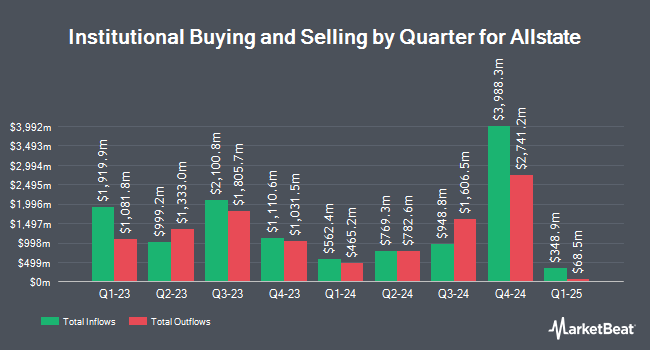

Jump Financial LLC raised its stake in shares of The Allstate Corporation (NYSE:ALL - Free Report) by 717.6% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 50,984 shares of the insurance provider's stock after purchasing an additional 44,748 shares during the quarter. Jump Financial LLC's holdings in Allstate were worth $10,557,000 at the end of the most recent reporting period.

Other hedge funds have also bought and sold shares of the company. Hughes Financial Services LLC acquired a new position in Allstate during the 1st quarter valued at approximately $28,000. Kapitalo Investimentos Ltda purchased a new stake in shares of Allstate in the 4th quarter valued at $29,000. Meeder Asset Management Inc. boosted its holdings in shares of Allstate by 113.8% in the 1st quarter. Meeder Asset Management Inc. now owns 186 shares of the insurance provider's stock valued at $39,000 after acquiring an additional 99 shares during the last quarter. McClarren Financial Advisors Inc. purchased a new stake in shares of Allstate in the 1st quarter valued at $43,000. Finally, Mattson Financial Services LLC purchased a new stake in shares of Allstate in the 4th quarter valued at $44,000. Institutional investors and hedge funds own 76.47% of the company's stock.

Allstate Stock Performance

Shares of ALL traded up $0.89 during trading hours on Tuesday, hitting $202.97. The stock had a trading volume of 1,498,147 shares, compared to its average volume of 1,516,677. The company has a debt-to-equity ratio of 0.37, a quick ratio of 0.43 and a current ratio of 0.43. The firm has a 50-day moving average price of $199.31 and a 200 day moving average price of $199.21. The Allstate Corporation has a fifty-two week low of $176.00 and a fifty-two week high of $214.76. The firm has a market capitalization of $53.49 billion, a price-to-earnings ratio of 9.54, a PEG ratio of 0.82 and a beta of 0.35.

Allstate (NYSE:ALL - Get Free Report) last posted its earnings results on Wednesday, July 30th. The insurance provider reported $5.94 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.20 by $2.74. The firm had revenue of $15.05 billion during the quarter, compared to analysts' expectations of $16.59 billion. Allstate had a net margin of 8.79% and a return on equity of 28.74%. The business's revenue was up 5.8% compared to the same quarter last year. During the same period in the previous year, the business posted $1.61 EPS. As a group, research analysts anticipate that The Allstate Corporation will post 18.74 EPS for the current year.

Allstate Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 1st. Shareholders of record on Friday, August 29th will be given a dividend of $1.00 per share. The ex-dividend date is Friday, August 29th. This represents a $4.00 dividend on an annualized basis and a yield of 2.0%. Allstate's dividend payout ratio is currently 18.81%.

Wall Street Analyst Weigh In

Several analysts have recently commented on the stock. Morgan Stanley upped their price objective on shares of Allstate from $235.00 to $245.00 and gave the company an "overweight" rating in a report on Friday, August 1st. Raymond James Financial reaffirmed a "strong-buy" rating and issued a $260.00 price objective (up from $250.00) on shares of Allstate in a report on Monday, August 4th. BMO Capital Markets upped their price objective on shares of Allstate from $230.00 to $235.00 and gave the company an "outperform" rating in a report on Wednesday, August 20th. Barclays reaffirmed an "underweight" rating and issued a $198.00 price objective (up from $188.00) on shares of Allstate in a report on Thursday, July 31st. Finally, Jefferies Financial Group upped their price objective on shares of Allstate from $254.00 to $255.00 and gave the company a "buy" rating in a report on Monday, August 11th. One analyst has rated the stock with a Strong Buy rating, thirteen have given a Buy rating, three have issued a Hold rating and one has assigned a Sell rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $230.73.

Check Out Our Latest Analysis on ALL

Allstate Company Profile

(

Free Report)

The Allstate Corporation, together with its subsidiaries, provides property and casualty, and other insurance products in the United States and Canada. It operates in five segments: Allstate Protection; Protection Services; Allstate Health and Benefits; Run-off Property-Liability; and Corporate and Other segments.

See Also

Before you consider Allstate, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allstate wasn't on the list.

While Allstate currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.