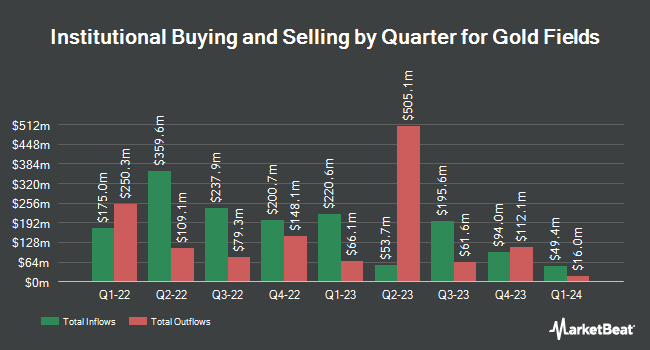

Groupe la Francaise boosted its holdings in Gold Fields Limited (NYSE:GFI - Free Report) by 27.3% in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 280,000 shares of the company's stock after purchasing an additional 60,000 shares during the quarter. Groupe la Francaise's holdings in Gold Fields were worth $5,869,000 at the end of the most recent quarter.

A number of other hedge funds have also added to or reduced their stakes in GFI. Robeco Institutional Asset Management B.V. increased its holdings in shares of Gold Fields by 153.6% during the first quarter. Robeco Institutional Asset Management B.V. now owns 1,486,280 shares of the company's stock valued at $32,832,000 after acquiring an additional 900,317 shares in the last quarter. Man Group plc raised its stake in shares of Gold Fields by 119.9% during the 4th quarter. Man Group plc now owns 1,417,329 shares of the company's stock valued at $18,709,000 after purchasing an additional 772,928 shares during the period. Silvercrest Asset Management Group LLC bought a new stake in shares of Gold Fields during the 4th quarter valued at $9,033,000. Connor Clark & Lunn Investment Management Ltd. increased its stake in Gold Fields by 169.4% in the 1st quarter. Connor Clark & Lunn Investment Management Ltd. now owns 931,777 shares of the company's stock worth $20,583,000 after acquiring an additional 585,950 shares during the last quarter. Finally, Deutsche Bank AG boosted its holdings in shares of Gold Fields by 21.5% in the 1st quarter. Deutsche Bank AG now owns 2,642,663 shares of the company's stock worth $58,376,000 after purchasing an additional 467,579 shares in the last quarter. 24.81% of the stock is currently owned by institutional investors.

Gold Fields Trading Down 2.8%

Shares of NYSE GFI traded down $0.91 during trading on Thursday, reaching $31.93. The stock had a trading volume of 1,448,609 shares, compared to its average volume of 3,384,671. The company has a market cap of $28.58 billion, a P/E ratio of 13.59, a PEG ratio of 0.36 and a beta of 0.42. The company has a debt-to-equity ratio of 0.40, a quick ratio of 0.73 and a current ratio of 1.89. Gold Fields Limited has a fifty-two week low of $12.98 and a fifty-two week high of $33.18. The business's 50-day moving average price is $26.65 and its 200-day moving average price is $23.41.

Gold Fields Increases Dividend

The company also recently disclosed a semi-annual dividend, which will be paid on Thursday, September 25th. Investors of record on Friday, September 12th will be given a $0.3993 dividend. The ex-dividend date is Friday, September 12th. This is an increase from Gold Fields's previous semi-annual dividend of $0.38. This represents a yield of 130.0%. Gold Fields's payout ratio is 26.38%.

Wall Street Analyst Weigh In

GFI has been the subject of several analyst reports. Wall Street Zen upgraded Gold Fields from a "buy" rating to a "strong-buy" rating in a report on Sunday. BMO Capital Markets increased their target price on Gold Fields from $24.00 to $32.00 and gave the company a "market perform" rating in a research note on Monday. Canaccord Genuity Group began coverage on Gold Fields in a research report on Monday, July 28th. They set a "buy" rating and a $33.00 target price on the stock. Finally, Capital One Financial set a $32.00 price objective on Gold Fields in a research report on Friday, August 22nd. Three analysts have rated the stock with a Buy rating and five have issued a Hold rating to the company's stock. Based on data from MarketBeat, Gold Fields has a consensus rating of "Hold" and an average target price of $25.11.

View Our Latest Stock Report on GFI

Gold Fields Profile

(

Free Report)

Gold Fields Limited operates as a gold producer with reserves and resources in Chile, South Africa, Ghana, Canada, Australia, and Peru. It also explores for copper and silver deposits. The company was founded in 1887 and is based in Sandton, South Africa.

See Also

Before you consider Gold Fields, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gold Fields wasn't on the list.

While Gold Fields currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.