Eastern Bank raised its position in Netflix, Inc. (NASDAQ:NFLX - Free Report) by 162.4% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 51,557 shares of the Internet television network's stock after buying an additional 31,908 shares during the period. Eastern Bank's holdings in Netflix were worth $48,078,000 as of its most recent filing with the SEC.

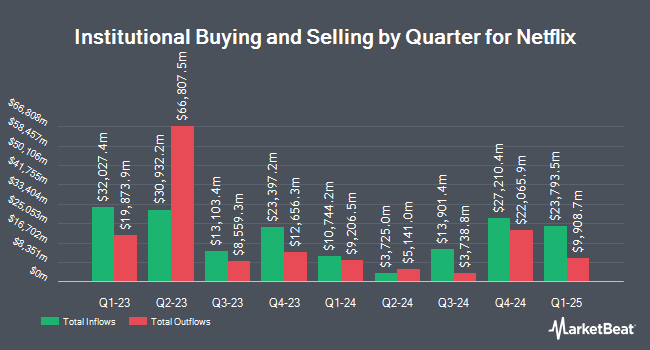

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. Resurgent Financial Advisors LLC boosted its holdings in Netflix by 234.4% in the 1st quarter. Resurgent Financial Advisors LLC now owns 1,010 shares of the Internet television network's stock worth $942,000 after buying an additional 708 shares during the period. Janus Henderson Group PLC boosted its holdings in Netflix by 8.7% in the 4th quarter. Janus Henderson Group PLC now owns 1,377,081 shares of the Internet television network's stock valued at $1,227,468,000 after purchasing an additional 110,432 shares during the period. PharVision Advisers LLC bought a new position in Netflix in the 4th quarter valued at $873,000. New England Research & Management Inc. boosted its holdings in Netflix by 148.5% in the 1st quarter. New England Research & Management Inc. now owns 2,122 shares of the Internet television network's stock valued at $1,979,000 after purchasing an additional 1,268 shares during the period. Finally, Sumitomo Mitsui DS Asset Management Company Ltd boosted its holdings in Netflix by 6.1% in the 1st quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 54,638 shares of the Internet television network's stock valued at $50,952,000 after purchasing an additional 3,137 shares during the period. 80.93% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Several research analysts have commented on the stock. Evercore ISI reissued an "outperform" rating on shares of Netflix in a report on Thursday, May 15th. Wolfe Research set a $1,340.00 price objective on shares of Netflix and gave the company an "outperform" rating in a research report on Friday, May 16th. Wells Fargo & Company raised their price objective on shares of Netflix from $1,500.00 to $1,560.00 and gave the company an "overweight" rating in a research report on Friday, July 18th. Oppenheimer raised their price objective on shares of Netflix from $1,200.00 to $1,425.00 and gave the company an "outperform" rating in a research report on Thursday, June 12th. Finally, Pivotal Research restated a "buy" rating on shares of Netflix in a research report on Thursday, July 10th. Three research analysts have rated the stock with a sell rating, ten have given a hold rating, twenty-three have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $1,297.66.

Get Our Latest Stock Analysis on NFLX

Insider Buying and Selling at Netflix

In other Netflix news, Director Strive Masiyiwa sold 290 shares of the company's stock in a transaction that occurred on Tuesday, July 1st. The shares were sold at an average price of $1,336.54, for a total transaction of $387,596.60. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CAO Jeffrey William Karbowski sold 620 shares of the stock in a transaction on Wednesday, June 25th. The stock was sold at an average price of $1,286.84, for a total transaction of $797,840.80. The disclosure for this sale can be found here. Insiders sold 123,830 shares of company stock valued at $153,102,930 in the last quarter. Insiders own 1.37% of the company's stock.

Netflix Stock Performance

Shares of NFLX traded down $0.80 during mid-day trading on Friday, hitting $1,158.60. 3,886,745 shares of the company traded hands, compared to its average volume of 3,831,108. Netflix, Inc. has a 1 year low of $587.04 and a 1 year high of $1,341.15. The stock has a market cap of $492.32 billion, a price-to-earnings ratio of 49.37, a P/E/G ratio of 1.95 and a beta of 1.59. The company has a debt-to-equity ratio of 0.58, a quick ratio of 1.34 and a current ratio of 1.34. The stock has a 50-day moving average price of $1,234.32 and a two-hundred day moving average price of $1,082.35.

Netflix (NASDAQ:NFLX - Get Free Report) last announced its earnings results on Thursday, July 17th. The Internet television network reported $7.19 EPS for the quarter, beating analysts' consensus estimates of $7.07 by $0.12. Netflix had a net margin of 24.58% and a return on equity of 42.50%. The business had revenue of $11.08 billion during the quarter, compared to analysts' expectations of $11.04 billion. During the same period in the prior year, the company earned $4.88 earnings per share. The firm's revenue was up 15.9% on a year-over-year basis. Equities analysts anticipate that Netflix, Inc. will post 24.58 earnings per share for the current year.

Netflix Company Profile

(

Free Report)

Netflix, Inc provides entertainment services. It offers TV series, documentaries, feature films, and games across various genres and languages. The company also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

Recommended Stories

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.