FRG Family Wealth Advisors LLC lessened its position in Costco Wholesale Corporation (NASDAQ:COST - Free Report) by 2.0% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 13,890 shares of the retailer's stock after selling 284 shares during the quarter. Costco Wholesale accounts for approximately 2.5% of FRG Family Wealth Advisors LLC's portfolio, making the stock its 11th largest holding. FRG Family Wealth Advisors LLC's holdings in Costco Wholesale were worth $13,137,000 at the end of the most recent reporting period.

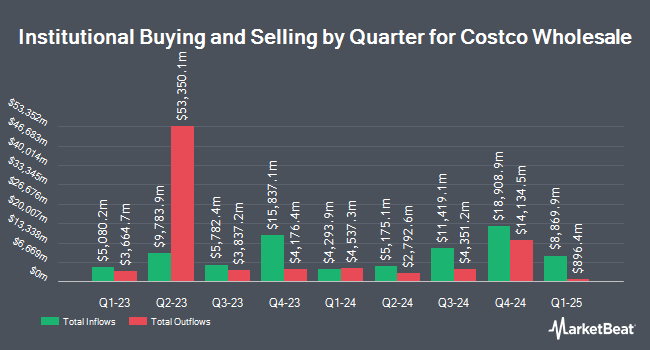

A number of other institutional investors have also added to or reduced their stakes in COST. GAMMA Investing LLC increased its stake in Costco Wholesale by 106,402.1% in the first quarter. GAMMA Investing LLC now owns 8,160,190 shares of the retailer's stock valued at $7,717,744,000 after acquiring an additional 8,152,528 shares during the last quarter. Nuveen LLC purchased a new stake in Costco Wholesale during the first quarter valued at about $3,461,159,000. Leigh Baldwin & CO. LLC purchased a new stake in Costco Wholesale during the fourth quarter valued at about $95,452,000. Vanguard Group Inc. boosted its position in Costco Wholesale by 1.0% during the first quarter. Vanguard Group Inc. now owns 42,644,711 shares of the retailer's stock valued at $40,332,515,000 after buying an additional 443,101 shares during the period. Finally, National Bank of Canada FI boosted its position in Costco Wholesale by 84.0% during the first quarter. National Bank of Canada FI now owns 812,188 shares of the retailer's stock valued at $768,114,000 after buying an additional 370,806 shares during the period. Institutional investors own 68.48% of the company's stock.

Analysts Set New Price Targets

COST has been the subject of several analyst reports. Stifel Nicolaus set a $1,035.00 price target on shares of Costco Wholesale in a research report on Thursday, May 29th. Morgan Stanley upped their price target on shares of Costco Wholesale from $1,150.00 to $1,225.00 and gave the company an "overweight" rating in a research report on Friday, May 30th. Wall Street Zen upgraded shares of Costco Wholesale from a "hold" rating to a "buy" rating in a research report on Friday, June 6th. Erste Group Bank lowered shares of Costco Wholesale from a "buy" rating to a "hold" rating in a research report on Tuesday, August 5th. Finally, Loop Capital dropped their target price on shares of Costco Wholesale from $1,115.00 to $1,110.00 and set a "buy" rating for the company in a report on Thursday, May 29th. Seventeen research analysts have rated the stock with a Buy rating and ten have issued a Hold rating to the company. Based on data from MarketBeat.com, Costco Wholesale has a consensus rating of "Moderate Buy" and an average target price of $1,050.00.

Read Our Latest Report on Costco Wholesale

Costco Wholesale Stock Down 0.2%

COST traded down $1.64 on Monday, hitting $943.32. The company had a trading volume of 1,606,977 shares, compared to its average volume of 2,241,319. The company has a debt-to-equity ratio of 0.21, a current ratio of 1.02 and a quick ratio of 0.52. Costco Wholesale Corporation has a 52-week low of $867.16 and a 52-week high of $1,078.23. The stock has a fifty day simple moving average of $966.42 and a 200-day simple moving average of $980.51. The firm has a market capitalization of $418.34 billion, a P/E ratio of 53.51, a P/E/G ratio of 5.86 and a beta of 0.97.

Costco Wholesale (NASDAQ:COST - Get Free Report) last issued its quarterly earnings data on Thursday, May 29th. The retailer reported $4.28 EPS for the quarter, topping the consensus estimate of $4.24 by $0.04. Costco Wholesale had a net margin of 2.92% and a return on equity of 30.48%. The business had revenue of $63.21 billion during the quarter, compared to analyst estimates of $62.93 billion. During the same period last year, the business posted $3.78 earnings per share. Costco Wholesale's quarterly revenue was up 8.0% compared to the same quarter last year. As a group, equities analysts expect that Costco Wholesale Corporation will post 18.03 EPS for the current fiscal year.

Costco Wholesale Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, August 15th. Shareholders of record on Friday, August 1st were paid a dividend of $1.30 per share. The ex-dividend date of this dividend was Friday, August 1st. This represents a $5.20 dividend on an annualized basis and a dividend yield of 0.6%. Costco Wholesale's dividend payout ratio (DPR) is currently 29.50%.

Insider Buying and Selling at Costco Wholesale

In other Costco Wholesale news, EVP Yoram Rubanenko sold 4,000 shares of the firm's stock in a transaction that occurred on Monday, July 14th. The shares were sold at an average price of $974.96, for a total transaction of $3,899,840.00. Following the completion of the transaction, the executive vice president owned 5,774 shares of the company's stock, valued at approximately $5,629,419.04. This trade represents a 40.92% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, EVP Pierre Riel sold 2,000 shares of the firm's stock in a transaction that occurred on Friday, June 6th. The shares were sold at an average price of $1,014.15, for a total transaction of $2,028,300.00. Following the transaction, the executive vice president directly owned 8,210 shares of the company's stock, valued at $8,326,171.50. This represents a 19.59% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 10,147 shares of company stock valued at $10,067,740. 0.18% of the stock is currently owned by company insiders.

Costco Wholesale Company Profile

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Featured Articles

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report