Itau Unibanco Holding S.A. lowered its position in Burlington Stores, Inc. (NYSE:BURL - Free Report) by 6.5% during the first quarter, according to its most recent filing with the SEC. The firm owned 14,140 shares of the company's stock after selling 988 shares during the period. Itau Unibanco Holding S.A.'s holdings in Burlington Stores were worth $3,370,000 as of its most recent filing with the SEC.

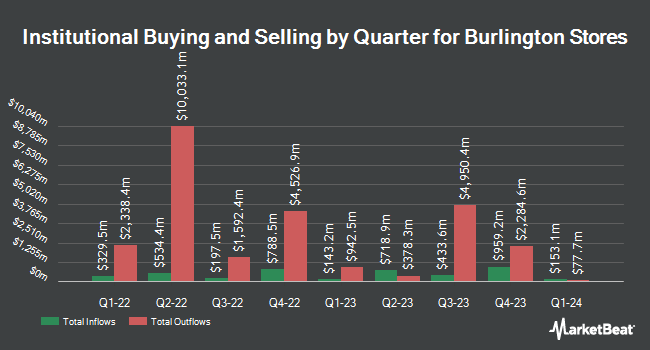

A number of other hedge funds and other institutional investors have also recently modified their holdings of BURL. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its position in shares of Burlington Stores by 55.6% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 671,999 shares of the company's stock valued at $191,560,000 after acquiring an additional 240,144 shares during the period. Steadfast Capital Management LP acquired a new position in shares of Burlington Stores during the 4th quarter valued at $67,075,000. Vanguard Group Inc. lifted its position in shares of Burlington Stores by 3.4% during the 1st quarter. Vanguard Group Inc. now owns 6,603,257 shares of the company's stock valued at $1,573,754,000 after acquiring an additional 219,124 shares during the period. GAMMA Investing LLC lifted its position in shares of Burlington Stores by 23,496.5% during the 1st quarter. GAMMA Investing LLC now owns 214,020 shares of the company's stock valued at $51,007,000 after acquiring an additional 213,113 shares during the period. Finally, Alyeska Investment Group L.P. lifted its position in shares of Burlington Stores by 23.1% during the 4th quarter. Alyeska Investment Group L.P. now owns 1,051,611 shares of the company's stock valued at $299,772,000 after acquiring an additional 197,187 shares during the period.

Insider Transactions at Burlington Stores

In other news, CMO Jennifer Vecchio sold 420 shares of the stock in a transaction dated Tuesday, July 1st. The shares were sold at an average price of $236.64, for a total value of $99,388.80. Following the sale, the chief marketing officer directly owned 65,429 shares of the company's stock, valued at approximately $15,483,118.56. This represents a 0.64% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CAO Stephen Ferroni sold 450 shares of the stock in a transaction dated Thursday, June 5th. The stock was sold at an average price of $241.39, for a total transaction of $108,625.50. Following the completion of the sale, the chief accounting officer directly owned 2,389 shares in the company, valued at approximately $576,680.71. The trade was a 15.85% decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.10% of the stock is owned by company insiders.

Analyst Ratings Changes

A number of research analysts recently issued reports on BURL shares. Loop Capital dropped their target price on shares of Burlington Stores from $315.00 to $305.00 and set a "buy" rating on the stock in a research report on Friday, May 30th. Jefferies Financial Group boosted their price target on shares of Burlington Stores from $300.00 to $350.00 and gave the company a "buy" rating in a research note on Friday. Bank of America boosted their price target on shares of Burlington Stores from $350.00 to $363.00 and gave the company a "buy" rating in a research note on Friday. JPMorgan Chase & Co. boosted their price target on shares of Burlington Stores from $280.00 to $338.00 and gave the company an "overweight" rating in a research note on Monday, July 28th. Finally, Robert W. Baird decreased their price target on shares of Burlington Stores from $335.00 to $325.00 and set an "outperform" rating for the company in a research note on Friday, May 30th. Fourteen analysts have rated the stock with a Buy rating, According to data from MarketBeat, the stock presently has an average rating of "Buy" and an average price target of $344.29.

Check Out Our Latest Report on Burlington Stores

Burlington Stores Stock Performance

NYSE:BURL traded down $3.66 on Tuesday, reaching $287.02. 391,674 shares of the company's stock were exchanged, compared to its average volume of 1,131,009. The company has a debt-to-equity ratio of 1.40, a current ratio of 1.23 and a quick ratio of 0.55. The firm has a market cap of $18.09 billion, a price-to-earnings ratio of 33.88, a P/E/G ratio of 2.46 and a beta of 1.72. Burlington Stores, Inc. has a 52 week low of $212.92 and a 52 week high of $309.00. The stock has a fifty day simple moving average of $266.92 and a 200-day simple moving average of $248.47.

Burlington Stores (NYSE:BURL - Get Free Report) last issued its earnings results on Thursday, August 28th. The company reported $1.59 earnings per share for the quarter, topping analysts' consensus estimates of $1.27 by $0.32. The firm had revenue of $2.70 billion during the quarter, compared to analyst estimates of $2.64 billion. Burlington Stores had a net margin of 4.96% and a return on equity of 42.74%. The company's quarterly revenue was up 9.7% on a year-over-year basis. During the same quarter last year, the business earned $1.24 earnings per share. Burlington Stores has set its Q3 2025 guidance at 1.5-1.600 EPS. FY 2025 guidance at 9.190-9.590 EPS. As a group, sell-side analysts predict that Burlington Stores, Inc. will post 7.93 earnings per share for the current year.

Burlington Stores Profile

(

Free Report)

Burlington Stores, Inc operates as a retailer of branded merchandise in the United States. The company provides fashion-focused merchandise, including women's ready-to-wear apparel, menswear, youth apparel, footwear, accessories, toys, gifts, and coats, as well as baby, home, and beauty products.

Featured Stories

Before you consider Burlington Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Burlington Stores wasn't on the list.

While Burlington Stores currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.