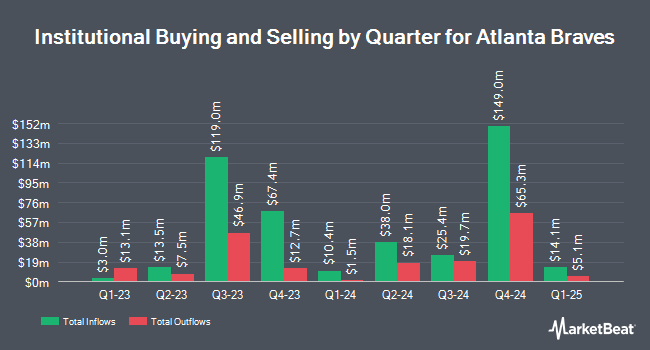

Parthenon LLC grew its stake in shares of Atlanta Braves Holdings, Inc. (NASDAQ:BATRK - Free Report) by 83.1% during the 2nd quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 158,295 shares of the financial services provider's stock after purchasing an additional 71,855 shares during the period. Parthenon LLC owned approximately 0.31% of Atlanta Braves worth $7,403,000 at the end of the most recent reporting period.

Several other institutional investors also recently made changes to their positions in BATRK. CWM LLC boosted its position in shares of Atlanta Braves by 56.4% during the 1st quarter. CWM LLC now owns 824 shares of the financial services provider's stock worth $33,000 after purchasing an additional 297 shares in the last quarter. Comerica Bank boosted its position in shares of Atlanta Braves by 44.8% during the 1st quarter. Comerica Bank now owns 1,031 shares of the financial services provider's stock worth $41,000 after purchasing an additional 319 shares in the last quarter. Summit Securities Group LLC purchased a new stake in shares of Atlanta Braves during the 1st quarter worth $60,000. BI Asset Management Fondsmaeglerselskab A S purchased a new stake in shares of Atlanta Braves during the 1st quarter worth $84,000. Finally, KBC Group NV purchased a new stake in shares of Atlanta Braves during the 1st quarter worth $94,000. 64.88% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Separately, Weiss Ratings restated a "sell (d-)" rating on shares of Atlanta Braves in a research report on Wednesday, October 8th. One research analyst has rated the stock with a Buy rating, one has issued a Hold rating and one has issued a Sell rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $57.00.

View Our Latest Report on BATRK

Atlanta Braves Stock Up 0.2%

Atlanta Braves stock opened at $39.17 on Friday. Atlanta Braves Holdings, Inc. has a 52 week low of $35.46 and a 52 week high of $47.18. The firm's 50-day simple moving average is $42.28 and its 200 day simple moving average is $42.32. The firm has a market capitalization of $2.46 billion, a PE ratio of -111.91 and a beta of 0.61.

Atlanta Braves (NASDAQ:BATRK - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The financial services provider reported $0.46 EPS for the quarter, missing the consensus estimate of $0.64 by ($0.18). The company had revenue of $312.44 million for the quarter, compared to analyst estimates of $296.36 million. On average, research analysts expect that Atlanta Braves Holdings, Inc. will post -0.89 EPS for the current fiscal year.

Insider Activity at Atlanta Braves

In related news, major shareholder Gamco Investors, Inc. Et Al sold 800 shares of the business's stock in a transaction dated Thursday, September 25th. The shares were sold at an average price of $45.41, for a total value of $36,328.00. Following the sale, the insider directly owned 1,000 shares in the company, valued at $45,410. The trade was a 44.44% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In the last 90 days, insiders have sold 3,700 shares of company stock valued at $167,859. 11.43% of the stock is owned by insiders.

Atlanta Braves Profile

(

Free Report)

Atlanta Braves Holdings, Inc owns and operates the Atlanta Braves Major league baseball club. It also operates mixed-use development project, including retail, office, hotel, and entertainment projects. The company was incorporated in 2022 and is based in Englewood, Colorado.

Further Reading

Want to see what other hedge funds are holding BATRK? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Atlanta Braves Holdings, Inc. (NASDAQ:BATRK - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Atlanta Braves, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlanta Braves wasn't on the list.

While Atlanta Braves currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.