Gradient Investments LLC trimmed its holdings in shares of Costco Wholesale Corporation (NASDAQ:COST - Free Report) by 2.8% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 24,534 shares of the retailer's stock after selling 717 shares during the quarter. Gradient Investments LLC's holdings in Costco Wholesale were worth $24,287,000 as of its most recent SEC filing.

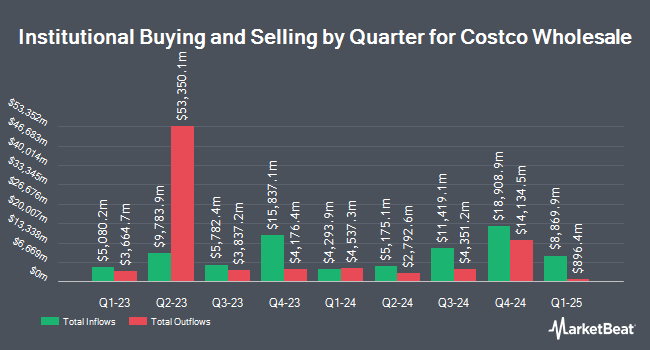

Several other large investors have also made changes to their positions in COST. Investment Management Corp VA ADV acquired a new position in shares of Costco Wholesale during the 4th quarter worth approximately $25,000. Anderson Financial Strategies LLC raised its stake in shares of Costco Wholesale by 900.0% during the 1st quarter. Anderson Financial Strategies LLC now owns 40 shares of the retailer's stock worth $38,000 after buying an additional 36 shares during the period. eCIO Inc. acquired a new position in shares of Costco Wholesale during the 1st quarter worth approximately $48,000. Aspect Partners LLC raised its stake in Costco Wholesale by 24.4% in the 1st quarter. Aspect Partners LLC now owns 56 shares of the retailer's stock valued at $53,000 after purchasing an additional 11 shares during the last quarter. Finally, Capital A Wealth Management LLC acquired a new position in Costco Wholesale in the 4th quarter valued at $58,000. 68.48% of the stock is owned by institutional investors and hedge funds.

Costco Wholesale Stock Performance

Shares of Costco Wholesale stock opened at $967.90 on Monday. The business has a 50-day moving average of $960.40 and a 200 day moving average of $974.31. Costco Wholesale Corporation has a 12 month low of $867.16 and a 12 month high of $1,078.23. The stock has a market capitalization of $429.24 billion, a price-to-earnings ratio of 54.90, a price-to-earnings-growth ratio of 5.45 and a beta of 0.97. The company has a debt-to-equity ratio of 0.21, a current ratio of 1.02 and a quick ratio of 0.52.

Costco Wholesale Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, August 15th. Investors of record on Friday, August 1st were issued a dividend of $1.30 per share. This represents a $5.20 dividend on an annualized basis and a yield of 0.5%. The ex-dividend date was Friday, August 1st. Costco Wholesale's dividend payout ratio (DPR) is 29.50%.

Analysts Set New Price Targets

COST has been the subject of several recent research reports. JPMorgan Chase & Co. increased their price objective on Costco Wholesale from $1,115.00 to $1,160.00 and gave the company an "overweight" rating in a research note on Thursday, August 7th. Evercore ISI cut their target price on Costco Wholesale from $1,075.00 to $1,060.00 and set an "outperform" rating for the company in a research note on Tuesday, June 17th. Erste Group Bank downgraded Costco Wholesale from a "buy" rating to a "hold" rating in a research note on Tuesday, August 5th. Wall Street Zen upgraded Costco Wholesale from a "hold" rating to a "buy" rating in a report on Friday, June 6th. Finally, Telsey Advisory Group reiterated an "outperform" rating and set a $1,100.00 price target on shares of Costco Wholesale in a report on Wednesday, August 27th. Seventeen equities research analysts have rated the stock with a Buy rating and nine have given a Hold rating to the company's stock. Based on data from MarketBeat.com, Costco Wholesale presently has an average rating of "Moderate Buy" and a consensus target price of $1,056.67.

Check Out Our Latest Research Report on Costco Wholesale

Insider Activity at Costco Wholesale

In related news, Director Susan L. Decker sold 547 shares of the firm's stock in a transaction dated Wednesday, June 18th. The stock was sold at an average price of $980.00, for a total transaction of $536,060.00. Following the completion of the transaction, the director directly owned 11,531 shares in the company, valued at $11,300,380. This trade represents a 4.53% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, EVP Yoram Rubanenko sold 4,000 shares of the firm's stock in a transaction dated Monday, July 14th. The shares were sold at an average price of $974.96, for a total value of $3,899,840.00. Following the transaction, the executive vice president owned 5,774 shares of the company's stock, valued at $5,629,419.04. This trade represents a 40.92% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 5,147 shares of company stock worth $5,031,130 in the last three months. 0.18% of the stock is owned by company insiders.

About Costco Wholesale

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.