Janney Montgomery Scott LLC acquired a new position in shares of Baidu, Inc. (NASDAQ:BIDU - Free Report) in the 1st quarter, according to the company in its most recent filing with the SEC. The fund acquired 2,974 shares of the information services provider's stock, valued at approximately $274,000.

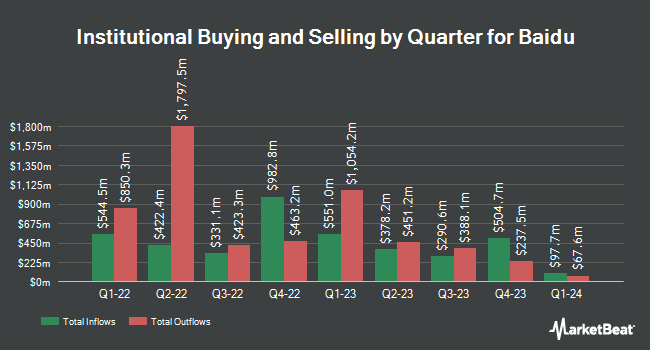

Several other large investors have also recently modified their holdings of BIDU. Dodge & Cox increased its stake in Baidu by 0.4% during the 4th quarter. Dodge & Cox now owns 5,916,215 shares of the information services provider's stock valued at $498,796,000 after purchasing an additional 22,000 shares in the last quarter. Pictet Asset Management Holding SA increased its stake in Baidu by 9.4% during the 4th quarter. Pictet Asset Management Holding SA now owns 2,410,307 shares of the information services provider's stock valued at $203,213,000 after purchasing an additional 207,966 shares in the last quarter. Appaloosa LP increased its stake in Baidu by 7.2% during the 4th quarter. Appaloosa LP now owns 1,527,909 shares of the information services provider's stock valued at $128,818,000 after purchasing an additional 102,909 shares in the last quarter. Dimensional Fund Advisors LP increased its stake in Baidu by 0.3% during the 4th quarter. Dimensional Fund Advisors LP now owns 1,350,315 shares of the information services provider's stock valued at $113,845,000 after purchasing an additional 4,236 shares in the last quarter. Finally, CoreView Capital Management Ltd increased its stake in Baidu by 2.0% during the 4th quarter. CoreView Capital Management Ltd now owns 1,262,003 shares of the information services provider's stock valued at $106,399,000 after purchasing an additional 25,220 shares in the last quarter.

Baidu Price Performance

BIDU traded down $1.62 during midday trading on Wednesday, hitting $88.66. 2,305,550 shares of the company traded hands, compared to its average volume of 4,069,659. The company has a current ratio of 2.29, a quick ratio of 2.29 and a debt-to-equity ratio of 0.27. The company has a market capitalization of $30.63 billion, a price-to-earnings ratio of 8.80 and a beta of 0.33. Baidu, Inc. has a 52-week low of $74.71 and a 52-week high of $116.25. The business has a 50 day simple moving average of $86.79 and a two-hundred day simple moving average of $87.67.

Analyst Ratings Changes

BIDU has been the topic of a number of recent analyst reports. Citigroup cut their price target on shares of Baidu from $139.00 to $138.00 and set a "buy" rating on the stock in a research note on Thursday, May 22nd. Barclays set a $84.00 price objective on shares of Baidu and gave the stock an "equal weight" rating in a research note on Thursday, May 22nd. Benchmark cut their price objective on shares of Baidu from $130.00 to $120.00 and set a "buy" rating on the stock in a research note on Thursday, May 22nd. Finally, Macquarie reiterated a "neutral" rating on shares of Baidu in a research note on Wednesday, May 21st. Twelve research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $107.82.

Check Out Our Latest Research Report on Baidu

Baidu Profile

(

Free Report)

Baidu, Inc engages in the provision of internet search services in China. It operates through two segments: Baidu Core and iQIYI. The company offers Baidu App to access search, feed, and other services using mobile devices; Baidu Search to access its search and other services; Baidu Feed that provides users with personalized timeline based on their demographics and interests; Baidu Health that helps users to find the doctor and hospital for healthcare needs; and Haokan, a short video app.

See Also

Before you consider Baidu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baidu wasn't on the list.

While Baidu currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.