First National Trust Co lifted its position in shares of Morgan Stanley (NYSE:MS - Free Report) by 4.1% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 46,991 shares of the financial services provider's stock after acquiring an additional 1,844 shares during the period. First National Trust Co's holdings in Morgan Stanley were worth $5,482,000 as of its most recent filing with the Securities & Exchange Commission.

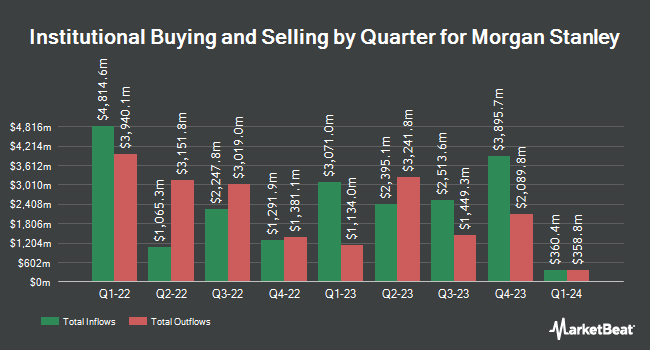

Other institutional investors and hedge funds also recently made changes to their positions in the company. Omnia Family Wealth LLC lifted its stake in shares of Morgan Stanley by 2.5% during the 4th quarter. Omnia Family Wealth LLC now owns 3,140 shares of the financial services provider's stock valued at $395,000 after buying an additional 77 shares in the last quarter. Continuum Advisory LLC lifted its stake in shares of Morgan Stanley by 2.5% during the 4th quarter. Continuum Advisory LLC now owns 3,638 shares of the financial services provider's stock valued at $457,000 after buying an additional 87 shares in the last quarter. Insight Inv LLC lifted its stake in shares of Morgan Stanley by 0.5% during the 1st quarter. Insight Inv LLC now owns 18,378 shares of the financial services provider's stock valued at $2,144,000 after buying an additional 88 shares in the last quarter. Vivaldi Capital Management LP lifted its stake in Morgan Stanley by 1.8% in the 4th quarter. Vivaldi Capital Management LP now owns 5,096 shares of the financial services provider's stock worth $696,000 after purchasing an additional 90 shares in the last quarter. Finally, Jacobsen Capital Management lifted its stake in Morgan Stanley by 4.2% in the 1st quarter. Jacobsen Capital Management now owns 2,212 shares of the financial services provider's stock worth $258,000 after purchasing an additional 90 shares in the last quarter. Institutional investors own 84.19% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages have commented on MS. Wells Fargo & Company boosted their price target on shares of Morgan Stanley from $120.00 to $145.00 and gave the stock an "equal weight" rating in a research note on Tuesday, July 8th. JPMorgan Chase & Co. decreased their price target on shares of Morgan Stanley from $125.00 to $122.00 and set a "neutral" rating on the stock in a research note on Monday, April 14th. The Goldman Sachs Group boosted their price target on shares of Morgan Stanley from $121.00 to $136.00 and gave the stock a "neutral" rating in a research note on Tuesday, June 10th. JMP Securities reiterated a "market perform" rating on shares of Morgan Stanley in a research note on Monday, April 14th. Finally, Keefe, Bruyette & Woods upgraded shares of Morgan Stanley from a "market perform" rating to an "outperform" rating and boosted their price target for the stock from $127.00 to $160.00 in a research note on Wednesday, July 9th. Nine investment analysts have rated the stock with a hold rating, five have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, Morgan Stanley presently has an average rating of "Hold" and a consensus price target of $138.25.

Check Out Our Latest Stock Analysis on Morgan Stanley

Morgan Stanley Trading Down 1.7%

NYSE:MS traded down $2.48 during mid-day trading on Thursday, hitting $142.46. 5,522,960 shares of the stock traded hands, compared to its average volume of 5,323,620. The stock has a market capitalization of $228.55 billion, a price-to-earnings ratio of 16.13, a PEG ratio of 1.82 and a beta of 1.30. Morgan Stanley has a 52 week low of $90.94 and a 52 week high of $145.48. The firm's 50 day moving average is $136.61 and its two-hundred day moving average is $128.23. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 3.11.

Morgan Stanley (NYSE:MS - Get Free Report) last issued its quarterly earnings results on Wednesday, July 16th. The financial services provider reported $2.13 EPS for the quarter, beating the consensus estimate of $1.98 by $0.15. The company had revenue of $16.79 billion for the quarter, compared to the consensus estimate of $16.15 billion. Morgan Stanley had a net margin of 13.06% and a return on equity of 15.33%. The firm's revenue was up 11.8% compared to the same quarter last year. During the same period in the prior year, the firm posted $1.82 EPS. On average, equities research analysts predict that Morgan Stanley will post 8.56 earnings per share for the current year.

Morgan Stanley Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, August 15th. Shareholders of record on Thursday, July 31st will be given a $1.00 dividend. This is a positive change from Morgan Stanley's previous quarterly dividend of $0.93. The ex-dividend date of this dividend is Thursday, July 31st. This represents a $4.00 annualized dividend and a yield of 2.8%. Morgan Stanley's dividend payout ratio is presently 41.90%.

Morgan Stanley announced that its board has initiated a stock repurchase plan on Tuesday, July 1st that authorizes the company to repurchase $20.00 billion in shares. This repurchase authorization authorizes the financial services provider to repurchase up to 8.9% of its shares through open market purchases. Shares repurchase plans are often an indication that the company's board of directors believes its shares are undervalued.

Insider Buying and Selling

In other Morgan Stanley news, insider Michael A. Pizzi sold 18,000 shares of the business's stock in a transaction dated Thursday, July 17th. The shares were sold at an average price of $140.62, for a total value of $2,531,160.00. Following the completion of the sale, the insider directly owned 136,407 shares of the company's stock, valued at $19,181,552.34. The trade was a 11.66% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Daniel A. Simkowitz sold 29,000 shares of the business's stock in a transaction dated Thursday, July 17th. The shares were sold at an average price of $141.13, for a total transaction of $4,092,770.00. Following the completion of the sale, the insider directly owned 399,105 shares of the company's stock, valued at approximately $56,325,688.65. This trade represents a 6.77% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 188,949 shares of company stock worth $25,737,084 over the last 90 days. Corporate insiders own 0.19% of the company's stock.

About Morgan Stanley

(

Free Report)

Morgan Stanley, a financial holding company, provides various financial products and services to corporations, governments, financial institutions, and individuals in the Americas, Europe, the Middle East, Africa, and Asia. It operates through Institutional Securities, Wealth Management, and Investment Management segments.

Read More

Before you consider Morgan Stanley, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morgan Stanley wasn't on the list.

While Morgan Stanley currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report