Inlet Private Wealth LLC purchased a new stake in Fabrinet (NYSE:FN - Free Report) in the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 4,595 shares of the technology company's stock, valued at approximately $908,000.

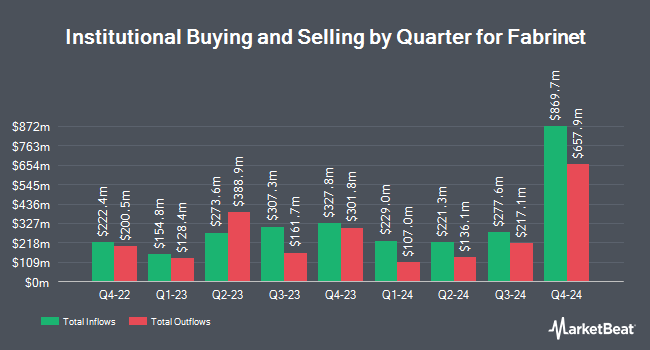

Several other large investors have also made changes to their positions in the company. FMR LLC boosted its position in Fabrinet by 13.1% during the fourth quarter. FMR LLC now owns 2,213,887 shares of the technology company's stock worth $486,789,000 after purchasing an additional 257,164 shares during the period. Wasatch Advisors LP boosted its position in Fabrinet by 47.0% during the fourth quarter. Wasatch Advisors LP now owns 1,132,636 shares of the technology company's stock worth $249,044,000 after purchasing an additional 362,064 shares during the period. Geode Capital Management LLC boosted its position in Fabrinet by 2.0% during the fourth quarter. Geode Capital Management LLC now owns 1,006,858 shares of the technology company's stock worth $221,430,000 after purchasing an additional 20,045 shares during the period. JPMorgan Chase & Co. boosted its position in Fabrinet by 1.4% during the fourth quarter. JPMorgan Chase & Co. now owns 669,459 shares of the technology company's stock worth $147,201,000 after purchasing an additional 9,058 shares during the period. Finally, Baillie Gifford & Co. boosted its position in Fabrinet by 16.5% during the first quarter. Baillie Gifford & Co. now owns 644,557 shares of the technology company's stock worth $127,306,000 after purchasing an additional 91,519 shares during the period. Institutional investors own 97.38% of the company's stock.

Fabrinet Trading Up 1.1%

FN opened at $308.29 on Monday. Fabrinet has a 1-year low of $148.55 and a 1-year high of $314.47. The stock has a market capitalization of $11.05 billion, a price-to-earnings ratio of 34.33 and a beta of 1.04. The business has a 50 day moving average of $267.74 and a 200-day moving average of $230.32.

Fabrinet (NYSE:FN - Get Free Report) last posted its quarterly earnings data on Monday, May 5th. The technology company reported $2.52 earnings per share for the quarter, beating the consensus estimate of $2.47 by $0.05. Fabrinet had a return on equity of 17.99% and a net margin of 10.00%. The company had revenue of $871.80 million during the quarter, compared to analysts' expectations of $857.12 million. During the same period in the prior year, the business earned $2.39 earnings per share. Fabrinet's revenue for the quarter was up 19.2% compared to the same quarter last year. Equities analysts predict that Fabrinet will post 9.4 EPS for the current year.

Wall Street Analyst Weigh In

A number of brokerages have issued reports on FN. Wolfe Research began coverage on Fabrinet in a research report on Tuesday, July 8th. They set a "peer perform" rating for the company. JPMorgan Chase & Co. upped their target price on Fabrinet from $235.00 to $318.00 and gave the stock a "neutral" rating in a research report on Thursday, July 17th. Rosenblatt Securities upped their target price on Fabrinet from $250.00 to $290.00 and gave the stock a "buy" rating in a research report on Thursday, June 12th. Barclays set a $234.00 target price on Fabrinet and gave the stock an "equal weight" rating in a research report on Tuesday, May 6th. Finally, B. Riley upgraded Fabrinet from a "sell" rating to a "neutral" rating and cut their price target for the stock from $178.00 to $176.00 in a report on Friday, April 4th. Four investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat.com, Fabrinet presently has a consensus rating of "Hold" and a consensus target price of $261.33.

View Our Latest Stock Analysis on FN

Insider Activity at Fabrinet

In related news, COO Harpal Gill sold 18,675 shares of the company's stock in a transaction on Wednesday, June 4th. The stock was sold at an average price of $240.00, for a total value of $4,482,000.00. Following the completion of the transaction, the chief operating officer directly owned 18,068 shares in the company, valued at approximately $4,336,320. This represents a 50.83% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Rollance E. Olson sold 2,500 shares of the company's stock in a transaction on Tuesday, May 13th. The shares were sold at an average price of $223.98, for a total value of $559,950.00. Following the completion of the transaction, the director owned 23,201 shares of the company's stock, valued at $5,196,559.98. The trade was a 9.73% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.38% of the stock is currently owned by corporate insiders.

Fabrinet Profile

(

Free Report)

Fabrinet provides optical packaging and precision optical, electro-mechanical, and electronic manufacturing services in North America, the Asia-Pacific, and Europe. The company offers a range of advanced optical and electro-mechanical capabilities in the manufacturing process, including process design and engineering, supply chain management, manufacturing, printed circuit board assembly, advanced packaging, integration, final assembly, and testing.

Recommended Stories

Want to see what other hedge funds are holding FN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Fabrinet (NYSE:FN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fabrinet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fabrinet wasn't on the list.

While Fabrinet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.