Mizuho Markets Americas LLC lessened its holdings in shares of Amcor PLC (NYSE:AMCR - Free Report) by 47.3% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 127,962 shares of the company's stock after selling 115,016 shares during the period. Mizuho Markets Americas LLC's holdings in Amcor were worth $1,241,000 as of its most recent SEC filing.

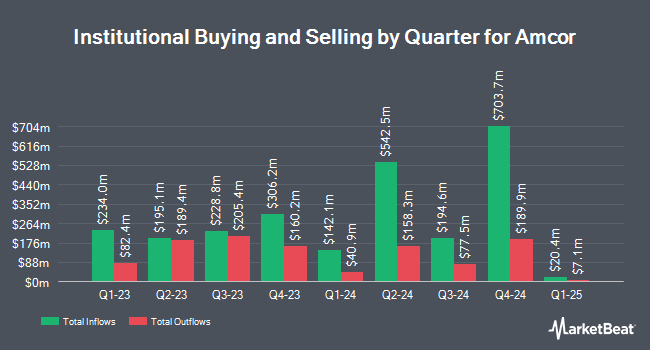

A number of other institutional investors and hedge funds have also recently bought and sold shares of the business. Covestor Ltd grew its holdings in Amcor by 727.0% during the first quarter. Covestor Ltd now owns 11,735 shares of the company's stock worth $114,000 after acquiring an additional 10,316 shares during the period. Townsquare Capital LLC grew its holdings in Amcor by 72.5% in the first quarter. Townsquare Capital LLC now owns 105,904 shares of the company's stock valued at $1,027,000 after purchasing an additional 44,527 shares during the last quarter. Zions Bancorporation National Association UT acquired a new stake in Amcor in the first quarter valued at $3,228,000. National Bank of Canada FI grew its holdings in Amcor by 61.1% in the first quarter. National Bank of Canada FI now owns 1,090,650 shares of the company's stock valued at $10,579,000 after purchasing an additional 413,807 shares during the last quarter. Finally, Mitsubishi UFJ Asset Management Co. Ltd. grew its holdings in Amcor by 5.9% in the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 3,065,891 shares of the company's stock valued at $29,739,000 after purchasing an additional 171,527 shares during the last quarter. Institutional investors and hedge funds own 45.14% of the company's stock.

Wall Street Analyst Weigh In

AMCR has been the topic of several research reports. Wells Fargo & Company upped their target price on Amcor from $10.00 to $11.00 and gave the company an "overweight" rating in a report on Friday, July 18th. UBS Group raised Amcor from a "neutral" rating to a "buy" rating in a report on Thursday, June 26th. Raymond James Financial initiated coverage on Amcor in a report on Tuesday, April 22nd. They issued a "market perform" rating on the stock. Jefferies Financial Group assumed coverage on Amcor in a report on Wednesday, July 2nd. They issued a "buy" rating and a $12.00 target price on the stock. Finally, Truist Financial set a $11.00 price objective on Amcor and gave the company a "buy" rating in a research note on Friday, July 11th. Two analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $11.51.

Read Our Latest Analysis on AMCR

Amcor Price Performance

Shares of AMCR traded up $0.03 during trading hours on Wednesday, reaching $9.80. 1,749,093 shares of the company traded hands, compared to its average volume of 28,522,164. The company has a quick ratio of 1.16, a current ratio of 1.70 and a debt-to-equity ratio of 2.24. The stock has a market capitalization of $14.16 billion, a PE ratio of 17.49, a price-to-earnings-growth ratio of 1.23 and a beta of 0.74. Amcor PLC has a fifty-two week low of $8.37 and a fifty-two week high of $11.48. The stock has a fifty day simple moving average of $9.42 and a 200 day simple moving average of $9.53.

Amcor Profile

(

Free Report)

Amcor plc develops, produces, and sells packaging products in Europe, North America, Latin America, Africa, and the Asia Pacific regions. The company operates through two segments, Flexibles and Rigid Packaging. The Flexibles segment provides flexible and film packaging products in the food and beverage, medical and pharmaceutical, fresh produce, snack food, personal care, and other industries.

Further Reading

Before you consider Amcor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amcor wasn't on the list.

While Amcor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.