Fjarde AP Fonden Fourth Swedish National Pension Fund lowered its stake in Corpay, Inc. (NYSE:CPAY - Free Report) by 10.1% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 17,852 shares of the company's stock after selling 2,000 shares during the quarter. Fjarde AP Fonden Fourth Swedish National Pension Fund's holdings in Corpay were worth $6,225,000 as of its most recent filing with the Securities & Exchange Commission.

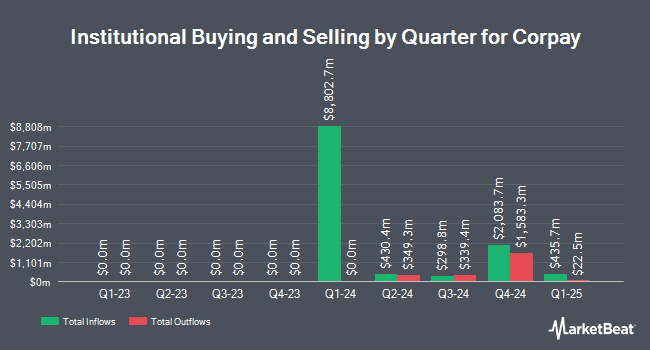

Several other large investors have also added to or reduced their stakes in CPAY. Colonial Trust Co SC boosted its position in shares of Corpay by 120.5% during the 4th quarter. Colonial Trust Co SC now owns 97 shares of the company's stock valued at $33,000 after acquiring an additional 53 shares during the last quarter. Zions Bancorporation National Association UT bought a new stake in shares of Corpay during the 1st quarter valued at about $41,000. Rakuten Securities Inc. bought a new stake in shares of Corpay during the 1st quarter valued at about $45,000. Larson Financial Group LLC boosted its position in shares of Corpay by 309.5% during the 1st quarter. Larson Financial Group LLC now owns 172 shares of the company's stock valued at $60,000 after acquiring an additional 130 shares during the last quarter. Finally, Continuum Advisory LLC lifted its position in Corpay by 29.6% in the 4th quarter. Continuum Advisory LLC now owns 184 shares of the company's stock worth $62,000 after buying an additional 42 shares during the last quarter. Institutional investors own 98.84% of the company's stock.

Corpay Trading Down 1.5%

Shares of NYSE:CPAY traded down $4.9070 during trading on Wednesday, hitting $315.7730. The company had a trading volume of 201,091 shares, compared to its average volume of 495,950. The stock has a market cap of $22.30 billion, a price-to-earnings ratio of 21.40, a price-to-earnings-growth ratio of 1.20 and a beta of 0.96. Corpay, Inc. has a one year low of $269.02 and a one year high of $400.81. The company has a fifty day simple moving average of $326.53 and a two-hundred day simple moving average of $335.15. The company has a debt-to-equity ratio of 1.48, a current ratio of 1.12 and a quick ratio of 1.12.

Corpay (NYSE:CPAY - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The company reported $5.13 earnings per share (EPS) for the quarter, beating the consensus estimate of $5.11 by $0.02. Corpay had a return on equity of 39.13% and a net margin of 25.17%.The business had revenue of $1.10 billion during the quarter, compared to analyst estimates of $1.09 billion. During the same period last year, the company earned $4.55 EPS. The company's revenue for the quarter was up 12.9% on a year-over-year basis. As a group, equities analysts forecast that Corpay, Inc. will post 19.76 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of analysts recently weighed in on the company. Raymond James Financial set a $392.00 target price on Corpay and gave the stock an "outperform" rating in a research report on Thursday, August 7th. Deutsche Bank Aktiengesellschaft assumed coverage on Corpay in a research report on Thursday, July 17th. They issued a "buy" rating and a $390.00 target price for the company. Wall Street Zen downgraded Corpay from a "buy" rating to a "hold" rating in a research report on Saturday. Morgan Stanley lowered their price target on Corpay from $360.00 to $356.00 and set an "equal weight" rating on the stock in a report on Monday, August 11th. Finally, Robert W. Baird set a $440.00 price objective on Corpay in a research report on Tuesday, June 10th. Nine research analysts have rated the stock with a Buy rating and five have issued a Hold rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $399.43.

View Our Latest Stock Report on CPAY

About Corpay

(

Free Report)

Corpay, Inc operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally. The company offers vehicle payment solutions, which include fuel, tolls, parking, fleet maintenance, and long-haul transportation services, as well as prepaid food and transportation vouchers and cards.

See Also

Before you consider Corpay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corpay wasn't on the list.

While Corpay currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.