Mackenzie Financial Corp lifted its holdings in Advanced Micro Devices, Inc. (NASDAQ:AMD - Free Report) by 36.8% in the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 271,398 shares of the semiconductor manufacturer's stock after acquiring an additional 73,062 shares during the period. Mackenzie Financial Corp's holdings in Advanced Micro Devices were worth $32,782,000 at the end of the most recent reporting period.

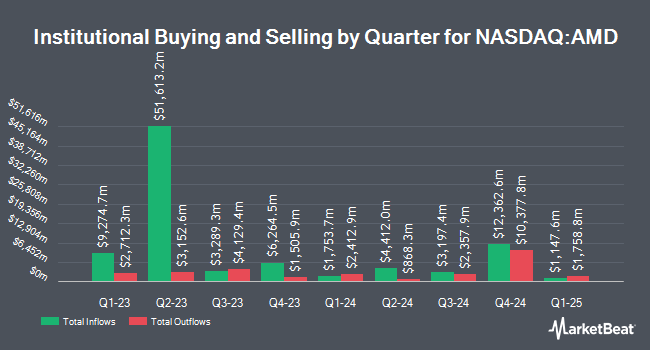

Other institutional investors have also recently made changes to their positions in the company. Bear Mountain Capital Inc. bought a new stake in shares of Advanced Micro Devices in the fourth quarter worth about $25,000. Greenline Partners LLC purchased a new stake in shares of Advanced Micro Devices during the 4th quarter worth approximately $28,000. Halbert Hargrove Global Advisors LLC bought a new position in shares of Advanced Micro Devices during the 4th quarter valued at approximately $29,000. Mpwm Advisory Solutions LLC purchased a new position in shares of Advanced Micro Devices in the fourth quarter valued at $30,000. Finally, Summit Securities Group LLC bought a new stake in Advanced Micro Devices in the fourth quarter worth $31,000. Hedge funds and other institutional investors own 71.34% of the company's stock.

Insider Buying and Selling at Advanced Micro Devices

In other news, EVP Mark D. Papermaster sold 17,500 shares of the company's stock in a transaction on Tuesday, April 15th. The stock was sold at an average price of $95.47, for a total transaction of $1,670,725.00. Following the transaction, the executive vice president now directly owns 1,713,710 shares of the company's stock, valued at approximately $163,607,893.70. This represents a 1.01% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Insiders own 0.06% of the company's stock.

Advanced Micro Devices Stock Up 0.4%

AMD stock traded up $0.40 during trading on Thursday, hitting $113.26. 17,262,889 shares of the company's stock traded hands, compared to its average volume of 42,023,338. The firm has a market capitalization of $183.64 billion, a P/E ratio of 114.33, a PEG ratio of 1.11 and a beta of 1.97. Advanced Micro Devices, Inc. has a 1 year low of $76.48 and a 1 year high of $187.28. The company has a quick ratio of 1.83, a current ratio of 2.62 and a debt-to-equity ratio of 0.03. The business has a fifty day simple moving average of $100.36 and a two-hundred day simple moving average of $113.35.

Advanced Micro Devices (NASDAQ:AMD - Get Free Report) last announced its quarterly earnings results on Tuesday, May 6th. The semiconductor manufacturer reported $0.96 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.93 by $0.03. The business had revenue of $7.44 billion for the quarter, compared to the consensus estimate of $7.10 billion. Advanced Micro Devices had a return on equity of 7.42% and a net margin of 6.36%. The business's revenue was up 35.9% compared to the same quarter last year. During the same period last year, the business posted $0.62 EPS. Sell-side analysts anticipate that Advanced Micro Devices, Inc. will post 3.87 EPS for the current year.

Advanced Micro Devices announced that its Board of Directors has authorized a share buyback program on Wednesday, May 14th that allows the company to buyback $6.00 billion in outstanding shares. This buyback authorization allows the semiconductor manufacturer to reacquire up to 3.1% of its stock through open market purchases. Stock buyback programs are typically a sign that the company's board believes its shares are undervalued.

Wall Street Analyst Weigh In

AMD has been the topic of a number of research reports. Truist Financial set a $130.00 target price on shares of Advanced Micro Devices in a report on Wednesday, February 5th. Argus set a $160.00 target price on Advanced Micro Devices in a report on Thursday, February 6th. Summit Insights upgraded Advanced Micro Devices to a "hold" rating in a report on Tuesday, February 4th. TD Cowen raised their price target on Advanced Micro Devices from $110.00 to $115.00 and gave the stock a "buy" rating in a research report on Wednesday, May 7th. Finally, Loop Capital cut their price objective on shares of Advanced Micro Devices from $175.00 to $140.00 and set a "buy" rating on the stock in a research report on Wednesday, May 7th. Fifteen investment analysts have rated the stock with a hold rating, twenty have assigned a buy rating and three have given a strong buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $132.58.

Check Out Our Latest Stock Report on Advanced Micro Devices

Advanced Micro Devices Company Profile

(

Free Report)

Advanced Micro Devices, Inc operates as a semiconductor company worldwide. It operates through Data Center, Client, Gaming, and Embedded segments. The company offers x86 microprocessors and graphics processing units (GPUs) as an accelerated processing unit, chipsets, data center, and professional GPUs; and embedded processors, and semi-custom system-on-chip (SoC) products, microprocessor and SoC development services and technology, data processing unites, field programmable gate arrays (FPGA), and adaptive SoC products.

Featured Stories

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.