Motco lessened its position in British American Tobacco p.l.c. (NYSE:BTI - Free Report) by 97.5% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 2,304 shares of the company's stock after selling 91,374 shares during the period. Motco's holdings in British American Tobacco were worth $95,000 as of its most recent filing with the SEC.

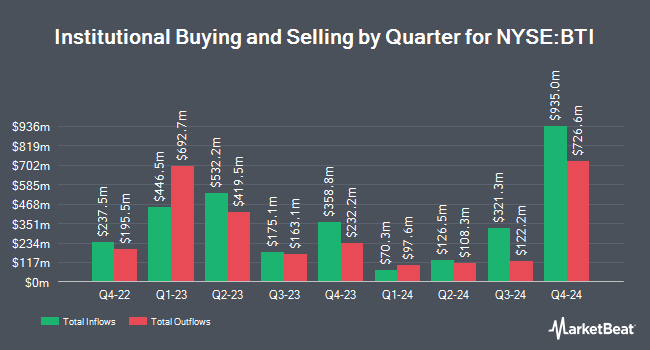

Other large investors have also recently bought and sold shares of the company. Park Avenue Securities LLC boosted its holdings in shares of British American Tobacco by 0.7% in the first quarter. Park Avenue Securities LLC now owns 33,866 shares of the company's stock valued at $1,401,000 after buying an additional 244 shares during the period. Applied Capital LLC FL boosted its holdings in shares of British American Tobacco by 1.1% in the first quarter. Applied Capital LLC FL now owns 23,284 shares of the company's stock valued at $963,000 after buying an additional 257 shares during the period. Elevation Point Wealth Partners LLC boosted its holdings in shares of British American Tobacco by 1.6% in the first quarter. Elevation Point Wealth Partners LLC now owns 16,715 shares of the company's stock valued at $691,000 after buying an additional 258 shares during the period. Keystone Financial Group boosted its holdings in shares of British American Tobacco by 1.5% in the fourth quarter. Keystone Financial Group now owns 17,695 shares of the company's stock valued at $643,000 after buying an additional 267 shares during the period. Finally, Financial Management Professionals Inc. boosted its holdings in shares of British American Tobacco by 78.5% in the first quarter. Financial Management Professionals Inc. now owns 632 shares of the company's stock valued at $26,000 after buying an additional 278 shares during the period. Institutional investors own 16.16% of the company's stock.

British American Tobacco Stock Performance

NYSE BTI traded up $0.38 on Wednesday, hitting $53.15. 3,981,795 shares of the stock were exchanged, compared to its average volume of 5,804,624. The company has a debt-to-equity ratio of 0.65, a current ratio of 0.76 and a quick ratio of 0.52. The business's fifty day moving average is $48.60 and its 200 day moving average is $43.32. British American Tobacco p.l.c. has a 52 week low of $34.12 and a 52 week high of $53.15. The company has a market capitalization of $109.63 billion, a PE ratio of 10.91, a P/E/G ratio of 4.79 and a beta of 0.33.

British American Tobacco Cuts Dividend

The company also recently declared a dividend, which will be paid on Wednesday, August 6th. Shareholders of record on Monday, June 30th will be given a dividend of $0.7391 per share. This represents a yield of 5.99%. The ex-dividend date is Friday, June 27th. British American Tobacco's dividend payout ratio (DPR) is currently 60.78%.

Wall Street Analyst Weigh In

A number of analysts have recently commented on BTI shares. Barclays reissued an "overweight" rating on shares of British American Tobacco in a research report on Friday, June 13th. Bank of America started coverage on shares of British American Tobacco in a research report on Wednesday, April 30th. They issued a "buy" rating on the stock. Jefferies Financial Group started coverage on shares of British American Tobacco in a research report on Wednesday, July 9th. They issued a "buy" rating on the stock. Finally, Wall Street Zen lowered shares of British American Tobacco from a "buy" rating to a "hold" rating in a research report on Saturday. One research analyst has rated the stock with a sell rating, one has given a hold rating and four have given a buy rating to the company. Based on data from MarketBeat.com, British American Tobacco currently has a consensus rating of "Moderate Buy" and a consensus price target of $33.00.

Read Our Latest Report on British American Tobacco

British American Tobacco Profile

(

Free Report)

British American Tobacco p.l.c. engages in the provision of tobacco and nicotine products to consumers worldwide. It also offers vapour, heated, and modern oral nicotine products; combustible cigarettes; and traditional oral products, such as snus and moist snuff. The company offers its products under the Vuse, glo, Velo, Grizzly, Kodiak, Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Camel, Natural American Spirit, Newport, Vogue, Viceroy, Kool, Peter Stuyvesant, Craven A, State Express 555 and Shuang Xi brands.

Recommended Stories

Before you consider British American Tobacco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and British American Tobacco wasn't on the list.

While British American Tobacco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.