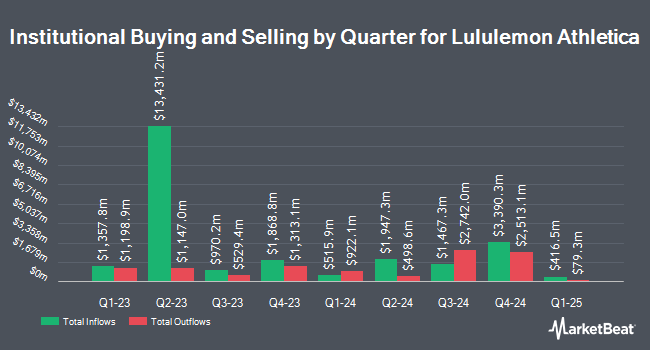

Cetera Investment Advisers cut its holdings in shares of lululemon athletica inc. (NASDAQ:LULU - Free Report) by 5.4% during the 1st quarter, according to its most recent Form 13F filing with the SEC. The firm owned 27,561 shares of the apparel retailer's stock after selling 1,563 shares during the period. Cetera Investment Advisers' holdings in lululemon athletica were worth $7,802,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. Dnca Finance grew its holdings in shares of lululemon athletica by 15.1% during the 4th quarter. Dnca Finance now owns 198 shares of the apparel retailer's stock worth $76,000 after acquiring an additional 26 shares during the period. Lido Advisors LLC grew its stake in lululemon athletica by 1.9% in the fourth quarter. Lido Advisors LLC now owns 1,748 shares of the apparel retailer's stock worth $668,000 after purchasing an additional 32 shares during the period. Belpointe Asset Management LLC grew its stake in lululemon athletica by 0.6% in the fourth quarter. Belpointe Asset Management LLC now owns 6,138 shares of the apparel retailer's stock worth $2,347,000 after purchasing an additional 36 shares during the period. Colonial Trust Co SC raised its holdings in lululemon athletica by 2.1% in the fourth quarter. Colonial Trust Co SC now owns 1,737 shares of the apparel retailer's stock worth $664,000 after purchasing an additional 36 shares in the last quarter. Finally, Carolinas Wealth Consulting LLC lifted its position in lululemon athletica by 30.7% during the fourth quarter. Carolinas Wealth Consulting LLC now owns 166 shares of the apparel retailer's stock valued at $63,000 after buying an additional 39 shares during the period. Institutional investors own 85.20% of the company's stock.

Insider Activity at lululemon athletica

In related news, CEO Calvin Mcdonald sold 27,049 shares of lululemon athletica stock in a transaction on Friday, June 27th. The stock was sold at an average price of $235.69, for a total transaction of $6,375,178.81. Following the transaction, the chief executive officer directly owned 110,564 shares in the company, valued at approximately $26,058,829.16. The trade was a 19.66% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. 0.54% of the stock is owned by company insiders.

lululemon athletica Stock Performance

Shares of NASDAQ LULU traded down $7.20 during midday trading on Friday, hitting $193.33. 4,678,061 shares of the company's stock traded hands, compared to its average volume of 2,882,063. The firm has a fifty day moving average of $248.66 and a 200 day moving average of $299.85. lululemon athletica inc. has a 1 year low of $191.44 and a 1 year high of $423.32. The stock has a market capitalization of $23.17 billion, a price-to-earnings ratio of 13.10, a price-to-earnings-growth ratio of 1.65 and a beta of 1.17.

lululemon athletica (NASDAQ:LULU - Get Free Report) last announced its earnings results on Thursday, June 5th. The apparel retailer reported $2.60 EPS for the quarter, meeting analysts' consensus estimates of $2.60. lululemon athletica had a net margin of 16.82% and a return on equity of 43.48%. The business had revenue of $2.37 billion during the quarter, compared to analysts' expectations of $2.36 billion. During the same period in the prior year, the company earned $2.54 earnings per share. The firm's revenue was up 7.3% on a year-over-year basis. On average, equities analysts anticipate that lululemon athletica inc. will post 14.36 earnings per share for the current year.

Analyst Ratings Changes

A number of analysts have recently commented on the stock. Bank of America dropped their target price on shares of lululemon athletica from $400.00 to $370.00 and set a "buy" rating on the stock in a report on Friday, June 6th. Barclays dropped their price objective on shares of lululemon athletica from $276.00 to $270.00 and set an "equal weight" rating on the stock in a research note on Monday, June 9th. CICC Research reiterated a "market perform" rating and set a $280.49 target price on shares of lululemon athletica in a report on Monday, June 9th. Wells Fargo & Company reissued an "equal weight" rating on shares of lululemon athletica in a research report on Friday, June 6th. Finally, UBS Group reduced their price objective on lululemon athletica from $330.00 to $290.00 and set a "neutral" rating for the company in a research report on Friday, June 6th. One analyst has rated the stock with a sell rating, thirteen have issued a hold rating, sixteen have given a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $333.57.

View Our Latest Research Report on LULU

About lululemon athletica

(

Free Report)

Lululemon Athletica Inc, together with its subsidiaries, designs, distributes, and retails athletic apparel, footwear, and accessories under the lululemon brand for women and men. It offers pants, shorts, tops, and jackets for healthy lifestyle, such as yoga, running, training, and other activities. It also provides fitness-inspired accessories.

Further Reading

Before you consider lululemon athletica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and lululemon athletica wasn't on the list.

While lululemon athletica currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.