Headlands Technologies LLC lowered its stake in shares of Roku, Inc. (NASDAQ:ROKU - Free Report) by 72.6% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 5,312 shares of the company's stock after selling 14,098 shares during the period. Headlands Technologies LLC's holdings in Roku were worth $374,000 as of its most recent filing with the Securities and Exchange Commission.

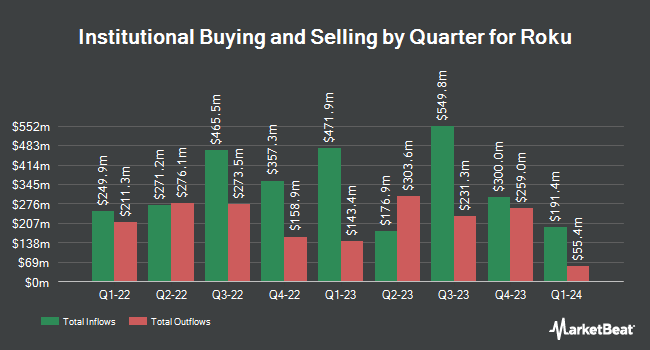

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the stock. Deutsche Bank AG increased its position in shares of Roku by 20.1% during the 1st quarter. Deutsche Bank AG now owns 398,438 shares of the company's stock worth $28,066,000 after purchasing an additional 66,756 shares during the last quarter. Charles Schwab Investment Management Inc. increased its position in shares of Roku by 3.8% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 1,028,332 shares of the company's stock worth $72,436,000 after purchasing an additional 37,465 shares during the last quarter. ASR Vermogensbeheer N.V. acquired a new position in shares of Roku during the 1st quarter worth approximately $440,000. Vanguard Group Inc. increased its position in shares of Roku by 2.1% during the 1st quarter. Vanguard Group Inc. now owns 12,503,595 shares of the company's stock worth $880,753,000 after purchasing an additional 254,504 shares during the last quarter. Finally, Maxi Investments CY Ltd increased its position in shares of Roku by 22.8% during the 1st quarter. Maxi Investments CY Ltd now owns 15,347 shares of the company's stock worth $1,081,000 after purchasing an additional 2,847 shares during the last quarter. Institutional investors own 86.30% of the company's stock.

Analyst Ratings Changes

Several research analysts have weighed in on ROKU shares. Susquehanna boosted their price target on Roku from $85.00 to $110.00 and gave the stock a "positive" rating in a research report on Friday, August 1st. Piper Sandler lifted their target price on Roku from $65.00 to $84.00 and gave the stock a "neutral" rating in a research note on Thursday, July 10th. Guggenheim lifted their target price on Roku from $100.00 to $105.00 and gave the stock a "buy" rating in a research note on Friday, August 1st. Wall Street Zen upgraded Roku from a "hold" rating to a "buy" rating in a research note on Saturday, July 26th. Finally, Citigroup reiterated a "neutral" rating and set a $84.00 target price (up from $68.00) on shares of Roku in a research note on Wednesday, June 18th. One analyst has rated the stock with a sell rating, seven have issued a hold rating, nineteen have given a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $98.96.

Check Out Our Latest Stock Report on ROKU

Roku Stock Performance

Shares of Roku stock traded up $2.33 during trading on Tuesday, reaching $84.32. 3,048,717 shares of the company's stock were exchanged, compared to its average volume of 4,025,145. Roku, Inc. has a 1-year low of $52.43 and a 1-year high of $104.96. The company has a market cap of $12.42 billion, a P/E ratio of -200.76, a PEG ratio of 11.65 and a beta of 2.05. The firm's 50-day moving average price is $85.18 and its 200 day moving average price is $77.17.

Roku (NASDAQ:ROKU - Get Free Report) last posted its quarterly earnings results on Thursday, July 31st. The company reported $0.07 EPS for the quarter, topping analysts' consensus estimates of ($0.16) by $0.23. Roku had a negative return on equity of 2.44% and a negative net margin of 1.40%. The company had revenue of $1.11 billion during the quarter, compared to analysts' expectations of $1.07 billion. During the same quarter in the previous year, the firm earned ($0.18) EPS. Roku's revenue was up 14.7% on a year-over-year basis. As a group, equities research analysts predict that Roku, Inc. will post -0.3 EPS for the current year.

Insider Transactions at Roku

In related news, CFO Dan Jedda sold 3,000 shares of the company's stock in a transaction dated Tuesday, July 15th. The stock was sold at an average price of $90.20, for a total transaction of $270,600.00. Following the sale, the chief financial officer owned 76,132 shares in the company, valued at $6,867,106.40. This represents a 3.79% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Charles Collier sold 212,559 shares of the company's stock in a transaction dated Monday, July 21st. The shares were sold at an average price of $95.00, for a total value of $20,193,105.00. Following the sale, the insider owned 200 shares in the company, valued at approximately $19,000. The trade was a 99.91% decrease in their position. The disclosure for this sale can be found here. Insiders sold 312,233 shares of company stock worth $28,362,681 in the last 90 days. 13.98% of the stock is currently owned by company insiders.

Roku Company Profile

(

Free Report)

Roku, Inc, together with its subsidiaries, operates a TV streaming platform in the United states and internationally. The company operates in two segments, Platform and Devices. Its streaming platform allows users to find and access TV shows, movies, news, sports, and others. The Platform segment offers digital advertising, including direct and programmatic video advertising, media and entertainment promotional spending, and related services; and streaming services distribution, such as subscription and transaction revenue shares, and sale of premium subscriptions and branded app buttons on remote controls.

See Also

Before you consider Roku, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roku wasn't on the list.

While Roku currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.