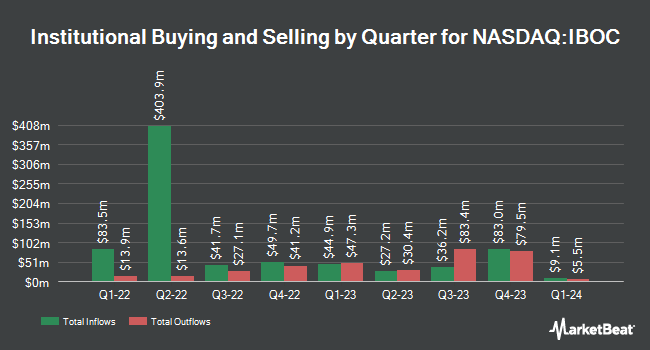

American Century Companies Inc. increased its holdings in International Bancshares Corporation (NASDAQ:IBOC - Free Report) by 37.9% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 2,418,758 shares of the bank's stock after purchasing an additional 665,280 shares during the quarter. American Century Companies Inc. owned approximately 3.89% of International Bancshares worth $152,527,000 at the end of the most recent reporting period.

Other institutional investors also recently modified their holdings of the company. Charles Schwab Investment Management Inc. boosted its position in International Bancshares by 3.1% during the first quarter. Charles Schwab Investment Management Inc. now owns 2,141,959 shares of the bank's stock valued at $135,072,000 after acquiring an additional 63,791 shares during the last quarter. First Trust Advisors LP raised its holdings in shares of International Bancshares by 21.3% during the fourth quarter. First Trust Advisors LP now owns 1,450,040 shares of the bank's stock valued at $91,585,000 after purchasing an additional 255,070 shares during the period. Northern Trust Corp raised its holdings in shares of International Bancshares by 10.4% during the fourth quarter. Northern Trust Corp now owns 844,517 shares of the bank's stock valued at $53,340,000 after purchasing an additional 79,814 shares during the period. Reinhart Partners LLC. raised its holdings in shares of International Bancshares by 13.2% during the first quarter. Reinhart Partners LLC. now owns 777,713 shares of the bank's stock valued at $49,043,000 after purchasing an additional 90,553 shares during the period. Finally, Millennium Management LLC raised its holdings in shares of International Bancshares by 1,883.6% during the fourth quarter. Millennium Management LLC now owns 346,185 shares of the bank's stock valued at $21,865,000 after purchasing an additional 328,733 shares during the period. Institutional investors own 65.91% of the company's stock.

International Bancshares Stock Up 0.3%

Shares of NASDAQ IBOC traded up $0.2050 during trading on Thursday, hitting $68.6650. 28,095 shares of the company traded hands, compared to its average volume of 260,369. The business's fifty day moving average is $68.07 and its 200 day moving average is $64.67. International Bancshares Corporation has a fifty-two week low of $54.11 and a fifty-two week high of $76.91. The firm has a market capitalization of $4.27 billion, a price-to-earnings ratio of 10.36 and a beta of 0.85. The company has a debt-to-equity ratio of 0.06, a quick ratio of 0.75 and a current ratio of 0.75.

International Bancshares (NASDAQ:IBOC - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The bank reported $1.61 earnings per share for the quarter. International Bancshares had a net margin of 39.51% and a return on equity of 14.37%.

International Bancshares Increases Dividend

The firm also recently announced a semi-annual dividend, which will be paid on Friday, August 29th. Investors of record on Friday, August 15th will be issued a $0.70 dividend. The ex-dividend date is Friday, August 15th. This represents a dividend yield of 200.0%. This is a boost from International Bancshares's previous semi-annual dividend of $0.66. International Bancshares's dividend payout ratio (DPR) is currently 21.15%.

International Bancshares Company Profile

(

Free Report)

International Bancshares Corporation, a financial holding company, provides commercial and retail banking services in Texas and the State of Oklahoma. It accepts checking and saving deposits; and offers commercial, real estate, personal, home improvement, automobile, and other installment and term loans.

Recommended Stories

Before you consider International Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Bancshares wasn't on the list.

While International Bancshares currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.