HB Wealth Management LLC lifted its holdings in shares of Phillips 66 (NYSE:PSX - Free Report) by 29.9% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The firm owned 29,276 shares of the oil and gas company's stock after buying an additional 6,737 shares during the period. HB Wealth Management LLC's holdings in Phillips 66 were worth $3,615,000 at the end of the most recent quarter.

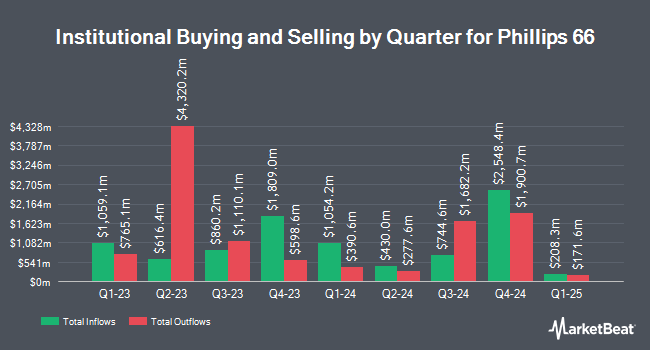

Several other hedge funds have also made changes to their positions in PSX. Pacific Center for Financial Services acquired a new stake in shares of Phillips 66 during the fourth quarter worth about $27,000. von Borstel & Associates Inc. acquired a new stake in Phillips 66 in the first quarter valued at about $27,000. Olde Wealth Management LLC acquired a new stake in Phillips 66 in the first quarter valued at about $28,000. Wood Tarver Financial Group LLC acquired a new stake in Phillips 66 in the fourth quarter valued at about $29,000. Finally, Opal Wealth Advisors LLC acquired a new stake in Phillips 66 in the first quarter valued at about $29,000. Institutional investors and hedge funds own 76.93% of the company's stock.

Phillips 66 Price Performance

PSX stock traded down $0.46 on Thursday, hitting $123.94. 783,709 shares of the company's stock traded hands, compared to its average volume of 3,460,280. Phillips 66 has a 1-year low of $91.01 and a 1-year high of $150.12. The stock has a market cap of $50.09 billion, a price-to-earnings ratio of 29.78, a P/E/G ratio of 1.81 and a beta of 1.02. The stock has a fifty day moving average of $122.07 and a 200-day moving average of $118.83. The company has a current ratio of 1.07, a quick ratio of 0.88 and a debt-to-equity ratio of 0.60.

Phillips 66 (NYSE:PSX - Get Free Report) last issued its quarterly earnings results on Friday, July 25th. The oil and gas company reported $2.38 EPS for the quarter, beating the consensus estimate of $1.79 by $0.59. The business had revenue of $33.77 billion during the quarter, compared to the consensus estimate of $32.11 billion. Phillips 66 had a net margin of 1.27% and a return on equity of 4.87%. During the same quarter in the prior year, the firm earned $2.31 EPS. On average, analysts forecast that Phillips 66 will post 6.8 EPS for the current fiscal year.

Phillips 66 Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, September 2nd. Investors of record on Tuesday, August 19th will be paid a $1.20 dividend. The ex-dividend date of this dividend is Tuesday, August 19th. This represents a $4.80 dividend on an annualized basis and a yield of 3.87%. Phillips 66's payout ratio is presently 115.38%.

Wall Street Analysts Forecast Growth

PSX has been the subject of a number of recent analyst reports. Evercore ISI initiated coverage on shares of Phillips 66 in a research report on Wednesday, June 18th. They issued an "outperform" rating and a $130.00 price objective for the company. Wells Fargo & Company reduced their price objective on shares of Phillips 66 from $149.00 to $147.00 and set an "overweight" rating for the company in a research report on Wednesday, June 11th. Mizuho raised their price objective on shares of Phillips 66 from $132.00 to $138.00 and gave the company a "neutral" rating in a research report on Tuesday, May 13th. Citigroup downgraded shares of Phillips 66 from a "buy" rating to a "neutral" rating and lifted their price target for the company from $126.00 to $130.00 in a research report on Wednesday, July 16th. Finally, JPMorgan Chase & Co. set a $115.00 price target on shares of Phillips 66 in a research report on Wednesday, June 18th. Ten research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $136.13.

Read Our Latest Report on Phillips 66

Insiders Place Their Bets

In other news, EVP Brian Mandell sold 9,800 shares of the firm's stock in a transaction dated Wednesday, June 18th. The shares were sold at an average price of $125.00, for a total transaction of $1,225,000.00. Following the completion of the transaction, the executive vice president directly owned 56,838 shares of the company's stock, valued at approximately $7,104,750. This trade represents a 14.71% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Robert W. Pease acquired 439 shares of Phillips 66 stock in a transaction dated Thursday, May 22nd. The shares were acquired at an average cost of $113.85 per share, with a total value of $49,980.15. Following the completion of the acquisition, the director directly owned 4,091 shares in the company, valued at $465,760.35. This trade represents a 12.02% increase in their position. The disclosure for this purchase can be found here. Company insiders own 0.22% of the company's stock.

About Phillips 66

(

Free Report)

Phillips 66 operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally. It operates through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties (M&S). The Midstream segment transports crude oil and other feedstocks; delivers refined petroleum products to market; provides terminaling and storage services for crude oil and refined petroleum products; transports, stores, fractionates, exports, and markets natural gas liquids; provides other fee-based processing services; and gathers, processes, transports, and markets natural gas.

Featured Articles

Before you consider Phillips 66, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Phillips 66 wasn't on the list.

While Phillips 66 currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.