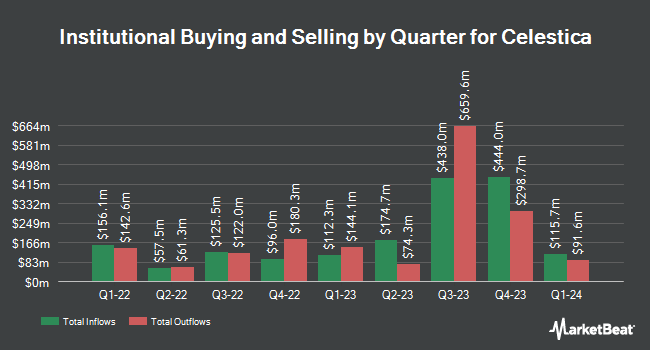

Oak Ridge Investments LLC lifted its holdings in shares of Celestica, Inc. (NYSE:CLS - Free Report) TSE: CLS by 201.4% in the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 74,492 shares of the technology company's stock after acquiring an additional 49,775 shares during the quarter. Celestica accounts for about 0.8% of Oak Ridge Investments LLC's holdings, making the stock its 27th largest position. Oak Ridge Investments LLC owned about 0.06% of Celestica worth $11,629,000 at the end of the most recent quarter.

Other institutional investors and hedge funds also recently modified their holdings of the company. Jones Financial Companies Lllp grew its holdings in Celestica by 1,103.8% during the first quarter. Jones Financial Companies Lllp now owns 24,486 shares of the technology company's stock valued at $1,930,000 after purchasing an additional 22,452 shares during the period. Consolidated Planning Corp bought a new position in Celestica during the first quarter valued at $3,361,000. Fortis Capital Advisors LLC bought a new position in Celestica during the second quarter valued at $343,000. Think Investments LP bought a new position in Celestica during the first quarter valued at $14,939,000. Finally, Royal Bank of Canada grew its holdings in Celestica by 1.5% during the first quarter. Royal Bank of Canada now owns 1,280,563 shares of the technology company's stock valued at $100,922,000 after purchasing an additional 19,391 shares during the period. 67.38% of the stock is owned by hedge funds and other institutional investors.

Celestica Price Performance

Celestica stock opened at $243.91 on Friday. Celestica, Inc. has a one year low of $55.30 and a one year high of $263.90. The business has a fifty day moving average price of $224.30 and a 200-day moving average price of $156.66. The company has a debt-to-equity ratio of 0.48, a current ratio of 1.44 and a quick ratio of 0.86. The firm has a market capitalization of $28.06 billion, a P/E ratio of 52.79 and a beta of 1.88.

Celestica (NYSE:CLS - Get Free Report) TSE: CLS last issued its quarterly earnings data on Monday, July 28th. The technology company reported $1.39 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.23 by $0.16. Celestica had a return on equity of 28.23% and a net margin of 5.11%.The company had revenue of $2.89 billion for the quarter, compared to the consensus estimate of $2.65 billion. During the same quarter last year, the business posted $0.91 earnings per share. The firm's revenue was up 21.0% compared to the same quarter last year. Celestica has set its Q3 2025 guidance at 1.370-1.530 EPS. FY 2025 guidance at 5.500-5.500 EPS. As a group, equities research analysts forecast that Celestica, Inc. will post 4.35 EPS for the current year.

Analyst Upgrades and Downgrades

CLS has been the subject of several research reports. TD Securities lowered Celestica from a "buy" rating to a "hold" rating and increased their price objective for the company from $130.00 to $238.00 in a report on Friday, October 3rd. CICC Research initiated coverage on Celestica in a report on Tuesday, August 19th. They set an "outperform" rating for the company. Citigroup increased their price objective on Celestica from $172.00 to $212.00 and gave the company a "neutral" rating in a report on Wednesday, July 30th. UBS Group reaffirmed a "neutral" rating and issued a $208.00 price target (up from $101.00) on shares of Celestica in a report on Wednesday, July 30th. Finally, TD Cowen reaffirmed a "hold" rating and issued a $238.00 price target on shares of Celestica in a report on Friday, October 3rd. One investment analyst has rated the stock with a Strong Buy rating, ten have assigned a Buy rating and four have given a Hold rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $207.38.

Check Out Our Latest Analysis on CLS

About Celestica

(

Free Report)

Celestica Inc provides supply chain solutions in North America, Europe, and Asia. It operates through two segments: Advanced Technology Solutions, and Connectivity & Cloud Solutions. The company offers a range of product manufacturing and related supply chain services, including design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, asset management, product licensing, and after-market repair and return services.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Celestica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celestica wasn't on the list.

While Celestica currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.