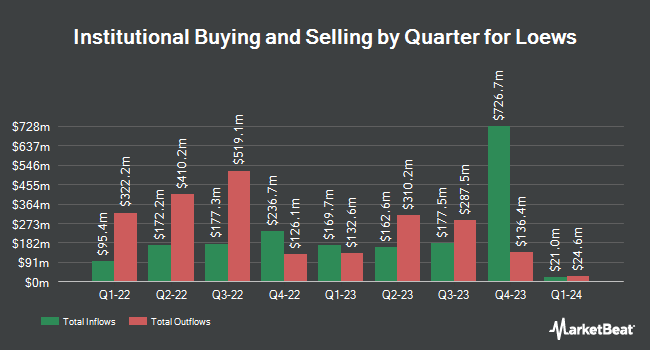

Price T Rowe Associates Inc. MD lessened its holdings in shares of Loews Corporation (NYSE:L - Free Report) by 10.6% in the first quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 4,140,631 shares of the insurance provider's stock after selling 490,946 shares during the quarter. Price T Rowe Associates Inc. MD owned 1.97% of Loews worth $380,567,000 as of its most recent filing with the SEC.

Several other large investors also recently bought and sold shares of the company. Wayfinding Financial LLC acquired a new stake in shares of Loews during the first quarter worth approximately $25,000. Minot DeBlois Advisors LLC acquired a new position in shares of Loews during the fourth quarter valued at $27,000. Sierra Ocean LLC boosted its holdings in shares of Loews by 805.9% during the first quarter. Sierra Ocean LLC now owns 308 shares of the insurance provider's stock valued at $28,000 after acquiring an additional 274 shares during the period. Elequin Capital LP acquired a new position in shares of Loews during the first quarter valued at $30,000. Finally, Zions Bancorporation National Association UT bought a new stake in shares of Loews during the first quarter valued at about $33,000. Institutional investors and hedge funds own 58.33% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen upgraded shares of Loews from a "hold" rating to a "buy" rating in a research note on Tuesday, May 6th.

Check Out Our Latest Stock Report on Loews

Loews Trading Up 0.6%

L traded up $0.60 during trading on Wednesday, reaching $96.50. The company had a trading volume of 616,566 shares, compared to its average volume of 782,196. The firm's 50-day simple moving average is $92.23 and its 200 day simple moving average is $88.67. The company has a market cap of $20.02 billion, a price-to-earnings ratio of 15.34 and a beta of 0.69. Loews Corporation has a 12-month low of $75.16 and a 12-month high of $97.41. The company has a debt-to-equity ratio of 0.43, a quick ratio of 0.33 and a current ratio of 0.33.

Loews (NYSE:L - Get Free Report) last released its earnings results on Monday, August 4th. The insurance provider reported $1.87 earnings per share for the quarter. Loews had a return on equity of 7.43% and a net margin of 7.47%.The company had revenue of $4.56 billion for the quarter.

Loews Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, September 2nd. Shareholders of record on Wednesday, August 20th will be paid a dividend of $0.0625 per share. This represents a $0.25 annualized dividend and a yield of 0.3%. The ex-dividend date of this dividend is Wednesday, August 20th. Loews's payout ratio is 3.97%.

Loews Company Profile

(

Free Report)

Loews Corporation provides commercial property and casualty insurance in the United States and internationally. The company offers specialty insurance products, such as management and professional liability, and other coverage products; surety and fidelity bonds; property insurance products that include standard and excess property, marine and boiler, and machinery coverages; and casualty insurance products, such as workers' compensation, general and product liability, and commercial auto, surplus, and umbrella coverages.

Read More

Before you consider Loews, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Loews wasn't on the list.

While Loews currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.