Vanguard Group Inc. trimmed its holdings in LendingClub Corporation (NYSE:LC - Free Report) by 1.4% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 11,855,242 shares of the credit services provider's stock after selling 171,929 shares during the quarter. Vanguard Group Inc. owned approximately 10.38% of LendingClub worth $122,346,000 at the end of the most recent quarter.

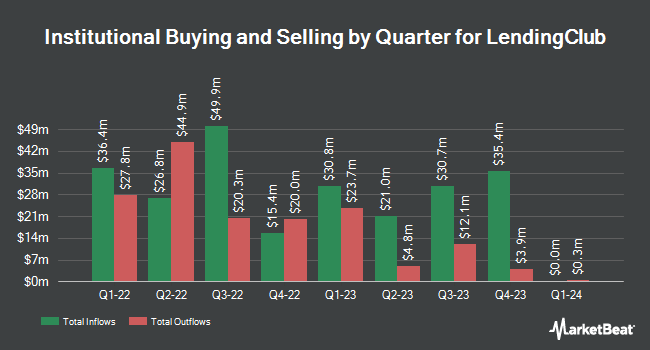

Other institutional investors have also modified their holdings of the company. SummerHaven Investment Management LLC boosted its position in shares of LendingClub by 1.2% during the 1st quarter. SummerHaven Investment Management LLC now owns 90,565 shares of the credit services provider's stock worth $935,000 after purchasing an additional 1,066 shares in the last quarter. Comerica Bank purchased a new stake in shares of LendingClub during the 4th quarter worth $37,000. Highland Capital Management LLC boosted its position in shares of LendingClub by 24.4% during the 1st quarter. Highland Capital Management LLC now owns 13,841 shares of the credit services provider's stock worth $143,000 after purchasing an additional 2,717 shares in the last quarter. MetLife Investment Management LLC boosted its position in shares of LendingClub by 4.8% during the 4th quarter. MetLife Investment Management LLC now owns 66,251 shares of the credit services provider's stock worth $1,073,000 after purchasing an additional 3,064 shares in the last quarter. Finally, Sterling Capital Management LLC boosted its position in shares of LendingClub by 818.6% during the 4th quarter. Sterling Capital Management LLC now owns 3,500 shares of the credit services provider's stock worth $57,000 after purchasing an additional 3,119 shares in the last quarter. 74.08% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, CFO Andrew Labenne sold 17,955 shares of the stock in a transaction that occurred on Wednesday, July 30th. The shares were sold at an average price of $16.65, for a total transaction of $298,950.75. Following the completion of the sale, the chief financial officer owned 178,111 shares of the company's stock, valued at approximately $2,965,548.15. This represents a 9.16% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Scott Sanborn sold 5,250 shares of the stock in a transaction that occurred on Thursday, July 17th. The shares were sold at an average price of $12.98, for a total transaction of $68,145.00. Following the completion of the sale, the chief executive officer directly owned 1,283,175 shares of the company's stock, valued at $16,655,611.50. This trade represents a 0.41% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 38,955 shares of company stock valued at $545,648. Corporate insiders own 3.19% of the company's stock.

Analyst Ratings Changes

Several research firms recently commented on LC. Wall Street Zen upgraded shares of LendingClub from a "sell" rating to a "hold" rating in a research report on Saturday, August 2nd. Stephens began coverage on shares of LendingClub in a research report on Thursday, June 12th. They issued an "overweight" rating and a $15.00 price objective on the stock. Citigroup began coverage on shares of LendingClub in a research report on Monday, July 7th. They issued a "market perform" rating on the stock. Keefe, Bruyette & Woods boosted their price objective on shares of LendingClub from $14.00 to $16.50 and gave the stock an "outperform" rating in a research report on Wednesday, July 30th. Finally, Piper Sandler set a $15.50 price objective on shares of LendingClub and gave the stock an "overweight" rating in a research report on Wednesday, July 30th. Six investment analysts have rated the stock with a Buy rating and three have given a Hold rating to the company. Based on data from MarketBeat, LendingClub currently has a consensus rating of "Moderate Buy" and an average price target of $16.57.

Get Our Latest Report on LendingClub

LendingClub Price Performance

NYSE:LC traded up $0.32 on Wednesday, reaching $16.87. The stock had a trading volume of 2,175,628 shares, compared to its average volume of 2,286,407. The company has a market cap of $1.94 billion, a price-to-earnings ratio of 26.35 and a beta of 2.46. The firm's fifty day moving average is $13.80 and its two-hundred day moving average is $11.87. LendingClub Corporation has a 12-month low of $7.90 and a 12-month high of $18.75.

LendingClub (NYSE:LC - Get Free Report) last posted its quarterly earnings data on Tuesday, July 29th. The credit services provider reported $0.33 EPS for the quarter, beating analysts' consensus estimates of $0.15 by $0.18. LendingClub had a net margin of 8.36% and a return on equity of 5.66%. The company had revenue of $248.44 million during the quarter, compared to the consensus estimate of $227.04 million. During the same quarter in the prior year, the company posted $0.13 EPS. The company's quarterly revenue was up 14.1% compared to the same quarter last year. As a group, research analysts forecast that LendingClub Corporation will post 0.72 earnings per share for the current fiscal year.

LendingClub Profile

(

Free Report)

LendingClub Corporation, operates as a bank holding company, that provides range of financial products and services in the United States. It offers deposit products, including savings accounts, checking accounts, and certificates of deposit. The company also provides loan products, such as consumer loans comprising unsecured personal loans, secured auto refinance loans, and patient and education finance loans; and commercial loans, including small business loans.

See Also

Before you consider LendingClub, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LendingClub wasn't on the list.

While LendingClub currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.