Federated Hermes Inc. lifted its holdings in shares of GE Vernova Inc. (NYSE:GEV - Free Report) by 0.1% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 567,902 shares of the company's stock after purchasing an additional 434 shares during the quarter. Federated Hermes Inc. owned 0.21% of GE Vernova worth $173,369,000 at the end of the most recent quarter.

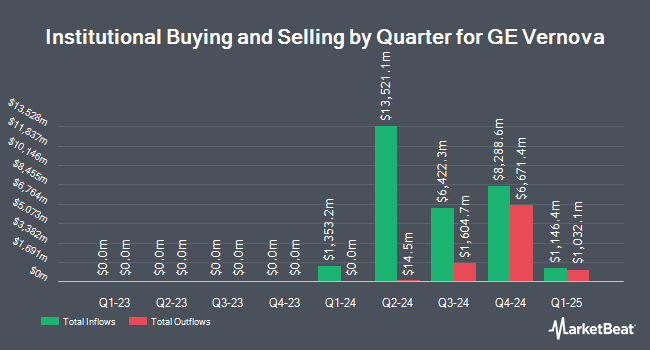

Other hedge funds and other institutional investors also recently modified their holdings of the company. Navigoe LLC purchased a new stake in GE Vernova in the fourth quarter worth approximately $27,000. Clarity Asset Management Inc. purchased a new stake in GE Vernova in the fourth quarter worth approximately $28,000. IMA Advisory Services Inc. purchased a new stake in GE Vernova in the first quarter worth approximately $27,000. Orion Capital Management LLC purchased a new stake in GE Vernova in the fourth quarter worth approximately $30,000. Finally, EQ Wealth Advisors LLC purchased a new stake in GE Vernova in the first quarter worth approximately $27,000.

Wall Street Analyst Weigh In

Several analysts have weighed in on GEV shares. Morgan Stanley boosted their price objective on GE Vernova from $511.00 to $675.00 and gave the company an "overweight" rating in a research report on Thursday, July 24th. Bank of America boosted their price objective on GE Vernova from $550.00 to $620.00 and gave the company a "buy" rating in a research report on Thursday, July 17th. The Goldman Sachs Group boosted their price objective on GE Vernova from $500.00 to $570.00 and gave the company a "buy" rating in a research report on Tuesday, June 10th. BMO Capital Markets boosted their price objective on GE Vernova from $590.00 to $690.00 and gave the company an "outperform" rating in a research report on Thursday, July 24th. Finally, TD Cowen boosted their price objective on GE Vernova from $390.00 to $685.00 and gave the company a "buy" rating in a research report on Friday, July 25th. Ten equities research analysts have rated the stock with a hold rating, eighteen have issued a buy rating and four have given a strong buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $560.21.

Get Our Latest Stock Report on GE Vernova

GE Vernova Trading Down 0.7%

GEV stock traded down $4.55 during trading on Friday, reaching $655.75. The stock had a trading volume of 2,630,152 shares, compared to its average volume of 3,669,422. GE Vernova Inc. has a 52 week low of $150.01 and a 52 week high of $677.29. The stock's 50 day moving average is $526.57 and its two-hundred day moving average is $413.87. The firm has a market cap of $178.51 billion, a PE ratio of 158.20, a PEG ratio of 4.53 and a beta of 1.86.

GE Vernova (NYSE:GEV - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The company reported $1.86 earnings per share for the quarter, beating analysts' consensus estimates of $1.63 by $0.23. GE Vernova had a return on equity of 13.23% and a net margin of 3.16%. The company had revenue of $9.11 billion for the quarter, compared to the consensus estimate of $8.78 billion. During the same quarter in the prior year, the company earned $4.65 earnings per share. GE Vernova's revenue was up 11.1% on a year-over-year basis. On average, research analysts anticipate that GE Vernova Inc. will post 6.59 EPS for the current year.

GE Vernova Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Monday, August 18th. Investors of record on Monday, July 21st will be given a dividend of $0.25 per share. The ex-dividend date is Monday, July 21st. This represents a $1.00 annualized dividend and a dividend yield of 0.2%. GE Vernova's dividend payout ratio (DPR) is currently 24.10%.

GE Vernova Profile

(

Free Report)

GE Vernova LLC, an energy business company, generates electricity. It operates under three segments: Power, Wind, and Electrification. The Power segments generates and sells electricity through hydro, gas, nuclear, and steam power. Wind segment engages in the manufacturing and sale of wind turbine blades; and Electrification segment provides grid solutions, power conversion, solar, and storage solutions.

Featured Stories

Before you consider GE Vernova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE Vernova wasn't on the list.

While GE Vernova currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.