Nemes Rush Group LLC lifted its position in CME Group Inc. (NASDAQ:CME - Free Report) by 2.2% during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 66,821 shares of the financial services provider's stock after acquiring an additional 1,439 shares during the period. CME Group accounts for 2.2% of Nemes Rush Group LLC's holdings, making the stock its 11th largest position. Nemes Rush Group LLC's holdings in CME Group were worth $17,727,000 at the end of the most recent quarter.

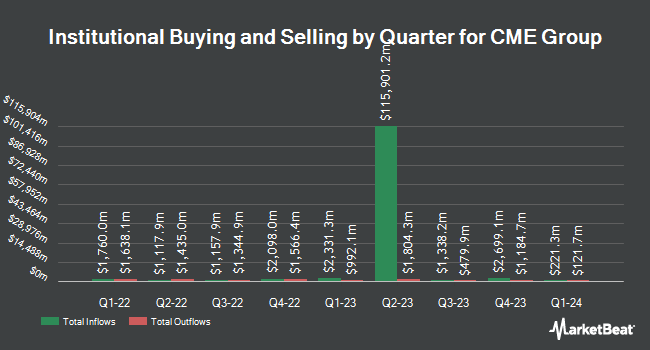

Other large investors also recently added to or reduced their stakes in the company. Wayfinding Financial LLC acquired a new position in shares of CME Group in the 1st quarter valued at $25,000. Cornerstone Planning Group LLC lifted its stake in shares of CME Group by 122.2% in the 1st quarter. Cornerstone Planning Group LLC now owns 100 shares of the financial services provider's stock valued at $26,000 after purchasing an additional 55 shares during the last quarter. New Age Alpha Advisors LLC lifted its stake in shares of CME Group by 50.0% in the 4th quarter. New Age Alpha Advisors LLC now owns 129 shares of the financial services provider's stock valued at $30,000 after purchasing an additional 43 shares during the last quarter. Golden State Wealth Management LLC lifted its stake in shares of CME Group by 612.5% in the 1st quarter. Golden State Wealth Management LLC now owns 114 shares of the financial services provider's stock valued at $30,000 after purchasing an additional 98 shares during the last quarter. Finally, Alpine Bank Wealth Management acquired a new position in shares of CME Group in the 1st quarter valued at $32,000. 87.75% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several brokerages have recently commented on CME. UBS Group reaffirmed a "neutral" rating and issued a $305.00 price target on shares of CME Group in a research note on Thursday, July 24th. JPMorgan Chase & Co. decreased their target price on CME Group from $223.00 to $211.00 and set an "underweight" rating on the stock in a research note on Thursday, April 24th. Erste Group Bank lowered CME Group from a "strong-buy" rating to a "hold" rating in a research note on Saturday, May 24th. Bank of America increased their target price on CME Group from $200.00 to $219.00 and gave the stock an "underperform" rating in a research note on Wednesday, April 2nd. Finally, Keefe, Bruyette & Woods increased their target price on CME Group from $265.00 to $273.00 and gave the stock a "market perform" rating in a research note on Thursday, April 24th. Four investment analysts have rated the stock with a sell rating, nine have issued a hold rating and four have assigned a buy rating to the company. According to MarketBeat, CME Group has an average rating of "Hold" and a consensus price target of $261.93.

Get Our Latest Stock Report on CME Group

Insiders Place Their Bets

In related news, Director Phyllis M. Lockett sold 1,060 shares of CME Group stock in a transaction on Monday, May 19th. The stock was sold at an average price of $277.88, for a total transaction of $294,552.80. Following the completion of the transaction, the director directly owned 3,108 shares of the company's stock, valued at approximately $863,651.04. The trade was a 25.43% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. Also, Director Charles P. Carey sold 500 shares of CME Group stock in a transaction on Tuesday, June 10th. The stock was sold at an average price of $265.35, for a total value of $132,675.00. Following the transaction, the director directly owned 4,900 shares of the company's stock, valued at approximately $1,300,215. This represents a 9.26% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 10,400 shares of company stock worth $2,881,130. Corporate insiders own 0.30% of the company's stock.

CME Group Stock Performance

CME traded up $1.17 during trading on Thursday, hitting $278.91. 804,933 shares of the stock were exchanged, compared to its average volume of 2,364,868. The firm has a market capitalization of $100.51 billion, a P/E ratio of 27.02, a PEG ratio of 4.88 and a beta of 0.44. CME Group Inc. has a 1-year low of $193.25 and a 1-year high of $290.79. The stock has a fifty day moving average price of $276.21 and a two-hundred day moving average price of $263.21. The company has a quick ratio of 1.02, a current ratio of 1.02 and a debt-to-equity ratio of 0.12.

CME Group (NASDAQ:CME - Get Free Report) last posted its quarterly earnings results on Wednesday, July 23rd. The financial services provider reported $2.96 EPS for the quarter, beating the consensus estimate of $2.91 by $0.05. The business had revenue of $1.69 billion during the quarter, compared to analysts' expectations of $1.68 billion. CME Group had a return on equity of 14.60% and a net margin of 58.48%. The company's quarterly revenue was up 10.4% compared to the same quarter last year. During the same period last year, the firm earned $2.56 EPS. As a group, sell-side analysts predict that CME Group Inc. will post 10.49 earnings per share for the current year.

CME Group Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Wednesday, June 25th. Stockholders of record on Monday, June 9th were issued a $1.25 dividend. The ex-dividend date was Monday, June 9th. This represents a $5.00 annualized dividend and a dividend yield of 1.79%. CME Group's dividend payout ratio is currently 48.40%.

CME Group Company Profile

(

Free Report)

CME Group Inc, together with its subsidiaries, operates contract markets for the trading of futures and options on futures contracts worldwide. It offers futures and options products based on interest rates, equity indexes, foreign exchange, agricultural commodities, energy, and metals, as well as fixed income and foreign currency trading services.

Read More

Before you consider CME Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CME Group wasn't on the list.

While CME Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.