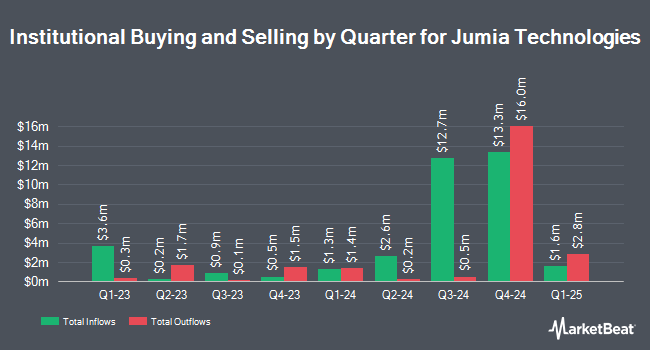

Goldman Sachs Group Inc. decreased its stake in shares of Jumia Technologies (NYSE:JMIA - Free Report) by 75.7% during the first quarter, according to the company in its most recent filing with the SEC. The fund owned 199,287 shares of the company's stock after selling 620,682 shares during the period. Goldman Sachs Group Inc. owned 0.16% of Jumia Technologies worth $428,000 as of its most recent filing with the SEC.

Other hedge funds have also made changes to their positions in the company. Deuterium Capital Management LLC acquired a new position in shares of Jumia Technologies during the 1st quarter valued at about $27,000. PDS Planning Inc acquired a new position in shares of Jumia Technologies during the 1st quarter valued at about $31,000. WealthTrust Axiom LLC increased its holdings in shares of Jumia Technologies by 30.8% during the 1st quarter. WealthTrust Axiom LLC now owns 17,161 shares of the company's stock valued at $37,000 after acquiring an additional 4,036 shares during the last quarter. Octavia Wealth Advisors LLC increased its holdings in shares of Jumia Technologies by 89.2% during the 1st quarter. Octavia Wealth Advisors LLC now owns 31,020 shares of the company's stock valued at $67,000 after acquiring an additional 14,625 shares during the last quarter. Finally, Blair William & Co. IL increased its holdings in shares of Jumia Technologies by 28.6% during the 1st quarter. Blair William & Co. IL now owns 33,700 shares of the company's stock valued at $72,000 after acquiring an additional 7,500 shares during the last quarter. Institutional investors and hedge funds own 16.50% of the company's stock.

Jumia Technologies Stock Performance

JMIA opened at $11.39 on Friday. The stock's 50 day moving average price is $7.91 and its two-hundred day moving average price is $4.68. The company has a quick ratio of 1.28, a current ratio of 1.38 and a debt-to-equity ratio of 0.15. Jumia Technologies has a 12-month low of $1.60 and a 12-month high of $12.37.

Wall Street Analysts Forecast Growth

Separately, Royal Bank Of Canada raised Jumia Technologies from a "sector perform" rating to an "outperform" rating and raised their target price for the company from $6.50 to $15.00 in a report on Tuesday, September 16th. One equities research analyst has rated the stock with a Buy rating, According to data from MarketBeat, the stock has an average rating of "Buy" and an average price target of $15.00.

Read Our Latest Research Report on Jumia Technologies

Jumia Technologies Profile

(

Free Report)

Jumia Technologies AG operates an e-commerce platform in West Africa, North Africa, East and South Africa, Europe, the United Arab Emirates, and internationally. The company's platform consists of marketplace that connects sellers with customers; logistics service, which enables the shipment and delivery of packages from sellers to consumers; and payment service, which facilitates transactions to participants active on the company's platform in selected markets under the JumiaPay name.

Featured Stories

Want to see what other hedge funds are holding JMIA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Jumia Technologies (NYSE:JMIA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Jumia Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jumia Technologies wasn't on the list.

While Jumia Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.