Baillie Gifford & Co. lifted its holdings in Grab Holdings Limited (NASDAQ:GRAB - Free Report) by 7.3% during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 50,443,998 shares of the company's stock after buying an additional 3,422,289 shares during the quarter. Baillie Gifford & Co. owned approximately 1.25% of Grab worth $228,511,000 at the end of the most recent quarter.

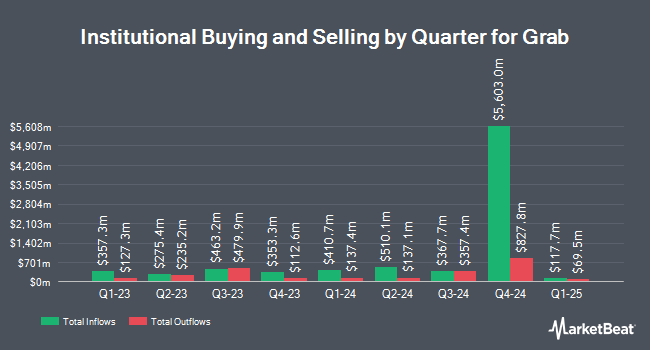

Several other hedge funds and other institutional investors have also recently modified their holdings of GRAB. Uber Technologies Inc bought a new position in Grab in the fourth quarter worth approximately $2,529,462,000. Toyota Motor Corp bought a new position in Grab in the fourth quarter worth approximately $1,052,117,000. Arrowstreet Capital Limited Partnership grew its stake in Grab by 5,066.0% in the fourth quarter. Arrowstreet Capital Limited Partnership now owns 33,914,101 shares of the company's stock worth $160,075,000 after purchasing an additional 33,257,610 shares in the last quarter. Norges Bank bought a new position in Grab in the fourth quarter worth approximately $145,927,000. Finally, BNP Paribas Financial Markets bought a new position in Grab in the fourth quarter worth approximately $137,561,000. 55.52% of the stock is currently owned by hedge funds and other institutional investors.

Grab Stock Performance

Shares of NASDAQ GRAB traded up $0.12 during trading on Tuesday, reaching $5.40. 24,822,590 shares of the company traded hands, compared to its average volume of 36,669,117. Grab Holdings Limited has a 12-month low of $2.98 and a 12-month high of $5.72. The company has a current ratio of 2.49, a quick ratio of 2.46 and a debt-to-equity ratio of 0.04. The stock has a market cap of $21.73 billion, a P/E ratio of 269.88 and a beta of 0.84. The firm's fifty day simple moving average is $4.94 and its 200 day simple moving average is $4.71.

Analysts Set New Price Targets

GRAB has been the topic of several recent research reports. CLSA raised Grab to a "moderate buy" rating in a research report on Wednesday, April 9th. JPMorgan Chase & Co. dropped their target price on Grab from $5.60 to $5.30 and set an "overweight" rating on the stock in a research report on Wednesday, April 16th. Two analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $5.82.

Check Out Our Latest Stock Report on GRAB

Grab Company Profile

(

Free Report)

Grab Holdings Limited engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. The company offers its Grab ecosystem, a single platform with superapps for driver- and merchant-partners and consumers, that allows access to mobility, delivery, digital financial services, and enterprise sector offerings.

See Also

Before you consider Grab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grab wasn't on the list.

While Grab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.