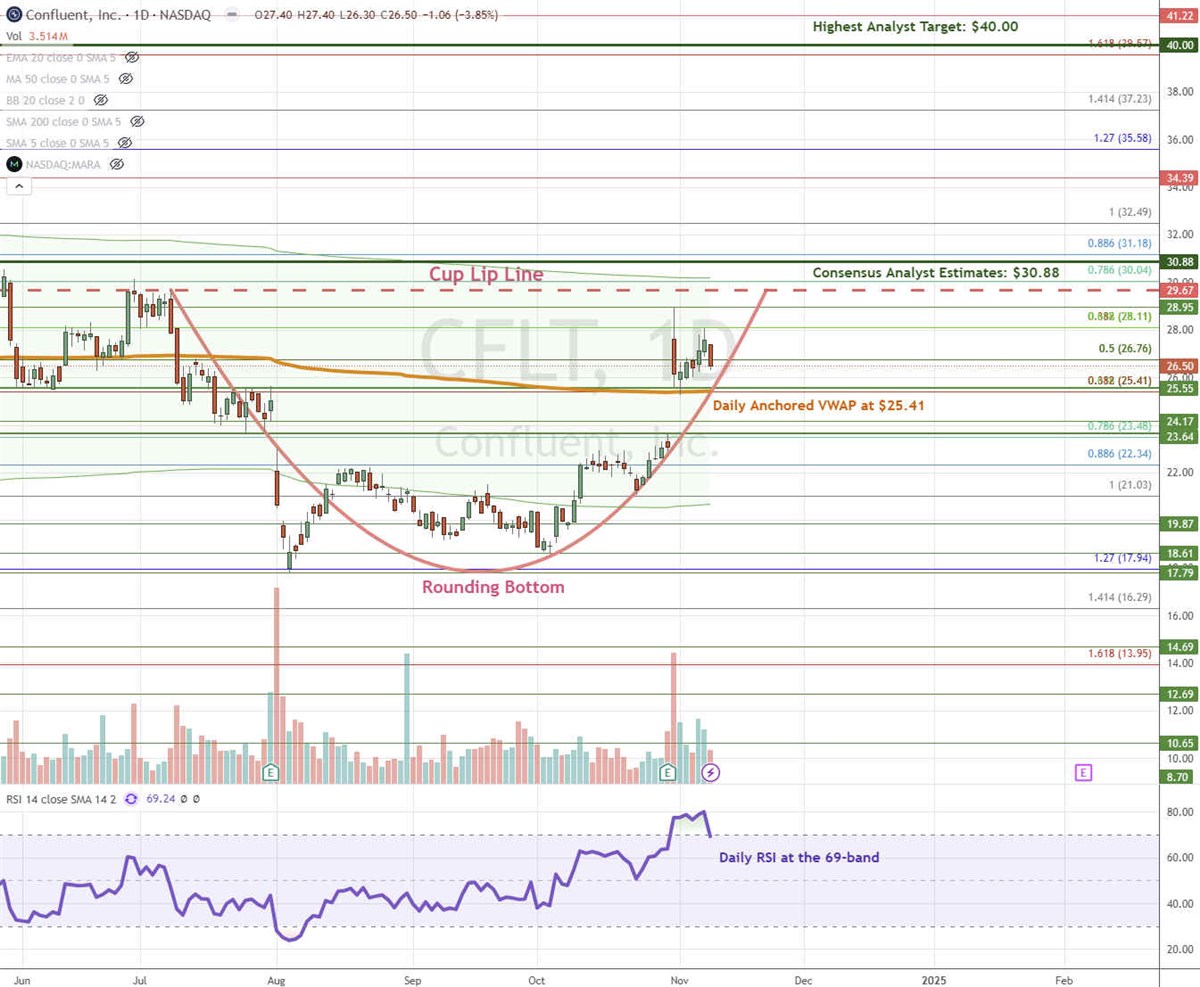

CFLT Is Developing a Cup Pattern

A cup pattern is formed when the stock falls from its swing-high lip line to a swing-low and forms a rounding bottom that slopes back up to retest the cup lip line again. If the stock surges back up through the cup lip line, a pullback can form the handle and trigger a breakout.

CFLT formed the cup lip line at the $29.67 swing high as it fell to the $17.79 swing low and then formed a rounding bottom to stage a recovery rally back up through the daily anchored VWAP at $25.41.The Q3 earnings release triggered the gap above the anchored VWAP, which is now acting as a support. The Cup lip line still needs to be tested to complete the cup pattern. The daily RSI peaked and is starting to fall at the 69-band. Fibonacci (Fib) pullback support levels are at $25.41, $23.48, $21.03, and $17.94.

CFLT’s average consensus price target is $30.88 implying a 16% upside, and its highest analyst price target sits at $40.00. It has 20 analysts' Buy ratings, seven Holds, and one Sell rating. The stock has an 8.4% short interest.

Actionable Options Strategies: Bullish options investors can enter CFLT on a pullback using cash-secured puts at the Fib pullback support levels or take a bullish call debit spread for a breakout through the cup lip line using less capital than owning the stock while minimizing the downside for capped upside gains.

Before you consider Confluent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Confluent wasn't on the list.

While Confluent currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.