Ieq Capital LLC purchased a new stake in Douglas Dynamics, Inc. (NYSE:PLOW - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The fund purchased 9,461 shares of the auto parts company's stock, valued at approximately $220,000.

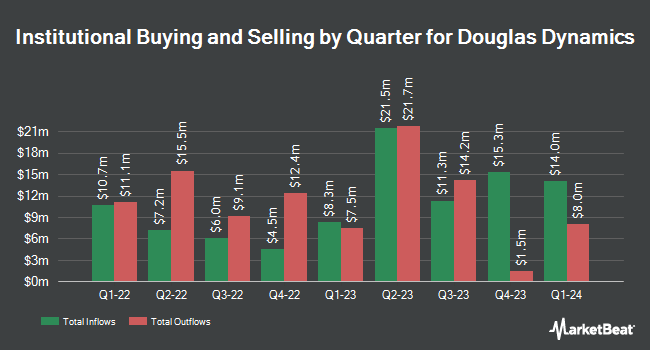

Several other institutional investors and hedge funds have also recently modified their holdings of the business. Allspring Global Investments Holdings LLC increased its stake in shares of Douglas Dynamics by 0.5% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 2,451,938 shares of the auto parts company's stock valued at $57,032,000 after purchasing an additional 11,297 shares in the last quarter. Pzena Investment Management LLC increased its stake in shares of Douglas Dynamics by 35.4% in the 1st quarter. Pzena Investment Management LLC now owns 2,273,003 shares of the auto parts company's stock valued at $52,802,000 after purchasing an additional 593,962 shares in the last quarter. Vanguard Group Inc. increased its stake in shares of Douglas Dynamics by 2.0% in the 1st quarter. Vanguard Group Inc. now owns 1,317,898 shares of the auto parts company's stock valued at $30,615,000 after purchasing an additional 26,118 shares in the last quarter. Hotchkis & Wiley Capital Management LLC increased its stake in shares of Douglas Dynamics by 48.3% in the 1st quarter. Hotchkis & Wiley Capital Management LLC now owns 379,660 shares of the auto parts company's stock valued at $8,820,000 after purchasing an additional 123,580 shares in the last quarter. Finally, Harbor Capital Advisors Inc. increased its stake in Douglas Dynamics by 3.3% during the 1st quarter. Harbor Capital Advisors Inc. now owns 367,673 shares of the auto parts company's stock worth $8,541,000 after buying an additional 11,696 shares in the last quarter. Hedge funds and other institutional investors own 91.85% of the company's stock.

Douglas Dynamics Price Performance

Shares of PLOW stock traded down $0.60 during trading hours on Friday, reaching $32.59. The company had a trading volume of 81,340 shares, compared to its average volume of 135,591. The company has a debt-to-equity ratio of 0.51, a quick ratio of 0.99 and a current ratio of 2.11. The stock has a fifty day moving average of $31.21 and a 200-day moving average of $27.83. The company has a market capitalization of $750.97 million, a price-to-earnings ratio of 11.68, a PEG ratio of 1.19 and a beta of 1.33. Douglas Dynamics, Inc. has a 12-month low of $21.30 and a 12-month high of $34.25.

Douglas Dynamics (NYSE:PLOW - Get Free Report) last posted its quarterly earnings results on Monday, August 4th. The auto parts company reported $1.14 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.84 by $0.30. The business had revenue of $194.33 million during the quarter, compared to analyst estimates of $189.47 million. Douglas Dynamics had a return on equity of 15.16% and a net margin of 11.38%.The business's revenue was down 2.8% compared to the same quarter last year. During the same period in the prior year, the business earned $1.11 earnings per share. Douglas Dynamics has set its FY 2025 guidance at 1.650-2.150 EPS. On average, equities analysts anticipate that Douglas Dynamics, Inc. will post 1.3 earnings per share for the current year.

Douglas Dynamics Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Tuesday, September 16th will be given a $0.295 dividend. The ex-dividend date is Tuesday, September 16th. This represents a $1.18 dividend on an annualized basis and a dividend yield of 3.6%. Douglas Dynamics's dividend payout ratio is 42.29%.

Analyst Upgrades and Downgrades

Several research firms have commented on PLOW. DA Davidson boosted their price objective on Douglas Dynamics from $32.00 to $34.00 and gave the stock a "buy" rating in a research note on Tuesday, July 22nd. Wall Street Zen lowered Douglas Dynamics from a "buy" rating to a "hold" rating in a research note on Saturday, August 9th. One equities research analyst has rated the stock with a Buy rating and one has issued a Hold rating to the company. According to MarketBeat.com, Douglas Dynamics has an average rating of "Moderate Buy" and an average target price of $30.00.

View Our Latest Analysis on PLOW

Douglas Dynamics Profile

(

Free Report)

Douglas Dynamics, Inc operates as a manufacturer and upfitter of commercial work truck attachments and equipment in North America. It operates through two segments, Work Truck Attachments and Work Truck Solutions. The Work Truck Attachments segment manufactures and sells snow and ice control attachments, including snowplows, and sand and salt spreaders for light trucks and heavy duty trucks, as well as various related parts and accessories.

Read More

Before you consider Douglas Dynamics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Douglas Dynamics wasn't on the list.

While Douglas Dynamics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.