Prescott Group Capital Management L.L.C. purchased a new position in Linde PLC (NASDAQ:LIN - Free Report) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 611 shares of the basic materials company's stock, valued at approximately $285,000.

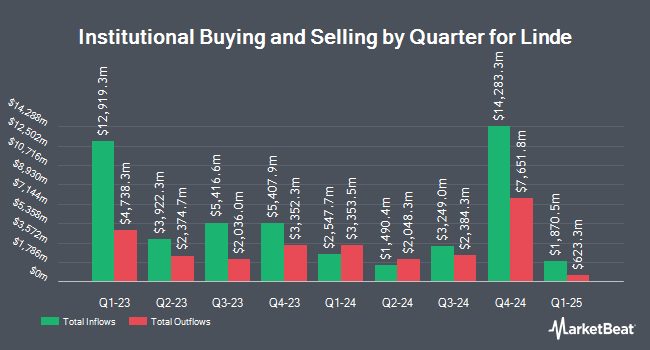

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Brighton Jones LLC bought a new stake in shares of Linde during the 4th quarter valued at $2,752,000. Revolve Wealth Partners LLC boosted its holdings in shares of Linde by 14.1% during the 4th quarter. Revolve Wealth Partners LLC now owns 777 shares of the basic materials company's stock valued at $325,000 after buying an additional 96 shares in the last quarter. Bank Pictet & Cie Europe AG boosted its holdings in shares of Linde by 2.8% during the 4th quarter. Bank Pictet & Cie Europe AG now owns 68,460 shares of the basic materials company's stock valued at $28,662,000 after buying an additional 1,876 shares in the last quarter. Focus Partners Advisor Solutions LLC boosted its holdings in shares of Linde by 80.4% during the 4th quarter. Focus Partners Advisor Solutions LLC now owns 2,253 shares of the basic materials company's stock valued at $943,000 after buying an additional 1,004 shares in the last quarter. Finally, Modern Wealth Management LLC boosted its holdings in shares of Linde by 20.0% during the 4th quarter. Modern Wealth Management LLC now owns 1,356 shares of the basic materials company's stock valued at $625,000 after buying an additional 226 shares in the last quarter. Hedge funds and other institutional investors own 82.80% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts have recently commented on the stock. Citigroup upgraded shares of Linde from a "neutral" rating to a "buy" rating and boosted their target price for the company from $500.00 to $535.00 in a report on Monday, June 30th. Royal Bank Of Canada started coverage on shares of Linde in a report on Friday, June 13th. They set an "outperform" rating and a $576.00 target price on the stock. Sanford C. Bernstein raised Linde to a "strong-buy" rating in a research report on Thursday, April 3rd. UBS Group lifted their price target on Linde from $485.00 to $504.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 9th. Finally, Argus raised Linde to a "strong-buy" rating in a research report on Tuesday, April 8th. Two investment analysts have rated the stock with a hold rating, nine have assigned a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat.com, Linde presently has a consensus rating of "Buy" and a consensus target price of $518.80.

Check Out Our Latest Stock Analysis on Linde

Insider Transactions at Linde

In other Linde news, VP David P. Strauss sold 1,987 shares of the business's stock in a transaction dated Friday, May 16th. The stock was sold at an average price of $457.04, for a total transaction of $908,138.48. Following the completion of the sale, the vice president directly owned 22,639 shares in the company, valued at $10,346,928.56. The trade was a 8.07% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, VP Sean Durbin sold 7,261 shares of the business's stock in a transaction dated Thursday, May 22nd. The shares were sold at an average price of $456.42, for a total value of $3,314,065.62. Following the sale, the vice president owned 8,151 shares of the company's stock, valued at approximately $3,720,279.42. This represents a 47.11% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.70% of the stock is currently owned by insiders.

Linde Stock Performance

NASDAQ:LIN traded up $3.68 during mid-day trading on Tuesday, reaching $471.14. The company's stock had a trading volume of 446,696 shares, compared to its average volume of 2,126,024. Linde PLC has a 12-month low of $408.65 and a 12-month high of $487.49. The firm's fifty day moving average price is $466.67 and its two-hundred day moving average price is $456.90. The company has a current ratio of 0.94, a quick ratio of 0.80 and a debt-to-equity ratio of 0.45. The stock has a market cap of $221.77 billion, a P/E ratio of 34.22, a PEG ratio of 3.34 and a beta of 0.96.

Linde (NASDAQ:LIN - Get Free Report) last issued its earnings results on Thursday, May 1st. The basic materials company reported $3.95 earnings per share for the quarter, topping analysts' consensus estimates of $3.92 by $0.03. Linde had a return on equity of 18.95% and a net margin of 20.02%. The business had revenue of $8.11 billion during the quarter, compared to analyst estimates of $8.24 billion. During the same quarter in the previous year, the firm earned $3.75 EPS. Linde's revenue was up .1% on a year-over-year basis. On average, equities analysts forecast that Linde PLC will post 16.54 EPS for the current fiscal year.

Linde Company Profile

(

Free Report)

Linde plc operates as an industrial gas company in the Americas, Europe, the Middle East, Africa, Asia, and South Pacific. It offers atmospheric gases, including oxygen, nitrogen, argon, and rare gases; and process gases, such as carbon dioxide, helium, hydrogen, electronic gases, specialty gases, and acetylene.

Recommended Stories

Before you consider Linde, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Linde wasn't on the list.

While Linde currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.