Monaco Asset Management SAM lessened its stake in Capri Holdings Limited (NYSE:CPRI - Free Report) by 35.0% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 130,000 shares of the company's stock after selling 70,000 shares during the quarter. Capri accounts for approximately 0.5% of Monaco Asset Management SAM's holdings, making the stock its 21st biggest position. Monaco Asset Management SAM owned approximately 0.11% of Capri worth $2,565,000 at the end of the most recent reporting period.

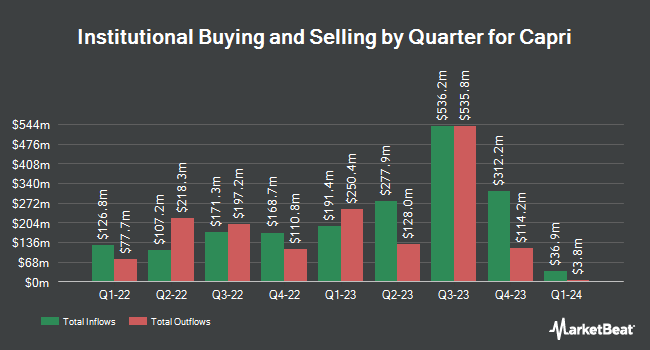

Other large investors also recently bought and sold shares of the company. Vanguard Group Inc. increased its holdings in Capri by 1.4% in the 4th quarter. Vanguard Group Inc. now owns 11,377,630 shares of the company's stock worth $239,613,000 after buying an additional 151,866 shares in the last quarter. Norges Bank bought a new stake in Capri in the 4th quarter worth about $58,070,000. Mirae Asset Global Investments Co. Ltd. bought a new stake in Capri in the 1st quarter worth about $30,000. Allspring Global Investments Holdings LLC bought a new stake in shares of Capri during the 1st quarter valued at about $826,000. Finally, Bayesian Capital Management LP bought a new stake in shares of Capri during the 4th quarter valued at about $767,000. 84.34% of the stock is currently owned by institutional investors.

Capri Stock Performance

Shares of NYSE:CPRI traded down $0.59 during mid-day trading on Wednesday, reaching $18.56. 2,009,212 shares of the company traded hands, compared to its average volume of 2,261,306. The company's 50 day moving average price is $18.07 and its 200-day moving average price is $19.06. The firm has a market cap of $2.19 billion, a PE ratio of -1.86, a PEG ratio of 0.41 and a beta of 1.67. The company has a debt-to-equity ratio of 3.97, a current ratio of 1.14 and a quick ratio of 0.49. Capri Holdings Limited has a 52 week low of $11.86 and a 52 week high of $43.34.

Capri (NYSE:CPRI - Get Free Report) last announced its quarterly earnings data on Wednesday, May 28th. The company reported ($4.90) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.22 by ($5.12). Capri had a negative net margin of 26.61% and a negative return on equity of 39.55%. The company had revenue of $1.04 billion for the quarter, compared to the consensus estimate of $989.05 million. During the same quarter last year, the firm posted $0.42 earnings per share. The company's revenue was down 15.4% compared to the same quarter last year. On average, equities analysts expect that Capri Holdings Limited will post 0.98 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of research firms have issued reports on CPRI. Wall Street Zen downgraded Capri from a "hold" rating to a "sell" rating in a research note on Sunday, July 13th. Wells Fargo & Company cut their price target on Capri from $30.00 to $25.00 and set an "overweight" rating for the company in a research note on Friday, April 11th. Telsey Advisory Group restated a "market perform" rating and set a $20.00 price target on shares of Capri in a research note on Wednesday. Robert W. Baird cut their price target on Capri from $26.00 to $18.00 and set a "neutral" rating for the company in a research note on Friday, April 11th. Finally, JPMorgan Chase & Co. boosted their price target on Capri from $18.00 to $21.00 and gave the company a "neutral" rating in a research note on Monday. One equities research analyst has rated the stock with a sell rating, eight have assigned a hold rating and four have given a buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Hold" and an average price target of $22.75.

Get Our Latest Stock Analysis on CPRI

About Capri

(

Free Report)

Capri Holdings Limited designs, markets, distributes, and retails branded women's and men's apparel, footwear, and accessories in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia. It operates through three segments: Versace, Jimmy Choo, and Michael Kors. The company offers ready-to-wear, accessories, footwear, handbags, scarves and belts, small leather goods, eyewear, watches, jewelry, fragrances, and home furnishings through a distribution network, including boutiques, department, and specialty stores, as well as through e-commerce sites.

Featured Stories

Before you consider Capri, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Capri wasn't on the list.

While Capri currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.