Aberdeen Group plc decreased its position in shares of Nextracker Inc. (NASDAQ:NXT - Free Report) by 6.6% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 90,210 shares of the company's stock after selling 6,421 shares during the period. Aberdeen Group plc owned 0.06% of Nextracker worth $3,801,000 at the end of the most recent reporting period.

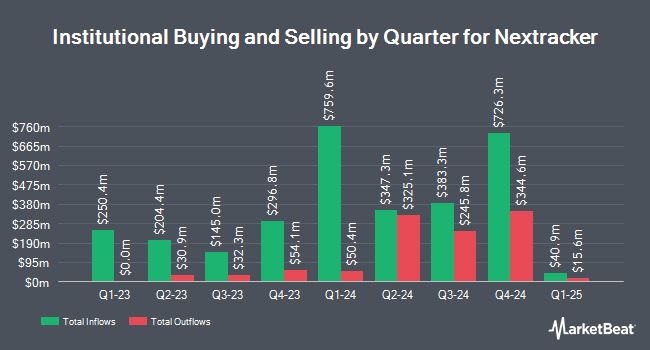

A number of other institutional investors have also recently bought and sold shares of NXT. Caitong International Asset Management Co. Ltd acquired a new stake in Nextracker during the first quarter valued at $40,000. Sterling Capital Management LLC boosted its position in Nextracker by 448.9% during the fourth quarter. Sterling Capital Management LLC now owns 1,290 shares of the company's stock valued at $47,000 after purchasing an additional 1,055 shares during the last quarter. Virtus Fund Advisers LLC acquired a new stake in Nextracker during the fourth quarter valued at $47,000. Fifth Third Bancorp boosted its position in Nextracker by 27.5% during the first quarter. Fifth Third Bancorp now owns 1,204 shares of the company's stock valued at $51,000 after purchasing an additional 260 shares during the last quarter. Finally, UMB Bank n.a. boosted its position in Nextracker by 127.2% during the first quarter. UMB Bank n.a. now owns 1,504 shares of the company's stock valued at $63,000 after purchasing an additional 842 shares during the last quarter. Institutional investors and hedge funds own 67.41% of the company's stock.

Nextracker Stock Performance

Shares of Nextracker stock traded up $0.99 during trading on Tuesday, reaching $68.58. The company's stock had a trading volume of 1,892,901 shares, compared to its average volume of 2,953,311. The business's fifty day moving average price is $60.76 and its 200-day moving average price is $51.94. The firm has a market cap of $10.15 billion, a price-to-earnings ratio of 18.69, a price-to-earnings-growth ratio of 1.57 and a beta of 2.25. Nextracker Inc. has a one year low of $30.93 and a one year high of $70.14.

Analysts Set New Price Targets

NXT has been the subject of a number of research reports. Mizuho set a $66.00 price objective on Nextracker in a research report on Wednesday, July 30th. Fox Advisors cut Nextracker from an "overweight" rating to an "equal weight" rating in a research report on Thursday, May 15th. The Goldman Sachs Group boosted their price target on Nextracker from $61.00 to $68.00 and gave the stock a "buy" rating in a research report on Thursday, May 15th. TD Cowen boosted their price target on Nextracker from $55.00 to $65.00 and gave the stock a "hold" rating in a research report on Wednesday, July 30th. Finally, Susquehanna boosted their price target on Nextracker from $66.00 to $76.00 and gave the stock a "positive" rating in a research report on Monday, July 21st. One equities research analyst has rated the stock with a Strong Buy rating, fourteen have assigned a Buy rating and nine have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $65.00.

Check Out Our Latest Stock Report on NXT

Insiders Place Their Bets

In other news, COO Nicholas Marco Miller sold 69,774 shares of Nextracker stock in a transaction dated Thursday, June 12th. The stock was sold at an average price of $59.65, for a total value of $4,162,019.10. Following the transaction, the chief operating officer directly owned 175,216 shares in the company, valued at approximately $10,451,634.40. The trade was a 28.48% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director William D. Watkins sold 10,000 shares of Nextracker stock in a transaction dated Tuesday, August 5th. The stock was sold at an average price of $56.79, for a total value of $567,900.00. Following the completion of the transaction, the director owned 7,666 shares in the company, valued at $435,352.14. The trade was a 56.61% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 186,822 shares of company stock valued at $10,836,212. Company insiders own 0.56% of the company's stock.

Nextracker Profile

(

Free Report)

Nextracker Inc, an energy solutions company, provides solar tracker and software solutions for utility-scale and distributed generation solar projects in the United States and internationally. The company offers tracking solutions, which includes NX Horizon, a solar tracking solution; and NX Horizon-XTR, a terrain-following tracker designed to expand the addressable market for trackers on sites with sloped, uneven, and challenging terrain.

Recommended Stories

Before you consider Nextracker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nextracker wasn't on the list.

While Nextracker currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.