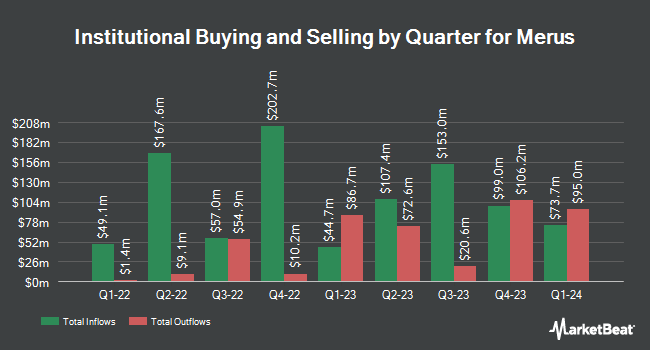

Invesco Ltd. grew its holdings in shares of Merus N.V. (NASDAQ:MRUS - Free Report) by 5.3% during the first quarter, according to its most recent Form 13F filing with the SEC. The firm owned 828,217 shares of the biotechnology company's stock after purchasing an additional 41,852 shares during the period. Invesco Ltd. owned approximately 1.20% of Merus worth $34,860,000 at the end of the most recent reporting period.

Other large investors have also bought and sold shares of the company. GAMMA Investing LLC boosted its stake in Merus by 2,153.6% during the first quarter. GAMMA Investing LLC now owns 631 shares of the biotechnology company's stock valued at $27,000 after buying an additional 603 shares in the last quarter. State of Wyoming acquired a new stake in Merus during the 4th quarter worth about $48,000. Wells Fargo & Company MN raised its stake in shares of Merus by 27.3% during the 4th quarter. Wells Fargo & Company MN now owns 1,400 shares of the biotechnology company's stock worth $59,000 after purchasing an additional 300 shares in the last quarter. GF Fund Management CO. LTD. purchased a new stake in shares of Merus during the 4th quarter worth about $60,000. Finally, Lazard Asset Management LLC purchased a new stake in shares of Merus during the 4th quarter worth about $84,000. Institutional investors own 96.14% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages recently weighed in on MRUS. Wall Street Zen downgraded Merus from a "hold" rating to a "sell" rating in a research note on Sunday, July 20th. HC Wainwright upgraded Merus to a "strong-buy" rating in a research report on Wednesday, August 6th. William Blair restated an "outperform" rating on shares of Merus in a research report on Monday, April 28th. Needham & Company LLC dropped their price objective on Merus from $97.00 to $96.00 and set a "buy" rating for the company in a report on Wednesday, August 6th. Finally, Wells Fargo & Company decreased their target price on Merus from $91.00 to $89.00 and set an "overweight" rating for the company in a research note on Thursday, May 8th. One research analyst has rated the stock with a Strong Buy rating and ten have assigned a Buy rating to the company's stock. According to MarketBeat, the stock has an average rating of "Buy" and an average target price of $88.50.

Check Out Our Latest Analysis on MRUS

Insider Activity

In other news, COO Peter B. Silverman sold 25,000 shares of the stock in a transaction on Thursday, July 17th. The stock was sold at an average price of $60.00, for a total transaction of $1,500,000.00. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Over the last quarter, insiders sold 82,500 shares of company stock worth $4,586,340. Corporate insiders own 3.70% of the company's stock.

Merus Stock Performance

Shares of NASDAQ MRUS traded up $0.84 during trading hours on Friday, reaching $67.49. 698,628 shares of the stock were exchanged, compared to its average volume of 585,369. The firm has a market capitalization of $5.10 billion, a price-to-earnings ratio of -12.27 and a beta of 1.09. Merus N.V. has a 52 week low of $33.19 and a 52 week high of $68.00. The stock's fifty day simple moving average is $59.91 and its 200 day simple moving average is $50.44.

Merus (NASDAQ:MRUS - Get Free Report) last announced its earnings results on Tuesday, August 5th. The biotechnology company reported ($2.23) earnings per share for the quarter, missing analysts' consensus estimates of ($1.17) by ($1.06). The firm had revenue of $8.83 million for the quarter, compared to the consensus estimate of $9.77 million. Merus had a negative return on equity of 50.28% and a negative net margin of 685.64%. Research analysts predict that Merus N.V. will post -3.85 EPS for the current fiscal year.

Merus Profile

(

Free Report)

Merus N.V., a clinical-stage immuno-oncology company, engages in the development of antibody therapeutics in the Netherlands. Its bispecific antibody candidate pipeline includes Zenocutuzumab (MCLA-128), which is in a phase 2 clinical trials for the treatment of patients with metastatic breast cancer and castration-resistant prostate cancer, as well as in Phase 1/2 clinical trials for the treatment of solid tumors that harbor Neuregulin 1.

See Also

Before you consider Merus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merus wasn't on the list.

While Merus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.